Market Trend aur Sideways Pattern:

1. Market Trend (Bazaar Ki Raftar):

Market trend ek direction mein jo price movements hoti hain, usay describe karta hai. Market trend ko do primary categories mein divide kiya jata hai:

- Uptrend (Uper Ki Taraf): Jab prices continuously higher highs aur higher lows banate hain.

- Downtrend (Neeche Ki Taraf): Jab prices continuously lower highs aur lower lows banate hain.

Market trends ke mukhtalif phases hote hain jaise ke primary trend, secondary trend, aur minor trend.

:max_bytes(150000):strip_icc()/dotdash_Final_Sideways_Trend_Jul_2020-01-957911b474f84d7db63e0d19f6aff770.jpg)

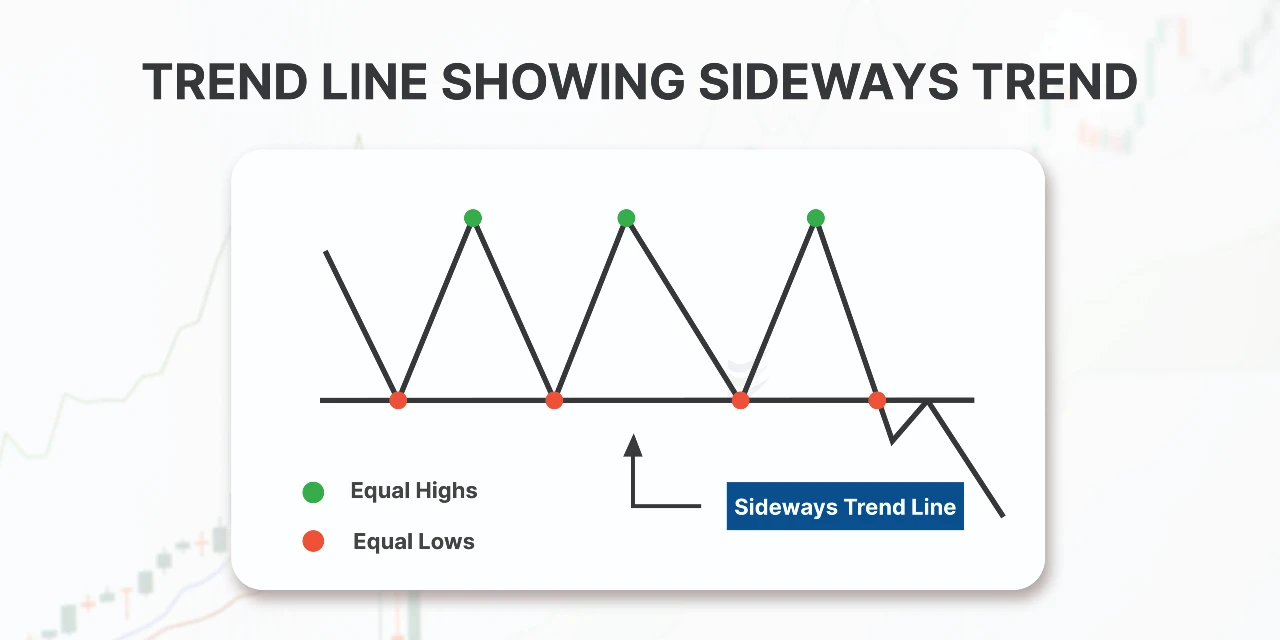

2. Sideways Pattern (Darmiyan Ki Shakal):

Sideways pattern, ya range-bound pattern, ek aisa market condition hai jahan prices kisi mukhtalif direction mein significant change nahi karti, balki ek range ya band mein hi rehti hain. Sideways patterns ko recognize karna aur samajhna traders ke liye zaroori hota hai taake woh trading strategies ko adjust kar sakein.

Kuch Ahem Points:

- Trading Strategy: Sideways patterns mein trading karna alag hota hai. Traders ko support aur resistance levels ko closely monitor karna chahiye aur breakout situations ka wait karna chahiye.

- Volatility: Sideways markets mein volatility kam hoti hai compared to trending markets. Yeh volatility levels traders ke trading decisions par asar dal sakti hai.

- Stop Loss aur Take Profit: Sideways markets mein traders ko apne stop loss aur take profit levels ko adjust karna chahiye, kyunki range-bound movement mein unexpected price spikes ki possibilities hoti hain.

- Indicators: Sideways markets mein traders indicators jaise ki Bollinger Bands ya Moving Averages ka use kar sakte hain, jo volatility aur trend directions ko identify karne mein madad karte hain.

:max_bytes(150000):strip_icc()/dotdash_inv-channeling-charting-a-path-to-success-july-2021-01-b275ea5948754176b0ba744d277f8fc6.jpg)

Mukhtasar Tor Par:

Market trend aur sideways pattern dono hi market conditions ke mukhtalif aspects ko reflect karte hain. Traders ko in dono situations ko samajhna aur recognize karna zaroori hai taki woh sahi trading decisions le sakein aur market movements ko effectively predict kar sakein.

تبصرہ

Расширенный режим Обычный режим