Introduction

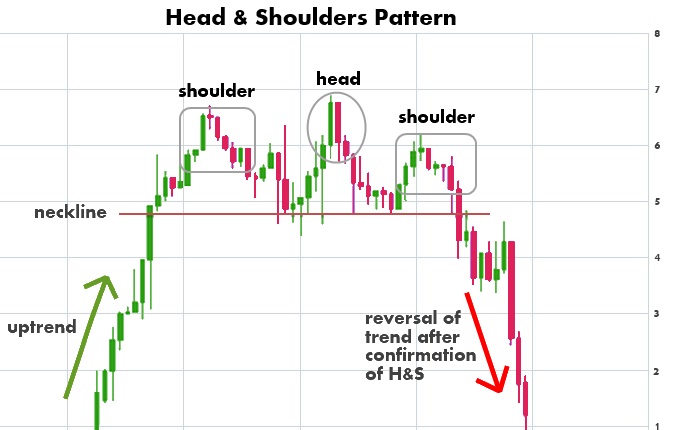

head and shoulder chart pattern aik kesam ka technical chart pattern hota hey jo keh forex trader ka chart pattern ko identify kar sakta hey forex market mein trend khatam honay kay bad market mein reversal start ho jay ga yeh forex market mein reversal up trend ka khatmay ko identify kar sakta hey head and shoulder pattern ke khas shape hote hey jes men bain shoulder dain shoulder head or neck line bhe shamel hote hey

what is inverted Head and Shoulder Pattern

forex market mein inverted head and shoulder pattern aik he sakhat say he melta julta chart pattern hota hey jaisa keh yeh aik kesam ka reversal chart pattern hota hey head and shoulder pattern nechay kay trend mein kabel e analysis chart pattern hota hey or forex market mein lower level kay paida honay kay analysis ko identify kar sakta hey market kay trend kay reversal janay ko identify kar saktay hein

Trade with Head and Shoulder Pattern

oper wala chart Germany 30 DAX30 ka chart deya geya hey jo keh forex market mein neck line ke tashkeel kay sath pattern ko wazah kar sakta hey trader neck line ke confirmation kay bad trade mein enter ho sakta hey or forex market mein aik short trade mein enter honay ke koshesh kar sakta hey jaisa keh forex market mein chart entry level pip ke movement kay zarey say entry lk ja sakte hey jo keh forex market mein short trade ko enter honay kay bad neck line ko indicate kar sakta hey pips kay breakout say he mokamal tor par market ka chart nechay janay ko identify kar sakta hey

head and shoulder chart pattern aik kesam ka technical chart pattern hota hey jo keh forex trader ka chart pattern ko identify kar sakta hey forex market mein trend khatam honay kay bad market mein reversal start ho jay ga yeh forex market mein reversal up trend ka khatmay ko identify kar sakta hey head and shoulder pattern ke khas shape hote hey jes men bain shoulder dain shoulder head or neck line bhe shamel hote hey

what is inverted Head and Shoulder Pattern

forex market mein inverted head and shoulder pattern aik he sakhat say he melta julta chart pattern hota hey jaisa keh yeh aik kesam ka reversal chart pattern hota hey head and shoulder pattern nechay kay trend mein kabel e analysis chart pattern hota hey or forex market mein lower level kay paida honay kay analysis ko identify kar sakta hey market kay trend kay reversal janay ko identify kar saktay hein

Trade with Head and Shoulder Pattern

oper wala chart Germany 30 DAX30 ka chart deya geya hey jo keh forex market mein neck line ke tashkeel kay sath pattern ko wazah kar sakta hey trader neck line ke confirmation kay bad trade mein enter ho sakta hey or forex market mein aik short trade mein enter honay ke koshesh kar sakta hey jaisa keh forex market mein chart entry level pip ke movement kay zarey say entry lk ja sakte hey jo keh forex market mein short trade ko enter honay kay bad neck line ko indicate kar sakta hey pips kay breakout say he mokamal tor par market ka chart nechay janay ko identify kar sakta hey

تبصرہ

Расширенный режим Обычный режим