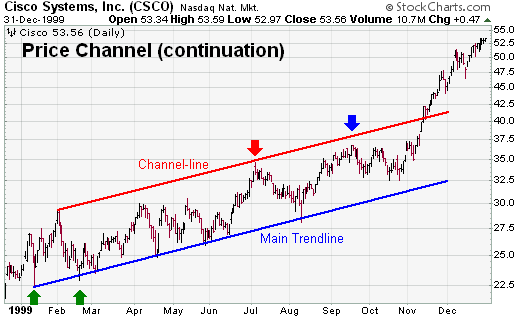

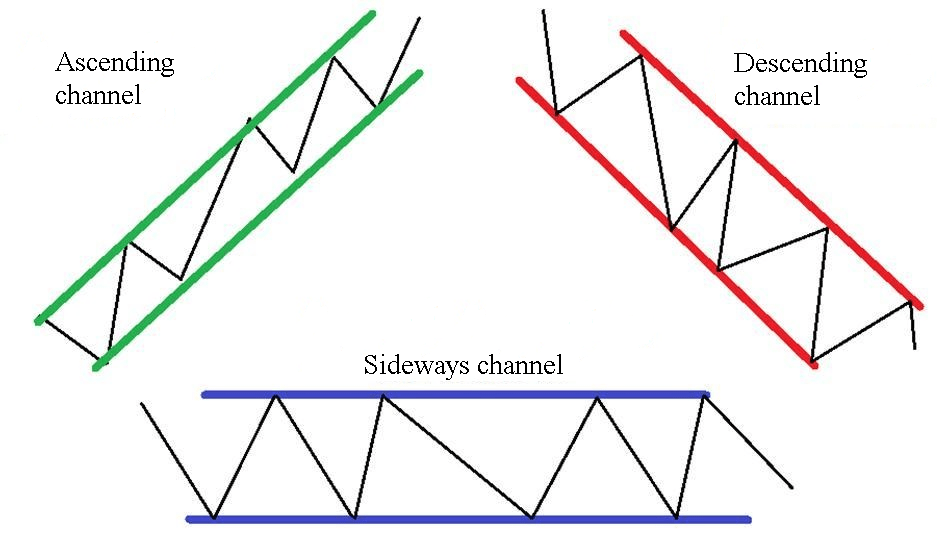

jo forex ex market mein "price channel" se murad woh price ke movement hai jo do trend lines ke darmiyan hoti hain. Forex market ke is channel ko "resistance" ke naam se jana jata hai, jabke price action ke neeche wale channel ko "support" ke naam se pukara jata hai. Dono lines aik dosray ke saath horizontal rehti haForex market mein price channel theory ke mutaliq hum chand details ke saath bat kar rahe hain taki mere dosto ko zyada waqt invest karne ki zarurat na pade. Jab forex market mein up trend ya down trend mein horizontal lines draw ki jati hain, to hum ek channel banate hain. Forex market mein trend channel ek aur technical analysis ka tool hai trend channmarket mein buy ya sell karne ke liye ek acha reference point pesh karta hai.Forex market mein up trend line ek resistance line hoti hai, aur lower trend line ko support ke naam se jana jata hai. Dono lines ke beech ka area support ya resistance ka darust nishan lagata hai. Forex market mein trend channel negative slope ya positive slope mein ho sakta hai. Negative slope ko bearish aur positive slope ko bullish mana jata hai.Forex market Forel banane ke liye ek horizontal line ka naam diya jata hai aur ek parallel line ka naam bhi hota hai. Up trend ko banane ke liye, ek horizontal line draw ki jati hai jo recently peak ko chhota kare, phir market ke angle par ek parallel line draw ki jati hai jo down trend line ko touch kare. Yeh process tab kiya jata hai jab market mein up trend hota hai.

Understanding a Price Channel

ke bara chuation ka signal ho channels trend ki quwat ya kamzori ki tasdeeq mein madad karte hain. Ek uptrend mein, price amuman channel ke andar higher highs aur higher lows banata hai. Isi tarah, downtrend mein lower highs aur lower lows dekhe jate hain. Traders apni trading decisions se pehle trend ki tasdeeq ke liyPrice channels risk management ke liye ahem hain. Traders stop-loss orders channel ke bahar rakh sakte hain taake nuqsaan ko had se zyada na hone de. Price channel ke structure ko samajhna trades ke liye munasib risk-reward ratios tay karne mein madad kartace channels apne andar patterns ko dikhate hain jese ke flags, pennants, ya Trehannels ft market meihai, jo potential entry ya exit points ke liye ahem signals hoce channel ki chodiya market ki volatility ke baray mein malumat faraham kar sakti hai. Ek tang channel low volatility ko darust karta hai, jabwedges. In patterns ko channel ke andar pehchanne se traders ko additional trading opportunities mil sakti hain aur overall analysis ko behtar banaya jaPrice channels ko mukhtalif timeframes par istemal kiya ja sakta hai, jisse ye mukhtalif trading styles ke liye versatile ho jata hai. Chahe trader short-term intraday trading kar raha ho ya long-term swing trading, price channels apne timeframe ke mutabiq adjust kiye ja sIkhtitami tor par, price channel pattern forex trading mein ahem hai kyun ke isse traders ko trends pehchanne, support aur resistance levels ko locate karne, volatility ko analyze karne, aur entry aur exit points ke baare mein malumat hasil karne mein madad milti hai. Price channels ko apne technical analysis toolkit mein shamil karke traders apni quwat barha sakte hain taake woh forex market ke dyn

تبصرہ

Расширенный режим Обычный режим