Bearish Engulfing Sandwich pattern Kia ha?

"Bearish Engulfing Sandwich" ek candlestick pattern hai jo market mein bearish reversal ko suggest karta hai. Ye pattern bearish engulfing aur bullish engulfing candles ke combination par adharit hota hai. Yeh pattern aksar trend reversal ko darust karta hai, lekin iska istemal karne se pehle confirmation aur doosre technical indicators ka bhi tawajju dena important hai.

Bearish Engulfing Sandwich Pattern Ki Khasiyat:

- Pehla Candle (Bullish):

- Bearish Engulfing Sandwich pattern ka pehla candle bullish hota hai.

- Yeh candle market mein uptrend ko represent karta hai.

- Dusra Candle (Bearish Engulfing):

- Dusra candle ek bearish engulfing pattern hota hai, jisme ek small bullish candle ko ek larger bearish candle engulf karta hai.

- Bearish engulfing candle pehle candle ke upper aur lower levels ko cover karta hai, iska matlab hai ki bearish pressure badh rahi hai.

- Teesra Candle (Bullish):

- Teesra candle phir se ek bullish candle hota hai.

- Is candle mein market mein phir se kuch recovery ka indication hota hai, lekin ye recovery pehle bearish engulfing candle ke losses ko cover nahi kar pata hai.

Trading Strategy:

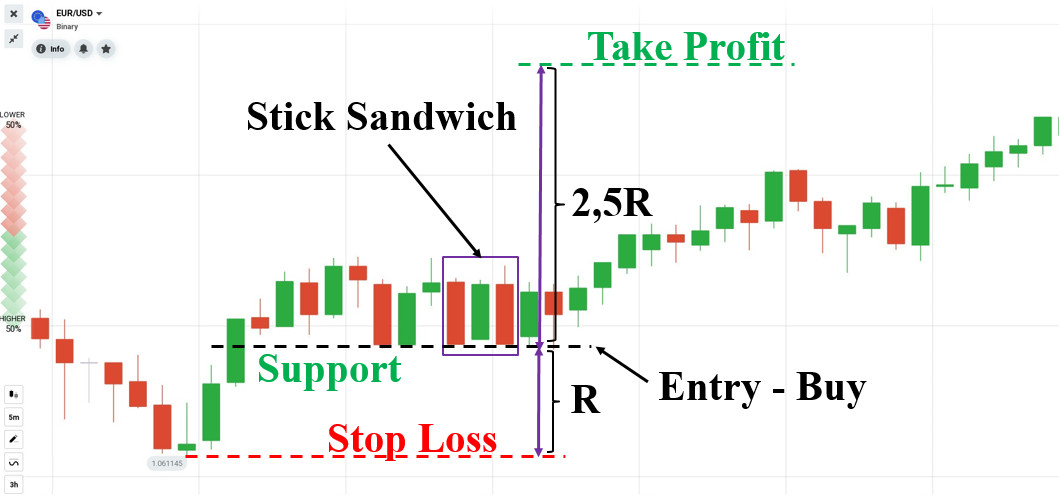

- Confirmation:

- Bearish Engulfing Sandwich pattern ko confirm karne ke liye, traders doosre technical indicators ka istemal karte hain, jese ke trendlines, support aur resistance levels, aur doosre candlestick patterns.

- Volume analysis bhi important hai. Agar bearish engulfing candle ke waqt volume badhta hai, toh ye pattern aur bhi strong hota hai.

- Entry Point aur Stop-Loss:

- Pattern ko confirm hone ke baad traders entry point decide karte hain. Entry point ko define karne ke liye doosre technical factors ka bhi tawajju dena important hai.

- Stop-loss order ka istemal nuksan se bachne ke liye kiya jata hai.

- Target Level:

- Target level ko set karna important hai taki traders apne profits ko lock kar sakein.

- Fibonacci retracement levels ya previous support levels ko target levels ke liye consider kiya ja sakta hai.

Bearish Engulfing Sandwich pattern ka istemal karne se pehle, market context aur doosre technical factors ka bhi tawajju dena chahiye. Is pattern ko sahi taur par interpret karne ke liye, traders ko market conditions aur overall trend ko bhi samajhna zaroori hai. Trading mein hamesha risk management ka dhyan rakha jana chahiye aur iske sath hi proper confirmation ke bina kisi bhi pattern par pura bharosa nahi karna chahiye.

تبصرہ

Расширенный режим Обычный режим