hai pahle vki role area of interest Hai to promote ki alternate car pay open Ho Jaati Hai. Job marketplace Mein chij ki kimat america jyada ho ye jo aapane Shri di thi to use Waqt automatically chij sale in step with Chali jaati hai ya nahin aap ko fayda hota hai ki aapki kam pasta Mein

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Characteristics of restriction orders; -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

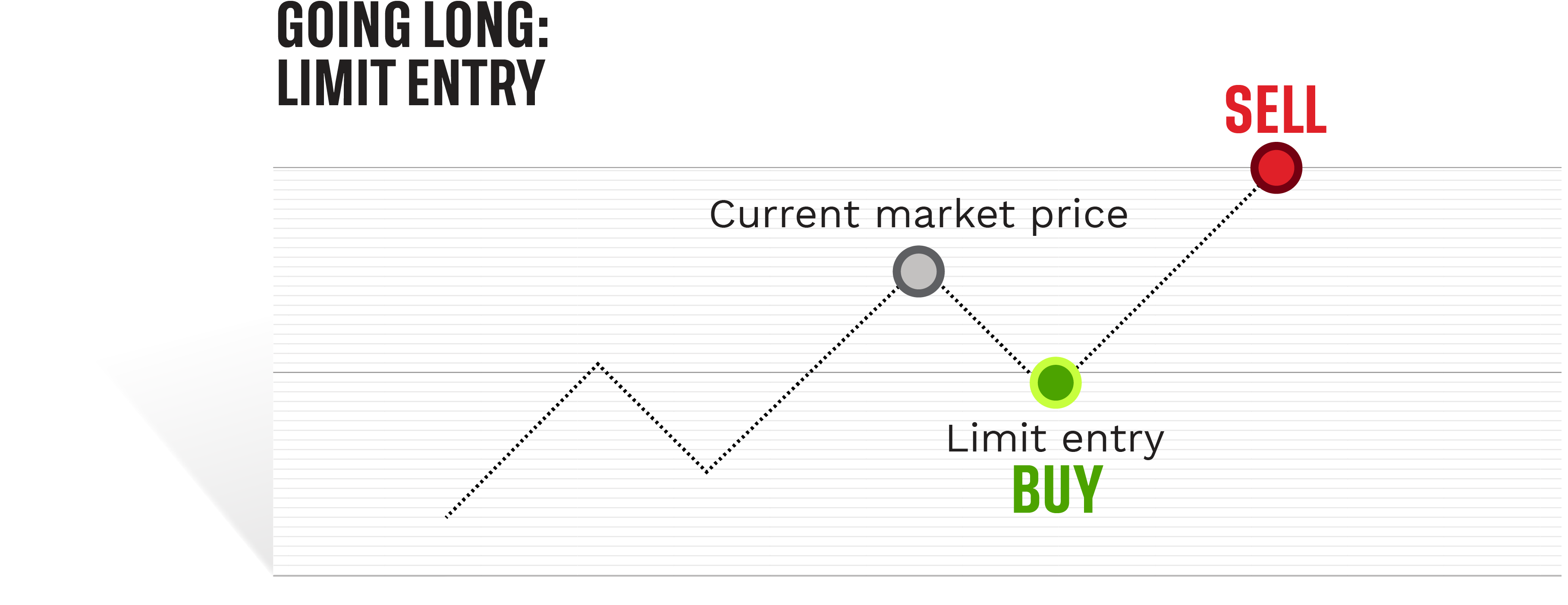

"Restriction Orders" ya "Limit Orders"

forex trading ya financial markets mein istemal hone wale ek aham trading order type hain. Ye orders traders ko specified price levels par buy ya sell karne ki permission dete hain. Yahan kuch key characteristics ya khasiyatien hain jo restriction orders ke taur par maqbul hain:- Mukarrar Price Level: Restriction order ek mukarrar (specified) price level par execute hone ke liye diya jata hai. Agar trader ne buy limit order diya hai, toh woh specified price ya usse kam par execute hoga. Aur agar sell limit order diya gaya hai, toh execution specified price ya usse zyada par hogi.

- Risk Management: Restriction orders traders ko apne trades ko control karne mein madad karte hain, khaas karke risk management ke liye. Traders apne trades ko execute karne se pehle hi decide kar sakte hain ke woh kitna maximum ya minimum price par trade karna chahte hain.

- Advance Planning: Ye orders traders ko advance mein planning karne ki permission dete hain. Trader specify karte hain ke jab market mein price desired level tak pahunchegi, tab unka order execute hoga. Isse traders ko market movements ka behtar and systematic control milta hai.

- Market Price Se Alag: Limit orders market price se alag hote hain. Agar market price specified level tak nahi pahunchti, toh order execute nahi hota. Isse traders ko flexibility milti hai apne desired price levels par trades karne mein.

