Breakout aur Retest Trading:

Ek Makhsoos Tijarat Ka Ta'aruf

Breakout aur retest trading do aham mizaaji tijarat ki malumat hai jo tijarat karne walayon ke darmiyan intehai ahem hai. Ye do tajaweezain mukhtalif tijaratyon mein istemal hoti hain, jin se behtar munafa haasil kiya ja sakta hai.

Breakout Trading:

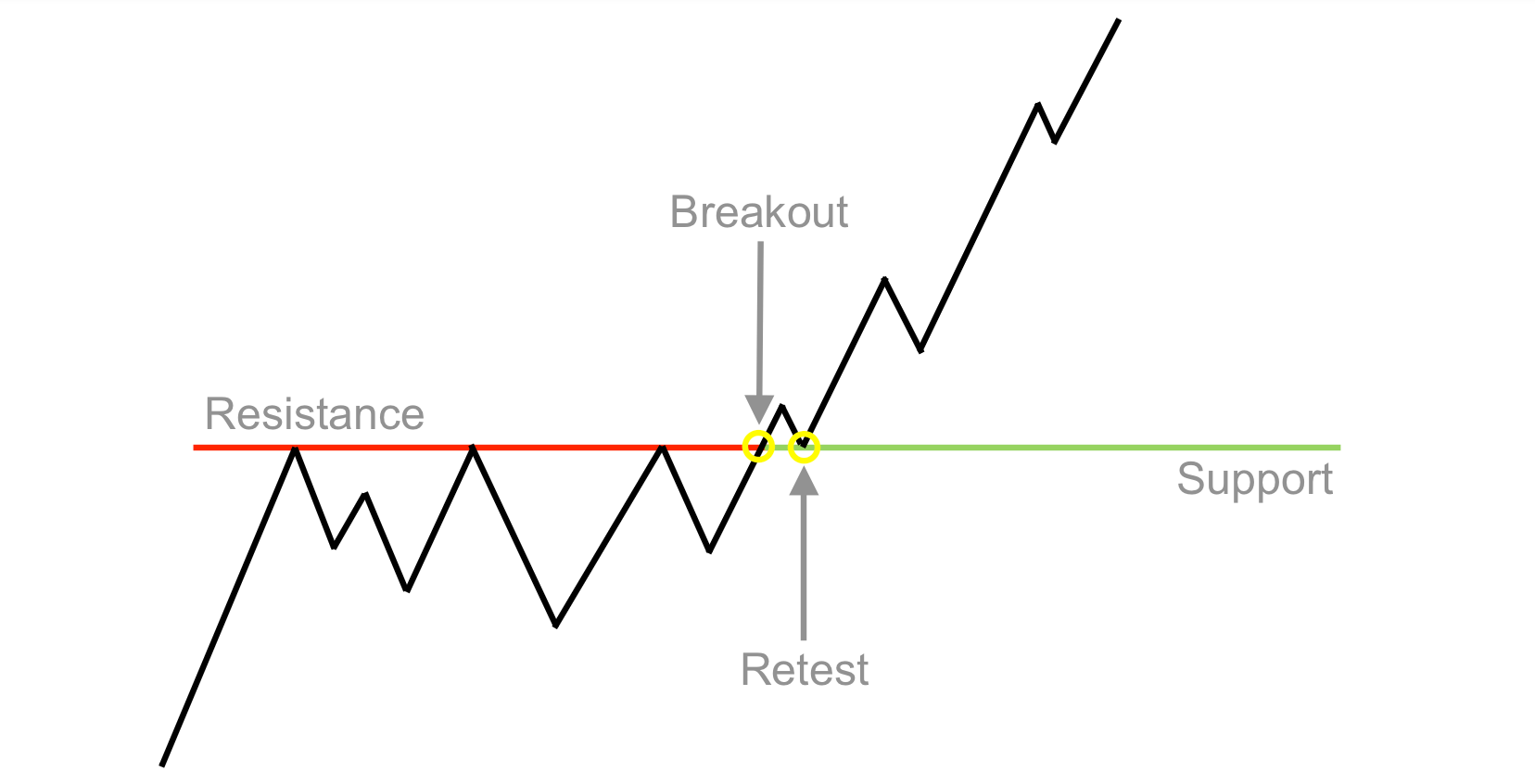

Breakout trading ka asal maqsad hota hai jab kisi makhsoos keemat ya support/resistance level ko paar karta hai. Jab kisi tareekhi level ko paar karta hai, to isay "breakout" kehte hain. Ye ek signal hota hai ke mojooda trend mein tabdili aanay wali hai.

Breakout trading mein, tijarat karne walay ek naye trend ko pehchannay ki koshish karte hain. Jab keemat ya support/resistance level ko paar karta hai, to traders naye trend ki shuruwat ke liye tayyar ho jaate hain. Ye tijarat amooman ziada volatil markets mein ki jaati hai, jaise ke stock market ya forex market.

Retest Trading:

Retest trading ka maqsad hota hai jab ek market breakout karta hai aur phir wapis usi level par laut kar check karta hai. Agar breakout ke baad market wapis us level par aa kar rukti hai aur us level ko ab support ya resistance banati hai, to ise "retest" kehte hain.

Retest trading mein, tijarat karne walay breakout ke baad market ko closely monitor karte hain. Agar market wapis breakout level par aa kar rukti hai aur usay support ya resistance banati hai, to ye ek strong signal hai ke naya trend confirm hua hai.

Tijarat Ke Faisle:

Breakout aur retest trading ke dauran tijarat karne walon ke liye faislay bohot zaroori hote hain. Breakout trading mein, tijarat karne se pehle achhi tarah se market ki analysis karni chahiye, aur retest trading mein, breakout ke baad market ki activity ko closely observe karna bohot zaroori hai.

In dono tijarat techniques ko samajhna aur istemal karna tijarat karne walon ke liye mushkil ho sakta hai, lekin inka istemal sahi taur par kiya jaye to ye behtareen munafa haasil karne mein madadgar sabit ho sakti hain.

In tamam malumat ko madde nazar rakhte hue, breakout aur retest trading ek mahir tijarat karne wale ke liye ahem tools hote hain jo market ki complexities ko samajhne aur munafa haasil karne mein madadgar sabit ho sakte hain.

تبصرہ

Расширенный режим Обычный режим