Tweezer Bottom Pattern (ٹویزر بوٹم پیٹرن) Ki Tafseel:

Tweezer bottom pattern aik candlestick chart pattern hai jo ke bearish trend ke baad aksar bullish reversal ka sign deta hai. Is pattern mein do ya zyada candles hote hain jo neechay ki taraf milti hain aur woh almost same level par close hoti hain. Yeh pattern neechay di gai trend ki khatam hone aur upar ki taraf move ka indication deta hai.

Characteristics (خصوصیات):

- Do Candles: Tweezer bottom pattern mein do alag alag candles hoti hain jo ke neechay ki taraf milti hain.

- Close Levels: Yeh candles almost same level par close hoti hain, jo ke ek strong support level ki taraf ishara karte hain.

- Location: Yeh pattern bearish trend ke neechay zyada tar paya jata hai, jahan se market reversal ki umeed hoti hai.

- Volume: Ideal scenario mein, tweezers bottom pattern ke sath acha volume bhi hota hai, jo ke reversal ki taasir ko strengthen karta hai.

Tashheer (تشہیر):

Jab market downtrend ke baad neechay ki taraf ja raha hota hai aur do candles almost same level par close karte hain, toh yeh bullish tweezer bottom pattern ki formation hoti hai. Is pattern ke baad traders bullish movement ki umeed rakhte hain.

Tawajjo (توجہ):

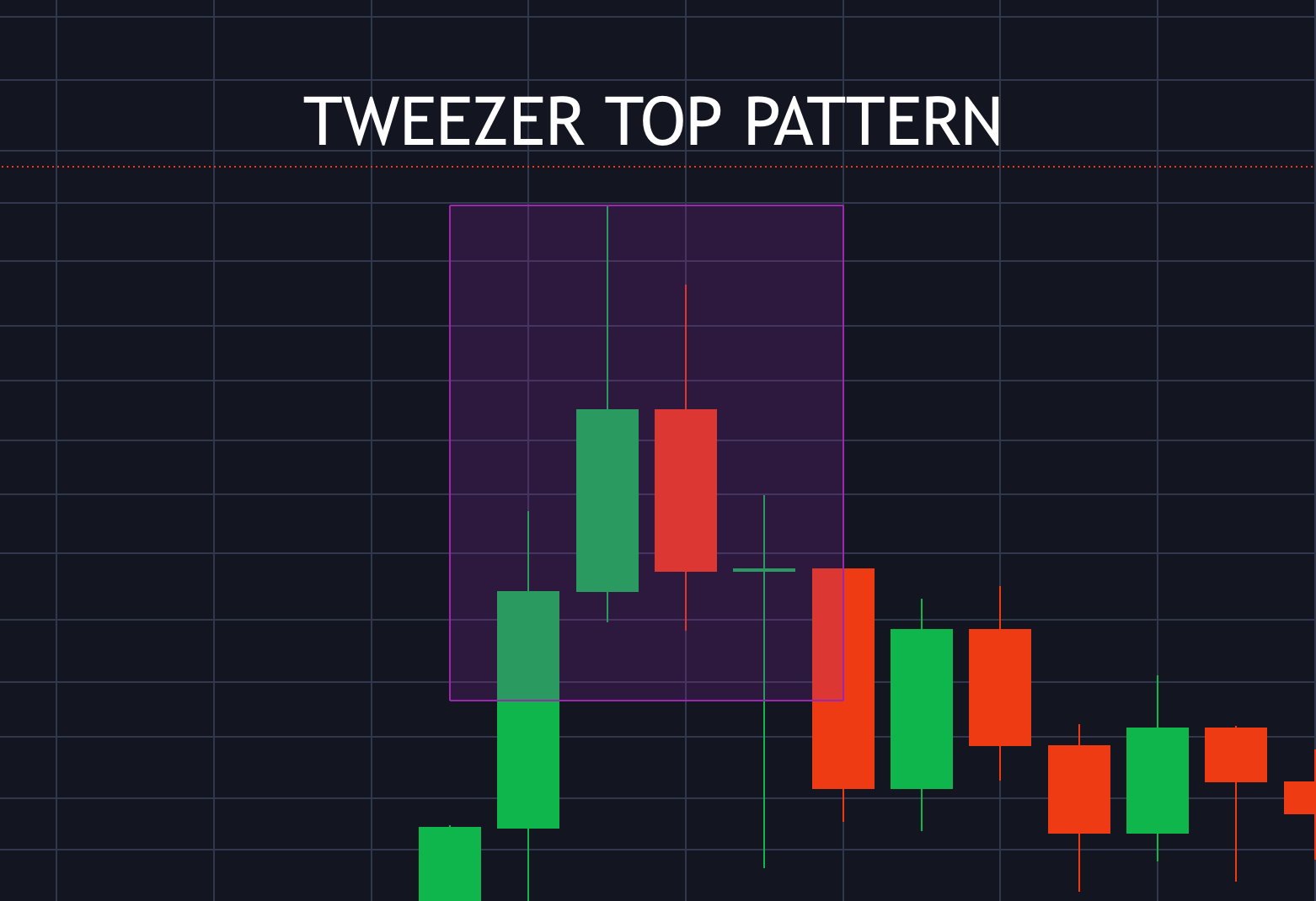

i se khatm kar sakti hai tweezer top ki identify two candle Se Ki Jaati Hai is pattern Mein tweezer Ke Niche Two candles Nazar aaenge Jiske Bajaye Usi Tarah Ki back to back lows hogie ke har chart patteLekin, jaisJab Bulls price ko Upar dhakel Dete Hain Aksar Dat ka end unchai ke kareeb Hota Hai phir next day traders Apne market ke sentiment ko ulat Dete Hain market Jab open Hoti Hai To Pichhle Day ki khilaf varzi nahin karti Hain aur jab bears prices ko kam Karte rahte hain jisse Day kam hone ke kareeb Hota Hai day 2 per Tezi se pesh kadmi Pichhle trading day ke losses ko Tezrn ki tarah, yeh pattern bhi akela indicator nahi hai. Traders ko is pattern ke sath sath doosre technical indicators aur tools ka bhi istemal karna chahiye taake confirmations mil sake.

تبصرہ

Расширенный режим Обычный режим