Forex mein "divergence" ek ahem convergence aur divergence ki tasawwur hai jo technical analysis mein istemal hoti hai. Yeh ek tijarat aur maishat ke sheharat mein ahem hissa hai. Divergence ek tijarat karne wale ke liye ahem malumat aur samajh laane wala tareeqa hai jisey woh tijarat mein behtar faislay kar sake. Divergence, market ki mukhtalif aspects aur tijarat karne wale ke faislay par asar andaz hoti hai.

Forex market mein divergence ko samajhna zaroori hai taake tijarat karne wale ko pata chale ke market mein kis tarah ka rujhan hai. Divergence, technical analysis ka aik hissa hai jise traders apni tijarat mein istemal karte hain taake woh future price movements ko predict kar sakein. Isay samajhne ke liye, zaroori hai ke ham pehle divergence ki bunyadi concepts ko samajhain.

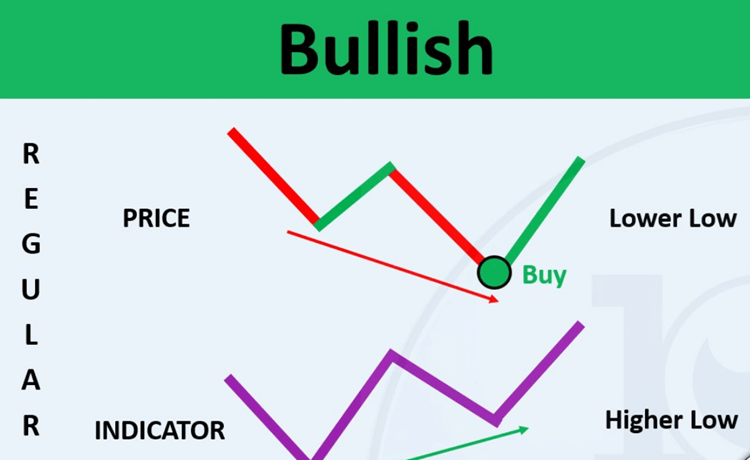

Divergence ka mtlb hota hai jab market ki price aur kisi indicator ki movement mein farq paida hota hai. Yani ke agar market upar ja rahi hai lekin koi indicator niche ja raha hai, ya phir market niche ja rahi hai lekin indicator upar ja raha hai, to isay divergence kaha jata hai. Isay samajhne ke liye, chand mukhtalif types ki divergence hoti hain, jese ke positive divergence aur negative divergence.

Positive divergence tab hoti hai jab market ki price niche ja rahi hoti hai lekin kisi indicator ki value upar ja rahi hoti hai. Yani ke market aur indicator mein aapas mein mawafiqat nahi hoti, lekin indicator ki movement positive direction mein hoti hai. Isay aksar trend reversal ka indication samjha jata hai, yani ke market ke trend mein badalav hone ke chances hote hain.

Negative divergence mein, situation ulta hoti hai. Market ki price upar ja rahi hoti hai lekin kisi indicator ki value niche ja rahi hoti hai. Yani ke market aur indicator mein mukhtalif rujhan hota hai aur isay aksar trend reversal ka indication samjha jata hai. Traders isay istemal karte hain taake woh samajh sakein ke current trend khatam hone wala hai aur naya trend shuru hone wala hai.

Divergence ko samajhne ke liye, kuch ahem indicators hain jin par zyada tawajju di jati hai. Inmein se kuch ahem hain:

Divergence ki pehchan karne ke baad, traders apne tijarat ke faislay mein isay istemal karte hain. Positive divergence ko dekhte hue, woh long positions le sakte hain, yani ke woh ummid karte hain ke market ka trend badalne wala hai aur upar jaayega. Negative divergence ko dekhte hue, woh short positions le sakte hain, yani ke woh ummid karte hain ke market ka trend badalne wala hai aur niche jaayega.

Lekin, yaad rahe ke divergence ek matnawi tool hai aur isay hamesha 100% sahi nahi hota. Market mein hamesha uncertainty hoti hai aur kai factors us par asar daal sakte hain. Isliye, traders ko hamesha apne risk ko manage karna chahiye aur dusre tajaweezat aur tijarat karne wale logon se isteshara karna chahiye.

