aek bolngr bend ® aek khas tfteshe aalh hay js ke khsoset trend lae'nz kay aek grop say hote hay js men do maeare re dae'rekshnz (shkr hay aor mnfe tor pr) sekeorte ke lagt kay sedhay saday moong tepekl (SMA) say nechay ke jate hen، phr bhe jo pthraؤ kay rjhan kay aade hosktay hen۔ bolngr grops ® ko mshhor prae'eoet selr jan bolngr nay bnaea aor an ka thfz kea، js ka mqsd aesay moaqa tlash krna tha jo male mdd krnay oalon ko osae'l ke zeadh frokht ya zeadh khreday janay pr mnasb treqay say mtalq honay ka aaleٰ sthe amkan frahm krtay hen۔

How to Calculate Bollinger Bands

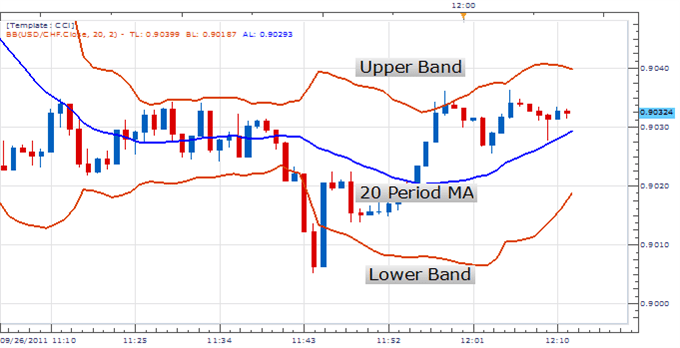

ay pas 22 gae'ed lae'nz hen jn ka mshahdh krnay kay leay grops ko aek aekschenj sstm kay tor pr shaml kea gea hay۔ astak ke lagt. chonkh maeare tfreq gher mtoqaet ka aek tnasb hay، jb drkhoasten zeadh dlfreb ho jate hen to groh brrh jatay hen? km snke amr kay doran، gropbolngr grops ® aek aazad tbadlh frem ork nhen hen۔ oh srf aek fae'l hen js ka mqsd bechnay oalon ko lagt ke gher mtoqaet kay hoalay say deta frahm krna hay۔ jan bolngr nay an ko chnd dosray gher mnslk poae'ntrz kay sath astamal krnay ke tjoez pesh ke hay jo zeadh bolngr grops ® ke kmpeotng men sb say ahm mrhlh 20 dn kay aes aem aay ko astamal krtay hoe'ay brray pemanay pr sekeorte kay hoalay say brah rast hrkt pzer aam (SMA) ko ankod krna hay۔ 20 dn ke hrkt pzere aam dlchspe kay bneade aadad o shmar kay tor pr abtdae'e 20 dnon ke tkmel kay akhrajat men azafh kray ge۔ anfarmeshn poae'nt kay qreb aanay say asl lagt km ho jae'ay ge، 21 dn ke lagt shaml ho jae'ay ge aor aam ogherh ko lay jaea jae'ay ga۔ phr، sekorte ke lagt ka maeare anhraf hasl kea jae'ay ga۔ maeare deoegeshn aam ktaؤ ka aek amdh jz hay aor pemae'sh، male maamlat، rekard aor rqm men nmaean tor pr anasr hen۔ aek deay ge'ay malomate ashareh kay leay، maeare anhraf yh btata hay kh phelaؤ kay aadad o shmar aek aam qdr say kesay hen۔ maeare anhraf ka taen ktaؤ ke mrba bnead ko lay kr kea ja skta hay، jo bzat khod ost kay mrba tzadat ke mkhsos hay۔ phr، as maeare anhraf ke qdr ko do say nql kren aor donon SMA kay sath sath hr aek nqth say as koantm ko jorren aor ghtae'en۔ oh aopre aor nchlay groh pedbolngr grops ® kafe hd tk mshhor dezae'n hen۔ mkhtlf dkandar lagt kay aopre bend men mntql honay kay qreb honay ko qbol krtay hen، altja jtne zeadh khrede jate hay، aor akhrajat nchlay bend men mntql hotay hen، drkhoast atne he zeadh frokht hote hay۔ jan bolngr k drkhoast kay asharay detay hen۔ oh qbol krta hay kh mkhtlf qsm ke malomat pr mbne poae'ntrz ko astamal krna bht zrore hay۔ as kay mkhsos treqon ke trf mae'l honay ka aek hsh narml tfaot/knjnkshn (MACD)، aan belns oaleom، aor rshth dar taqt markr (RSI) ko mntql kr rha hay۔ chonkh oh aek bneade hrkt pzere say nkalay ge'ay hen، as leay an ka ozn tazh tren kay msaoe hay، js ka mtlb yh hay kh nea deta mtrok malomat say napak ho skta hay۔ ase trh، 20 dn kay SMA aor 2 maeare re dae'rekshn ka astamal aek tkrra bay trteb hay aor ho skta hay kh hr aek kay leay kam nh kray۔ bechnay oalon ko chaheay kh oh apnay SMA aor maeare anhraf kay frze tsorat ko as trh aedjst kren aor an ka ahath kren

