What is Triple top candlestick pattern kai hai

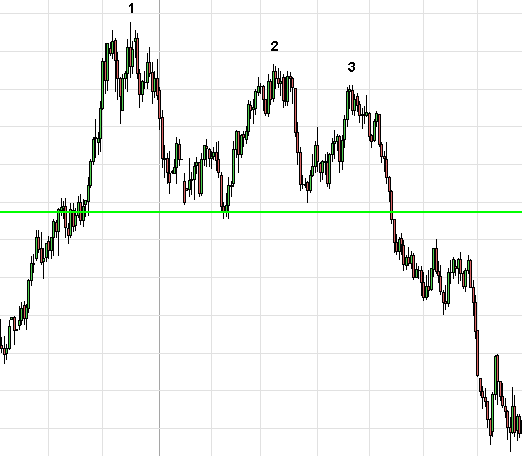

Triple Top ek technical analysis pattern hai jo market mein trend reversal ko suggest karta hai. Yeh pattern price chart par triple peaks (teesri baar ki high) ke roop mein dikhta hai. Yeh uptrend ke baad aata hai aur bearish reversal ke indication ke roop mein dekha ja sakta hai.

Triple Top Candlestick Pattern ki pehchan karne ke liye kuch key characteristics hain:

- Three Peaks: Triple Top pattern mein, price chart par teen successive peaks hote hain jo approximately ek hi horizontal level par hote hain. Ye peaks resistance level ko darust karte hain jahan se price bar-bar neeche aati hai.

- Declining Volume: Har ek peak ke saath, trading volume mein bhi decrease hota hai. Yeh decline in volume, traders ke interest mein kami ko darust karta hai aur reversal ki possibility ko highlight karta hai.

- Breakdown Below Support: Jab price teesri baar se bhi neeche aati hai aur support level ko breach karti hai, tab triple top pattern confirm hota hai. Is point par traders ko ye indication milta hai ki uptrend khatam ho gaya hai aur bearish trend shuru hone wala hai.

Triple Top pattern bearish reversal ke ek signal ke taur par consider hota hai, aur iski pehchan karne ke baad traders selling positions mein enter kar sakte hain ya existing long positions ko close kar sakte hain. Lekin, hamesha yaad rahe ki kisi bhi pattern ko confirm karne ke liye, dusre technical indicators aur market conditions ko bhi madhya mein rakhna important hai. False signals se bachne ke liye, confirmatory factors ka istemal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим