Rising Three Methods:

Ajj ka Trading Chart Mein Samajhain

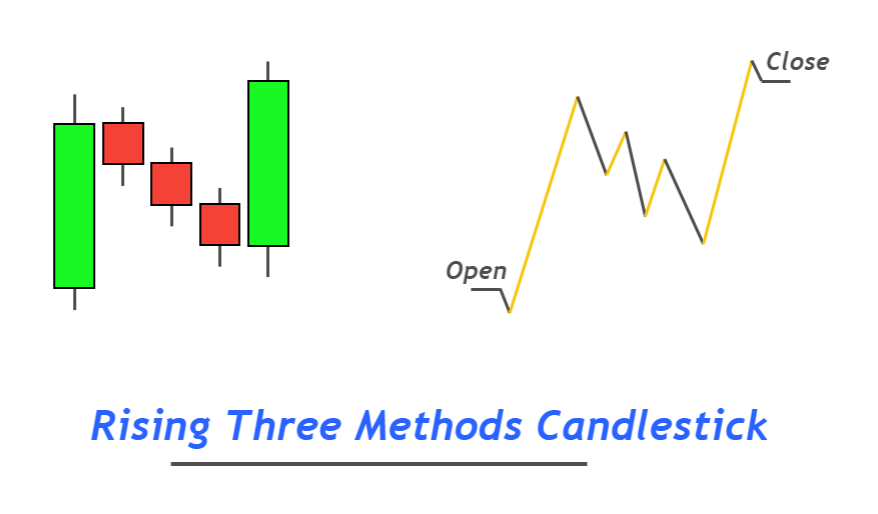

"Rising Three Methods" ek candlestick pattern hai jo bullish trend ko indicate karta hai. Yeh pattern Japanese candlestick charts par dikhai deta hai aur traders ko market ke future price movements ke baare mein hint dene mein madad karta hai.

Rising Three Methods Kya Hai?

Rising Three Methods ek continuation pattern hai, jo ek uptrend ke dauran aata hai. Is pattern mein ek lambi bullish candlestick (up candle) hoti hai, jise "rising" candle kehte hain, aur uske baad teen small bearish candlesticks (down candles) aati hain, jinke beech mein phir se ek lambi bullish candle hoti hai. Yeh bearish candles up candle ke range ke andar rehti hain aur overall trend bullish hi rehta hai.

Rising Three Methods Ka Formation:

- Pehla Candle (Rising Candle): Pehla candle ek strong bullish candle hoti hai jo uptrend ko represent karti hai. Is candle ka size bada hota hai.

- Teen Chote Candles (Down Candles): Uske baad teen chote bearish candles aati hain, jo pehle candle ke range ke andar rehti hain. Yeh candles market mein choti si consolidation ko darust karte hain.

- Doosra Candle (Rising Candle): Phir se ek lambi bullish candle aati hai jo pehle candle ke upar ja sakti hai. Yeh indicate karta hai ke uptrend continue ho sakta hai.

Rising Three Methods Ka Trading Strategy:

- Confirmation: Traders ko Rising Three Methods pattern ko confirm karne ke liye wait karna chahiye. Confirmation ke liye, doosre bullish candle ke closing price se upar hone ka wait karein.

- Entry Point: Agar confirmation mil gayi hai, to traders long position le sakte hain. Entry point ko properly determine karein, jaise ke doosre bullish candle ke high ke upar.

- Stop-Loss Order: Risk management ke liye stop-loss order set karna important hai, taake unexpected price movements se protection ho sake.

- Target Price: Target price ko determine karne ke liye, pehle bullish candle ka range istemal kiya ja sakta hai. Target price ko calculate karne ke liye, us range ko doosre bullish candle ke closing price ke upar extend karein.

Conclusion:

Rising Three Methods pattern, traders ko uptrend continuation ke signals provide karta hai. Lekin, market conditions aur doosre technical indicators ka bhi dhyan rakha jana chahiye. Trading decisions lene se pehle, pattern ki confirmations aur overall market analysis ka moolya lagana important hai.

تبصرہ

Расширенный режим Обычный режим