- Partial Execution: Kabhi-kabhi, jab market price specified level tak pahunchti hai, toh order partially execute ho sakta hai. Yani ke sirf ek hissa order complete hota hai aur baaki ka portion pending rehta hai.

- Gallanay Ka Risk: Limit orders ke istemal mein ek risk hota hai ke market price specified level tak nahi pahunch sake, aur order execute na ho sake. Ismein yeh bhi ho sakta hai ke market specified level tak chali jaye, lekin order execute na ho paye agar market mein liquidity kam hai.

- Long-Term Trading Ke Liye Suitable: Limit orders, khaas karke long-term traders ke liye suitable hote hain jo market price fluctuations se bachna chahte hain aur apni trades ko carefully plan karna pasand karte hain.

Yeh characteristics, restriction orders ko ek flexible aur control-oriented trading tool banate hain jo traders ko apne trading strategies ko effectively implement karne mein madad karte hain.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trading mein restriction orders ek ahem kirdar ada karte hain, jo market participants ko kuch qisam ki specific conditions ko follow karne par majboor karte hain. Inke zarie trading mein kuch paabandiyan aur qayde logon par lagaye jaate hain jo market ke stability aur transparency ko qaim rakhne mein madadgar hote hain. Restriction orders different qisam ke hote hain aur inka effect trading ki mukhtalif aspects par hota hai, jaise ke trading volume, stock price, aur trader ke behavior par.

Restriction Orders Ka Maqsad

Restriction orders ka maqsad trading market mein ek fair aur systematic environment ko ensure karna hai. Iska matlab ye hai ke jab bhi koi restriction order lagaya jata hai, toh uska pehla maqsad ye hota hai ke kisi qisam ki speculative aur manipulative activities ko roka jaaye. Iss se investors ka trust qaim rehta hai aur market mein transparency aur discipline ko promote kiya jata hai. Restriction orders ka ek aur maqsad trading ke process ko smoothly chalayana hai, taake market participant confidently aur comfortably trade kar saken.

Types of Restriction Orders

Restriction orders mukhtalif qisam ke hote hain jo alag-alag conditions mein lagaye jate hain. Ye orders depend karte hain trading ki type, trader ki profile, aur market condition par. Kuch ahem types ye hain:

i. Price Band Restrictions

Price band restriction wo orders hain jo stock ke price ko ek specific range mein band kar dete hain. Yeh band ek upper limit aur lower limit set karta hai, jisse kisi bhi stock ka price us range se bahar nahi ja sakta. Iska faida yeh hai ke price fluctuations control mein rehti hain aur kisi bhi qisam ki manipulative trading aur speculation se bachne mein madad milti hai.

ii. Volume Restriction Orders

Volume restriction orders ka matlab hai ke kisi bhi stock ka ek din mein trade hone wala volume restricted hota hai. Yeh orders especially un securities ke liye lagaye jate hain jo high volatility show karte hain ya jisme speculative trading ka andesha hota hai. Iska asar ye hota hai ke kisi bhi stock ka excessive trading roka ja sakta hai aur iske wajah se market pe unka asar bhi control mein rehta hai.

iii. Circuit Breakers

Circuit breakers ek ahem qisam ka restriction order hai jo market ke stability ko ensure karte hain. Yeh wo paabandi hoti hai jo stock market ke ek set percentage decline ya rise par lagayi jati hai. Jaise hi market ya kisi stock ka price is set level ko touch karta hai, trading automatically halt ho jati hai. Yeh restrictions usually short period ke liye hote hain, magar ye traders ko sochne ka waqt dete hain aur panic aur overreaction ko control karte hain.

iv. Account-Specific Restriction Orders

Yeh wo orders hain jo specific accounts par lagaye jate hain, jo kisi qisam ki questionable ya illegal activities mein shamil hote hain. Misal ke taur par, agar kisi trader par insider trading ka ilzaam lagta hai toh us par account-specific restrictions lagayi ja sakti hain. Iska faida ye hai ke illegal activities aur unethical trading ko roka ja sakta hai, aur market mein integrity maintain kiya jata hai.

Importance of Restriction Orders

Restriction orders trading environment mein bohot importance rakhte hain. Yeh trading ke transparency aur fairness ko ensure karte hain aur kisi bhi qisam ki unlawful activities ko prevent karte hain. Trading market mein trust aur reliability ko barqarar rakhne ke liye restriction orders zaroori hain. Inka asar long-term mein investors ke confidence par bhi hota hai, jo market ke liye beneficial hai.

Market mein agar restriction orders na ho, toh speculative aur manipulative activities ke chances barh jate hain jo market ko destabilize kar sakte hain. Isliye restriction orders market ke overall health ke liye zaroori hain aur inka hona investors aur traders ke liye bhi protective hota hai.