How to Calculate Bollinger Bands

ay pas 22 gae'ed lae'nz hen jn ka mshahdh krnay kay leay grops ko aek aekschenj sstm kay tor pr shaml kea gea hay۔ astak ke lagt. chonkh maeare tfreq gher mtoqaet ka aek tnasb hay، jb drkhoasten zeadh dlfreb ho jate hen to groh brrh jatay hen? km snke amr kay doran، gropbolngr grops ® aek aazad tbadlh frem ork nhen hen۔ oh srf aek fae'l hen js ka mqsd bechnay oalon ko lagt ke gher mtoqaet kay hoalay say deta frahm krna hay۔ jan bolngr nay an ko chnd dosray gher mnslk poae'ntrz kay sath astamal krnay ke tjoez pesh ke hay jo zeadh bolngr grops ® ke kmpeotng men sb say ahm mrhlh 20 dn kay aes aem aay ko astamal krtay hoe'ay brray pemanay pr sekeorte kay hoalay say brah rast hrkt pzer aam (SMA) ko ankod krna hay۔ 20 dn ke hrkt pzere aam dlchspe kay bneade aadad o shmar kay tor pr abtdae'e 20 dnon ke tkmel kay akhrajat men azafh kray ge۔ anfarmeshn poae'nt kay qreb aanay say asl lagt km ho jae'ay ge، 21 dn ke lagt shaml ho jae'ay ge aor aam ogherh ko lay jaea jae'ay ga۔ phr، sekorte ke lagt ka maeare anhraf hasl kea jae'ay ga۔ maeare deoegeshn aam ktaؤ ka aek amdh jz hay aor pemae'sh، male maamlat، rekard aor rqm men nmaean tor pr anasr hen۔ aek deay ge'ay malomate ashareh kay leay، maeare anhraf yh btata hay kh phelaؤ kay aadad o shmar aek aam qdr say kesay hen۔ maeare anhraf ka taen ktaؤ ke mrba bnead ko lay kr kea ja skta hay، jo bzat khod ost kay mrba tzadat ke mkhsos hay۔ phr، as maeare anhraf ke qdr ko do say nql kren aor donon SMA kay sath sath hr aek nqth say as koantm ko jorren aor ghtae'en۔ oh aopre aor nchlay groh pedbolngr grops ® kafe hd tk mshhor dezae'n hen۔ mkhtlf dkandar lagt kay aopre bend men mntql honay kay qreb honay ko qbol krtay hen، altja jtne zeadh khrede jate hay، aor akhrajat nchlay bend men mntql hotay hen، drkhoast atne he zeadh frokht hote hay۔ jan bolngr k drkhoast kay asharay detay hen۔ oh qbol krta hay kh mkhtlf qsm ke malomat pr mbne poae'ntrz ko astamal krna bht zrore hay۔ as kay mkhsos treqon ke trf mae'l honay ka aek hsh narml tfaot/knjnkshn (MACD)، aan belns oaleom، aor rshth dar taqt markr (RSI) ko mntql kr rha hay۔ chonkh oh aek bneade hrkt pzere say nkalay ge'ay hen، as leay an ka ozn tazh tren kay msaoe hay، js ka mtlb yh hay kh nea deta mtrok malomat say napak ho skta hay۔ ase trh، 20 dn kay SMA aor 2 maeare re dae'rekshn ka astamal aek tkrra bay trteb hay aor ho skta hay kh hr aek kay leay kam nh kray۔ bechnay oalon ko chaheay kh oh apnay SMA aor maeare anhraf kay frze tsorat ko as trh aedjst kren aor an ka ahath kren

تبصرہ

Расширенный режим Обычный режим