Fundamental analysis:

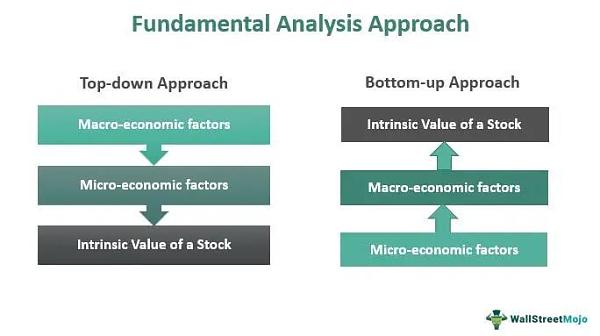

Forex trading mein fundamental analysis ek aisi process hai jismein aap aisa research karte hain jo forex market mein currency rate ko affect kar sakta hai. Fundamental analysis mein aap aisi cheezon ko dekhte hain jaise ki:

How to trade:

Agar aap fundamental analysis karke forex market mein trade karte hain to aapko aise trades karne mein madad milti hai jo profit generate karenge.

Yahan kuchh fundamental analysis tools hain jinka use aap forex trading mein kar sakte hain:

Agar aap forex trading mein fundamental analysis karna chahte hain to aapko in tools ka use karna chahiye.

Conclusion:

Mujhe umeed hai ki yah jankari aapke liye helpful rahi hogi Yahan Ham Apne har topic ko jyada se jyada information create karte Hain Taki trading mein fayda ho sake..

Forex trading mein fundamental analysis ek aisi process hai jismein aap aisa research karte hain jo forex market mein currency rate ko affect kar sakta hai. Fundamental analysis mein aap aisi cheezon ko dekhte hain jaise ki:

- Economic indicators: In indicators se aapko pata chalta hai ki ek country ki economy kaisi chal rahi hai. Agar ek country ki economy strong hai to uske currency ki value badhti hai.

- Interest rates: Interest rates ek country ki central bank set karti hai. Agar interest rates badhti hain to uske currency ki value badhti hai.

- Political stability: Agar ek country mein political stability hai to uske currency ki value badhti hai.

- Natural disasters: Natural disasters se ek country ki economy ko nuksan pahunch sakta hai, isse currency ki value kam ho sakti hai.

How to trade:

Agar aap fundamental analysis karke forex market mein trade karte hain to aapko aise trades karne mein madad milti hai jo profit generate karenge.

Yahan kuchh fundamental analysis tools hain jinka use aap forex trading mein kar sakte hain:

- Economic calendar: Economic calendar mein aapko aise economic events ki list milti hai jo forex market ko affect kar sakti hain.

- News feed: News feed mein aapko aisi news milti hai jo forex market ko affect kar sakti hai.

- Technical analysis tools: Technical analysis tools ka use aap currency rate ki past performance ko analyze karne ke liye kar sakte hain.

Agar aap forex trading mein fundamental analysis karna chahte hain to aapko in tools ka use karna chahiye.

Conclusion:

Mujhe umeed hai ki yah jankari aapke liye helpful rahi hogi Yahan Ham Apne har topic ko jyada se jyada information create karte Hain Taki trading mein fayda ho sake..

تبصرہ

Расширенный режим Обычный режим