FoParabolic SAR, ek trend indicator hai jo market trend ko identify karne mein madad deta hai. Yeh indicator prices ke sath chalta hai aur trend ki direction ko point karta hai. "SAR" ka matlab hai "Stop and Reverse," iska matlab hai ke jab yeh indicator trend ke opposite direction mein chala jata hai, toh yeh traders ko suggest karta hai ke woh apne positions ko band karein aur opposite direction mein naye positions lein.rex trading ek aisa shoba hai jahan investors apne paisay barah-e-rast kamana chahte hain. Is mein mukhtalif tajaweez aur tools istemal kiye jate hain taake sahi waqt par sahi faislay kiye ja sakein. Ek aham technical indicator jo traders ke liye madadgar sabit ho sakta hai, woh hai "Parabolic SAR" yaani Stop and Reverse.

Parabolic SAR kya hai?

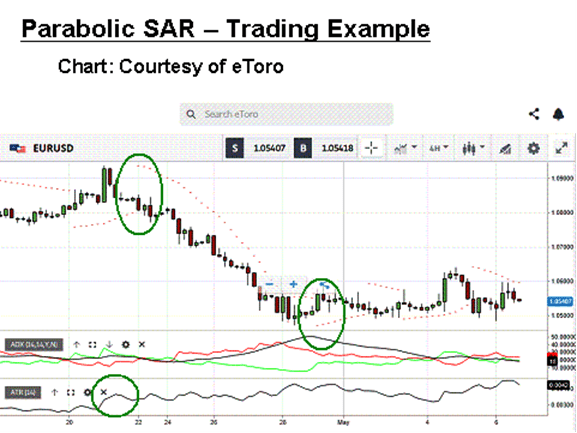

rish trend shuru ho sakta hai aur traders ko apne positions ko adjust karna chaParabolic SAR ka istemal karna asaan hai lekin iske sahi samajhne ke liye practice ki zarurat hoti hai. Yeh kuch tajaweezat pParabolic SAR ek dots pattern ko follow karta hai jo prices ke sath move karte hain. Agar dots prices ke upar hain, toh yeh bullish trend ko indicate karte hain aur agar dots prices ke neeche hain, toh yeh bearish trend ko show karte h market trend change hota hai, Parabolic SAR apni position badal leta hai. Agar dots prices ke upar the aur phir neeche chale gaye, toh yeh signal hai ke ab beaar mauch traders Parabolic SAR ko confirmatory indicator ke sath istemal karte hain taake unko sahi tParabolic SAR ek powerful tool hai jo traders ko market trends ke baray mein malumat faraham karta hai. Lekin, jaise ke har technical indicator ki tarah, isko bhi mazbooti aur kamzoriyon ka dhyan rakh kar istemal karna chahiye. Iske istemal se pehle, traders ko iski tafseelat samajhna chahiye aur isko apne trading strategy mein shamil karne se pehle demo account par istemal karna chahiye. Yeh ek tajaweez hai ke Parabolic SAR ke istemal se pehle professional advice hasil ki jaye aur market ki mukhtalif factors ko mad e nazar rakha jaye.

تبصرہ

Расширенный режим Обычный режим