Divergence ka istemal karna tijarat karne walon ke liye ek nayab tareeqa hai jisse woh market ke mizaj ko samajh sakte hain. Lekin, yeh ek tool hai, aur isay sahi taur par istemal karne ke liye practice aur samajh zaroori hai. Traders ko chahiye ke woh market ko ghaur se dekhein aur apne faislay ko achi tarah se sochein taake woh behtar tijarat kar sakein.

Forex market mein divergence ko samajhna zaroori hai taake tijarat karne wale ko pata chale ke market mein kis tarah ka rujhan hai. Divergence, technical analysis ka aik hissa hai jise traders apni tijarat mein istemal karte hain taake woh future price movements ko predict kar sakein. Isay samajhne ke liye, zaroori hai ke ham pehle divergence ki bunyadi concepts ko samajhain.

Divergence ka mtlb hota hai jab market ki price aur kisi indicator ki movement mein farq paida hota hai. Yani ke agar market upar ja rahi hai lekin koi indicator niche ja raha hai, ya phir market niche ja rahi hai lekin indicator upar ja raha hai, to isay divergence kaha jata hai. Isay samajhne ke liye, chand mukhtalif types ki divergence hoti hain, jese ke positive divergence aur negative divergence.

Positive divergence tab hoti hai jab market ki price niche ja rahi hoti hai lekin kisi indicator ki value upar ja rahi hoti hai. Yani ke market aur indicator mein aapas mein mawafiqat nahi hoti, lekin indicator ki movement positive direction mein hoti hai. Isay aksar trend reversal ka indication samjha jata hai, yani ke market ke trend mein badalav hone ke chances hote hain.

Negative divergence mein, situation ulta hoti hai. Market ki price upar ja rahi hoti hai lekin kisi indicator ki value niche ja rahi hoti hai. Yani ke market aur indicator mein mukhtalif rujhan hota hai aur isay aksar trend reversal ka indication samjha jata hai. Traders isay istemal karte hain taake woh samajh sakein ke current trend khatam hone wala hai aur naya trend shuru hone wala hai.

Divergence ko samajhne ke liye, kuch ahem indicators hain jin par zyada tawajju di jati hai. Inmein se kuch ahem hain:

- Relative Strength Index (RSI): RSI market ki strength aur weakness ko measure karta hai. Agar RSI upar ja raha hai jab ke market niche ja rahi hai, to yeh positive divergence ki nishani ho sakti hai.

- Moving Average Convergence Divergence (MACD): MACD market ke trend ko measure karta hai. Agar MACD aur market mein mukhtalif rujhan hai, to isay divergence kaha jata hai.

- Stochastic Oscillator: Yeh bhi ek popular indicator hai jo market ke overbought aur oversold conditions ko measure karta hai. Agar market niche ja rahi hai aur Stochastic upar ja raha hai, to yeh positive divergence ho sakti hai.

Divergence ki pehchan karne ke baad, traders apne tijarat ke faislay mein isay istemal karte hain. Positive divergence ko dekhte hue, woh long positions le sakte hain, yani ke woh ummid karte hain ke market ka trend badalne wala hai aur upar jaayega. Negative divergence ko dekhte hue, woh short positions le sakte hain, yani ke woh ummid karte hain ke market ka trend badalne wala hai aur niche jaayega.

Lekin, yaad rahe ke divergence ek matnawi tool hai aur isay hamesha 100% sahi nahi hota. Market mein hamesha uncertainty hoti hai aur kai factors us par asar daal sakte hain. Isliye, traders ko hamesha apne risk ko manage karna chahiye aur dusre tajaweezat aur tijarat karne wale logon se isteshara karna chahiye.

Divergence ka istemal karna tijarat karne walon ke liye ek nayab tareeqa hai jisse woh market ke mizaj ko samajh sakte hain. Lekin, yeh ek tool hai, aur isay sahi taur par istemal karne ke liye practice aur samajh zaroori hai. Traders ko chahiye ke woh market ko ghaur se dekhein aur apne faislay ko achi tarah se sochein taake woh behtar tijarat kar sakein.

تبصرہ

Расширенный режим Обычный режим