Effects of Restriction Orders on Market Participants

Restriction orders ka asar market ke mukhtalif participants par hota hai, chahe wo institutional investors hon ya retail traders. Inke kuch asar ye hain:

i. On Institutional Investors

Institutional investors, jo usually large investments ke saath trade karte hain, restriction orders se zyada affected hote hain. Price band aur volume restrictions ki wajah se unka buying aur selling strategy par asar padta hai. Isliye woh apne trades ko carefully plan karte hain aur market ke rules aur regulations ka ehtemaam rakhte hain.

ii. On Retail Traders

Retail traders bhi restriction orders ka effect mehsoos karte hain, magar unka exposure kam hota hai. Ye orders retail investors ko zyada speculative aur impulsive trading se bachaate hain. Misal ke taur par, circuit breakers jab lagte hain, toh retail investors ko time milta hai taake woh market situation ko analyze kar saken aur panic mein decision na lein.

iii. On Market Makers

Market makers ke liye restriction orders ek challenge ho sakte hain, kyunki unka kaam liquidity provide karna hota hai. Agar price band ya volume restrictions ki wajah se liquidity kam ho, toh market makers ka kaam mushkil ho jata hai. Magar iske bawajood woh apne role ko transparency aur ethical tariqe se ada karte hain.

Impact of Restriction Orders on Market Stability

Market stability restriction orders ka aik barra faida hai. Ye orders market ke stability ko ensure karte hain aur kisi bhi qisam ki extreme volatility se bachaate hain. Jab market excessively volatile ho jaye toh yeh orders panic aur fear ko control karte hain aur market participants ko mauka dete hain ke woh rational decisions lein. Market stability aur restriction orders ka close connection hai, jo long-term mein market ke liye beneficial hota hai.

Criticisms of Restriction Orders

Jahan restriction orders ke faide hain, wahin iske kuch negative aspects bhi hain jo traders aur investors ke liye kabhi kabhi challenging ho sakte hain. Kuch log isko criticize bhi karte hain, aur unke kuch ahem points ye hain:- Liquidity Issues: Volume restrictions aur circuit breakers ki wajah se market mein liquidity issues ho sakte hain, kyunki trades limit ho jati hain aur investors ko orders execute karne mein mushkil hoti hai.

- Over-Regulation: Kuch traders aur investors ko lagta hai ke excessive restriction orders se over-regulation ka issue ho jata hai jo market ke natural flow ko disturb karta hai.

- Market Freedom Ka Khatma: Restriction orders market freedom ko bhi effect karte hain aur kuch traders isko unjustified restrictions samajhte hain jo unke investment decisions par zabardasti ki paabandi lagate hain.

Market conditions aur trading ke nature ke sath sath restriction orders mein bhi developments aati rehti hain. Technology aur artificial intelligence ke development ke sath, future mein restriction orders aur bhi advanced aur accurate ho sakte hain. Algorithmic trading ke era mein, restriction orders ko is tarah design kiya ja sakta hai ke yeh instant trading activities ko monitor aur control kar sakein.

Future mein blockchain aur AI ke integration ke zariye restriction orders aur bhi effective aur accurate ho sakte hain. Yeh new technologies restriction orders ko real-time mein apply kar sakti hain aur speculative activities aur insider trading ko aur bhi efficiently prevent kar sakti hain.

Restriction orders ka kirdar trading aur market environment mein bohot ahem hai. Yeh orders na sirf market ke stability aur transparency ko ensure karte hain, balki investor ke confidence ko bhi maintain karte hain. Restriction orders se kisi bhi qisam ki unlawful aur unethical activities ko control karne mein madad milti hai, jo trading market ke liye ek positive environment create karta hai.

Halaat aur market conditions ke mutabiq restriction orders mein flexibility aur modernization ki zaroorat hai, taake yeh market aur traders dono ke liye beneficial ho. Technology ke sath sath restriction orders ko bhi update karna chahiye, taake yeh aane wale dor mein bhi trading ke ecosystem ko secure aur transparent banayein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Restrictive Orders ka Mafhoom aur Unke Khasusiyat

Aaj hum ek ahem topic par baat karenge jo trading aur investment ki duniya mein bohot ahmiyat rakhta hai – ye hai restrictive orders aur unke khasusiyat. Restrictive orders wo orders hain jo kisi financial transaction ke dauran kuch khaas limitations aur conditions ka taayun karte hain. Yeh orders asan alfaz mein kahen to investors ko kuch specific conditions par kaam karne ki ijazat dete hain. Aayein dekhte hain ke ye orders kis tarah se kaam karte hain aur investor aur traders ko kaise madad faraham karte hain.

