Why technical analysis is important

Technical analysis is important for several reasons in the field of trading and investing. Here are some key points that highlight its significance:

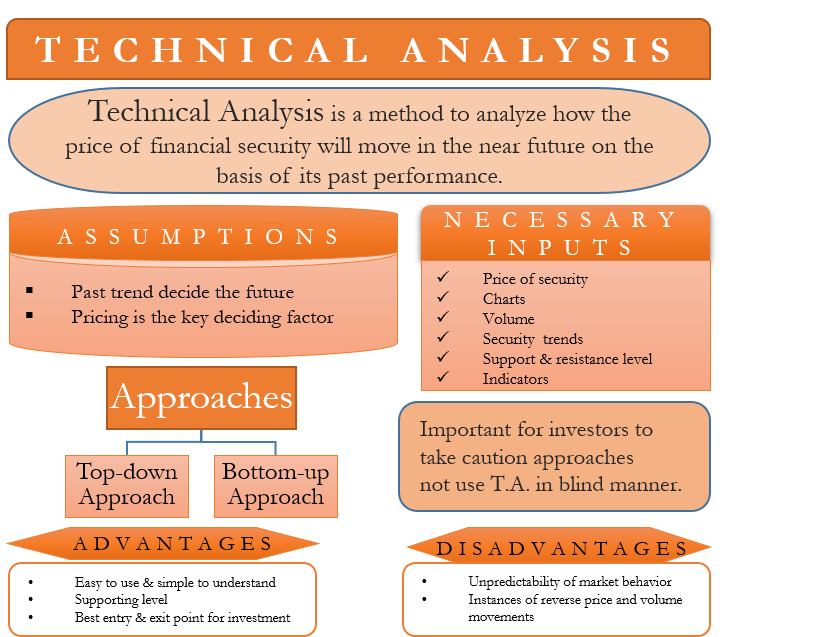

- Price Patterns and Trends: Technical analysis helps traders and investors identify price patterns and trends in financial markets. Understanding the direction of the trend can be crucial for making informed decisions.

- Entry and Exit Points: It provides tools and techniques to determine optimal entry and exit points for trades. By analyzing charts and indicators, traders can make decisions about when to buy or sell an asset.

- Support and Resistance Levels: Technical analysis identifies support and resistance levels, which are price levels at which an asset tends to stop moving and change direction. This information is valuable for setting stop-loss orders and take-profit targets.

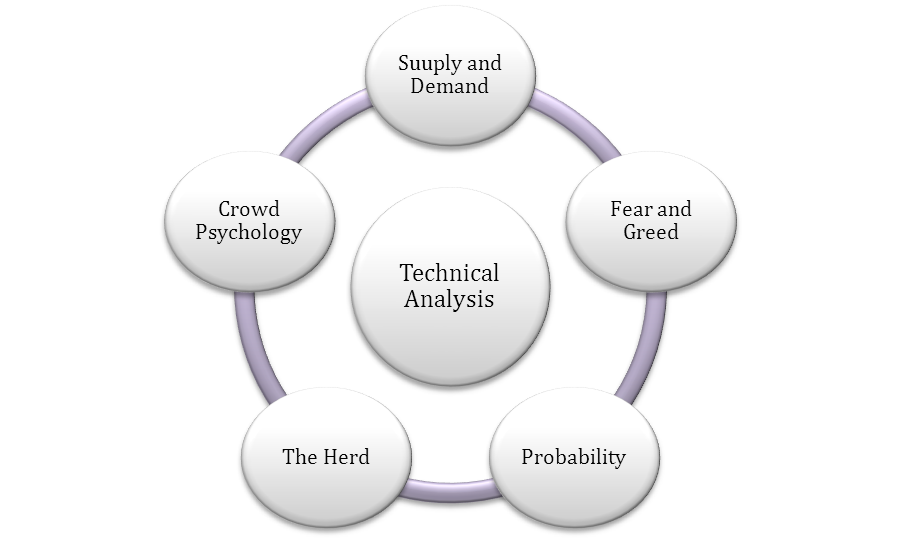

- Market Sentiment: Technical analysis reflects market sentiment. Patterns such as double tops, double bottoms, and head and shoulders can provide insights into the psychology of market participants.

- Risk Management: It plays a crucial role in risk management. By using tools like stop-loss orders, traders can manage their risks effectively and prevent significant losses.

- Historical Price Data: Technical analysis relies on historical price data. Analyzing past price movements can provide insights into how an asset is likely to behave in the future.

- Timing Trades: Technical analysis helps traders time their trades effectively. It provides tools like oscillators and momentum indicators that can signal overbought or oversold conditions, helping traders make decisions about when to enter or exit a trade.

- Quantifying Market Trends: It allows traders to quantify market trends and make data-driven decisions. This is especially important in dynamic markets where trends can change rapidly.

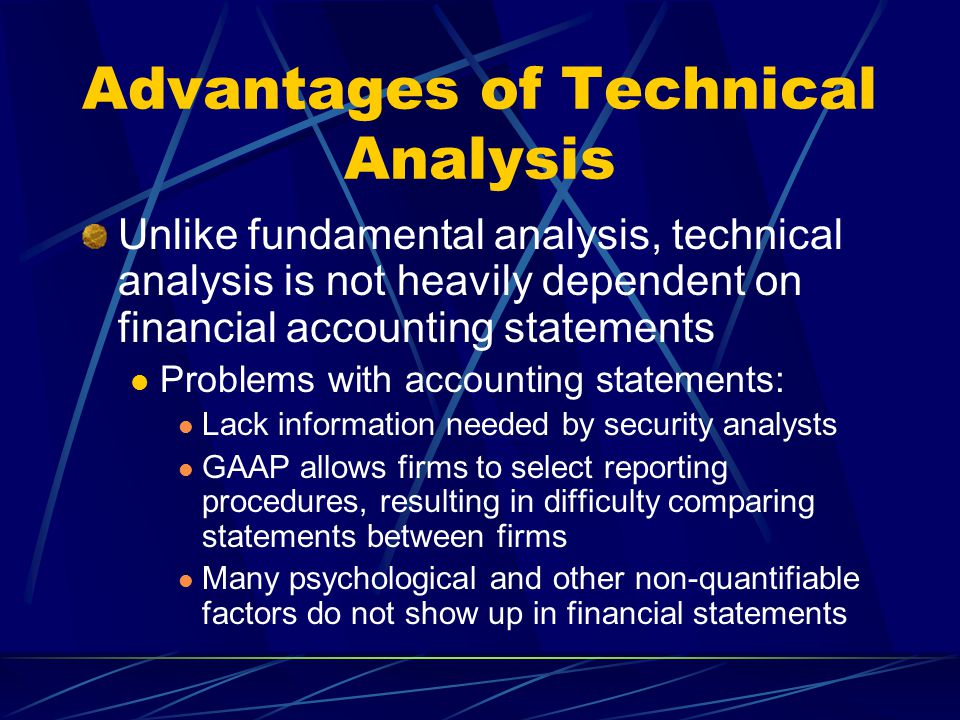

- Complementary to Fundamental Analysis: While fundamental analysis focuses on the intrinsic value of an asset, technical analysis complements it by providing insights into the timing and potential price movements based on market sentiment and historical data.

- Global Applicability: Technical analysis can be applied to various financial markets, including stocks, commodities, currencies, and cryptocurrencies. This universality makes it a valuable tool for a wide range of traders and investors.

It's important to note that while technical analysis is a powerful tool, it is not foolproof, and market conditions can change. Many traders use a combination of technical and fundamental analysis to make well-informed decisions.

تبصرہ

Расширенный режим Обычный режим