1. Restrictive Orders ka Maqsad

Restrictive orders ka buniyadi maqsad investor ya trader ko kisi transaction mein ek limited scope ya qisam ka ikhtiyaar dena hai. Yeh orders khas taur par us waqt istamaal kiye jaate hain jab koi investor ya trader apne nuksan ko control mein rakhna chahta hai ya kisi khaas daam par profit ya sale secure karna chahta hai. Iska faida ye hai ke investor ya trader ko kuch restriction ke saath woh condition mil jati hai jo usay unke financial goals ke mutabiq risk aur reward ke ta’aluq mein ek mawafiq position deta hai.

2. Types of Restrictive Orders aur Unka Taaruf

Restrictive orders ke kai mukhtalif qisam hain, lekin kuch aam qisam ki orders jo aksar investors aur traders istamaal karte hain, unmein following hain:- Limit Order: Ye wo order hai jo kisi specific price par execute hota hai. Iska matlab ye hai ke agar investor kisi khaas price par hi stock ko khareedna ya bechna chahta hai to woh limit order use karega. Yeh khas taur par un logon ke liye acha hota hai jo ek muqarara price par stock acquire ya sale karna chahte hain.

- Stop Order: Is order ka maqsad kisi stock ki price ek specific threshold ko touch karne par woh trade execute hona hai. Yeh aksar loss ko rokne ke liye lagaya jata hai aur issay stop-loss order bhi kaha jata hai.

- Stop-Limit Order: Ye order dono stop aur limit orders ka combination hai. Pehle ek stop price set kiya jata hai aur jab woh price hit ho jati hai, toh limit price par trade execute hota hai. Yeh un logon ke liye faidemand hai jo precise execution par yaqeen rakhte hain.

Market ke dynamics aur volatility ka bhi restrictive orders par asar hota hai. Markets mein bohot se external factors, jaise economic announcements, earnings reports aur political instability hoti hain jo stock prices ko tezi se badalne mein ahm kirdar ada kar sakti hain. Aise mein restrictive orders lagana investor ko market ke ups aur downs ke dauran apne desired targets ko achieve karne mein madadgar hota hai. Yani agar kisi stock ki price ek sudden jump le ya sudden fall ho, to ye orders aapke targets ko barqarar rakhne mein madadgar sabit hote hain.

4. Restrictive Orders ke Advantages aur Disadvantages

Jahan restrictive orders ke kai faide hain, wahin kuch nuqsan bhi hain jo kisi bhi investor ko inhe samajhne aur lagane se pehle samajhne chahiye.

Advantages:- Price Control: Restrictive orders mein investor ko ye ikhtiyaar hota hai ke woh ek specific price par apne trade ko execute kar sakta hai, jo unke financial goals aur planning ke mutabiq hota hai.

- Risk Management: Yeh orders aapko loss control karne mein madad dete hain, khas taur par stop-loss orders jo investor ko ek desired loss level par trade ko khatam karne ki ijazat dete hain.

- Flexible Execution: Investor ko kuch specific aur customizied conditions ke saath trade karne ka option milta hai jo ke market orders mein possible nahi hota.

Disadvantages:- Delayed Execution: Agar market mein price kabhi target limit par na aaye, to order execute nahi ho sakta aur investor apni opportunity kho sakta hai.

- Partial Fills: Kabhi kabhi restrictive orders mein partial fills bhi ho sakti hain, jo ke investor ke strategy ko effect kar sakta hai aur woh full execution nahi le sakta.

Market timing aur placement bhi restrictive orders ke liye bohot ahmiyat rakhta hai. Khaas taur par pre-market ya after-market timing mein ye orders different behavior show kar sakte hain. Iska faida ye hai ke agar aap ek specific market session ke dauran trading karte hain to aap apne orders ke liye aik structured aur disciplined approach rakh sakte hain. Ismein aap stock ke high volatility hours ya trading volume hours ko dekhte hue orders place kar sakte hain jo ke efficient execution mein madadgar sabit hote hain.

6. Restrictive Orders aur Investor ki Strategy

Restrictive orders ka istimaal har investor ki strategy par depend karta hai. Khaas taur par short-term aur long-term strategies mein iska different impact hota hai. Long-term investors aksar limit orders ka istimaal karte hain jab ke short-term traders stop orders ko zyada tarjeeh dete hain. Yeh orders unki investment aur trading ki strategies ko support karte hain aur unhe apne desired targets achieve karne mein madadgar sabit hote hain.

Conclusion

Restrictive orders trading aur investment ke world mein ek ahem role ada karte hain. Yeh investor ko specific prices par stocks khareedne aur bechne mein flexibility dete hain aur risk ko control karne mein madadgar hote hain. Lekin har investor ko inke pros aur cons ko samajhna chahiye aur apne financial goals ke mutabiq inka istimaal karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:43 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим