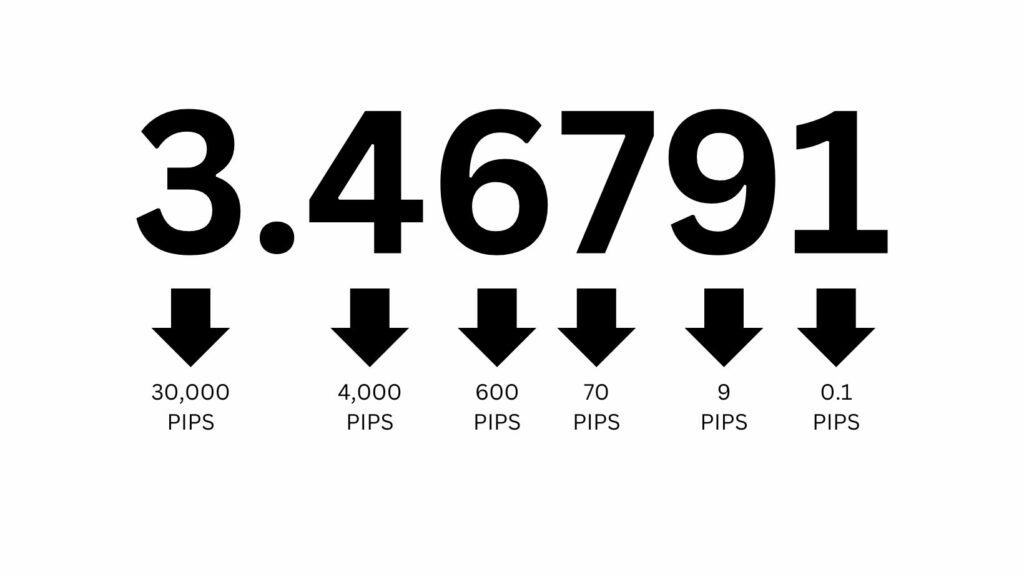

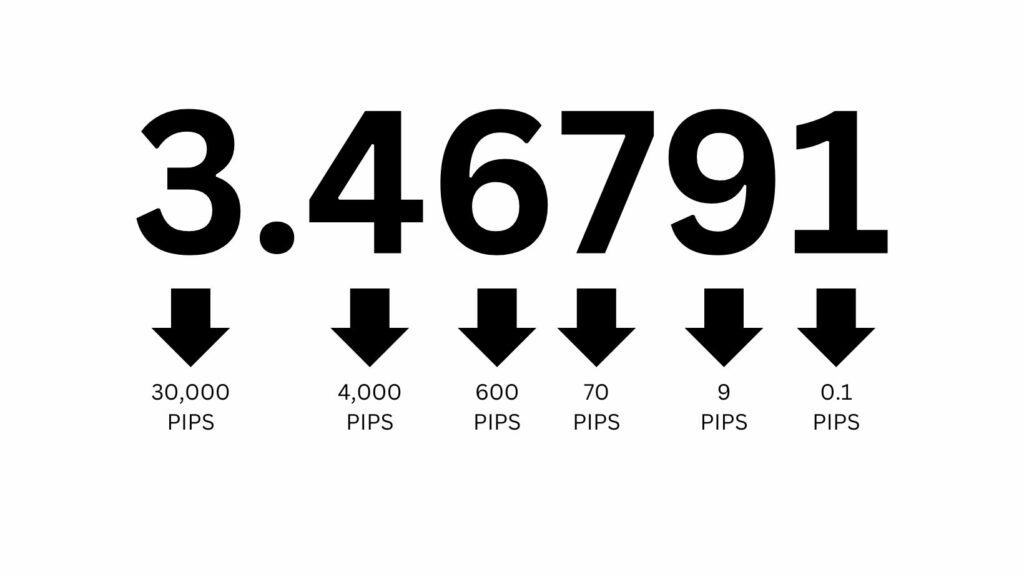

Forex market mein pips woh sabse chhote price movements hote hain jo kisi currency pair mein kiye ja sakte hain. Aik pip aam taur par major currency pairs mein 0.0001 ek sothay percent ka ke barabar hota hai, jese ke EUR/USD, USD/JPY, aur GBP/USD.

Understanding Pip Values:

Pip lafz percentage in point ka hai, aur iska istemaal kisi currency pair ki price quote ke aakhri decimal place ko refer karne ke liye hota hai. Maslan, EUR/USD pair mein, standard pip value 0.0001 ya aik pip hoti hai. Iska matlab hai ke agar EUR/USD rate 1.1750 se 1.1751 mein chala jata hai, to ye aik pip upar chala gaya hai. Usi tarah, agar ye 1.1750 se 1.1749 mein chala jata hai, to ye aik pip neeche chala gaya hai.

The Significance of Pips in Forex Trading:

Pips forex trading mein ahmiyat rakhte hain kyun ke ye trade par munafa ya nuksan tay karte hain. Jab ek trader position kholta hai, to usne apne potential nuksan ko had mein rakhne aur munafa ko ziyaada karne ke liye stop-loss aur take-profit order set karte hain. Entry price aur stop-loss price ke darmiyan ka farq trade ka potential risk hota hai, jabke entry price aur take-profit price ke darmiyan ka farq trade ka potential reward hota hai.

Misal ke taur par agar ek trader EUR/USD par 1.1750 par buy position kholta hai, stop-loss order 1.1745 par set karta hai, aur take-profit order 1.1760 par set karta hai. Agar EUR/USD rate 1.1765 tak chala jata hai, to trader is trade par 10 pips 1.1760 se 1.1765 tak ka munafa kamata hai. Munafa ko pips ke number, position ki size units mein, aur pip value jo ke aam taur par $10 per standard lot hoti hai se multiply kar ke calculate kiya jata hai.

Lekin agar EUR/USD rate 1.1735 tak chala jata hai, to trader is trade par 15 pips 1.1745 se 1.1735 tak ka nuksan hota hai. Nuksan bhi pips ke number, position ki size, aur pip value se multiply kar ke calculate kiya jata hai.

Pips is liye bhi ahmiyat rakhte hain kyun ke ye trading strategies ko kai tareeqon mein asar andaz karte hain:

Understanding Pip Values:

Pip lafz percentage in point ka hai, aur iska istemaal kisi currency pair ki price quote ke aakhri decimal place ko refer karne ke liye hota hai. Maslan, EUR/USD pair mein, standard pip value 0.0001 ya aik pip hoti hai. Iska matlab hai ke agar EUR/USD rate 1.1750 se 1.1751 mein chala jata hai, to ye aik pip upar chala gaya hai. Usi tarah, agar ye 1.1750 se 1.1749 mein chala jata hai, to ye aik pip neeche chala gaya hai.

The Significance of Pips in Forex Trading:

Pips forex trading mein ahmiyat rakhte hain kyun ke ye trade par munafa ya nuksan tay karte hain. Jab ek trader position kholta hai, to usne apne potential nuksan ko had mein rakhne aur munafa ko ziyaada karne ke liye stop-loss aur take-profit order set karte hain. Entry price aur stop-loss price ke darmiyan ka farq trade ka potential risk hota hai, jabke entry price aur take-profit price ke darmiyan ka farq trade ka potential reward hota hai.

Misal ke taur par agar ek trader EUR/USD par 1.1750 par buy position kholta hai, stop-loss order 1.1745 par set karta hai, aur take-profit order 1.1760 par set karta hai. Agar EUR/USD rate 1.1765 tak chala jata hai, to trader is trade par 10 pips 1.1760 se 1.1765 tak ka munafa kamata hai. Munafa ko pips ke number, position ki size units mein, aur pip value jo ke aam taur par $10 per standard lot hoti hai se multiply kar ke calculate kiya jata hai.

Lekin agar EUR/USD rate 1.1735 tak chala jata hai, to trader is trade par 15 pips 1.1745 se 1.1735 tak ka nuksan hota hai. Nuksan bhi pips ke number, position ki size, aur pip value se multiply kar ke calculate kiya jata hai.

Pips is liye bhi ahmiyat rakhte hain kyun ke ye trading strategies ko kai tareeqon mein asar andaz karte hain:

- Scalping: Scalping aik short-term trading strategy hai jo chand minute ya ghanton ke andar multiple positions khol kar band karne ko shamil karta hai, taake chhote price movements se munafa kamaya ja sake. Scalpers chhoti pips se munafa kamane ki koshish karte hain, is liye unhe tight stop-loss aur take-profit orders rakhne ki zarurat hoti hai taki unka risk kam ho aur munafa ziyaada ho. Maslan, scalper EUR/USD par mukhtalif prices par chand minute mein multiple buy positions khol sakta hai aur jab wo unke take-profit orders ya stop-loss orders tak pahunche, to unhe band kar dega, ye unke upar depend karta hai ke price upar ya neeche jata hai.

- Pip hunting: Pip hunting ek aur short-term trading strategy hai jo chhoti price movements ka intezaar karta hai ek mukarar direction mein, phir tight stop-loss aur take-profit orders ke sath trade mein dakhil hota hai. Maslan, aik pip hunter wait kar sakta hai ke EUR/USD 1.1750 se 1.1752 tak chala jaye, phir us ek buy position mein dakhil ho sakta hai jisme uska stop-loss order 1.1749 aur take-profit order 1.1753 ya 1.1754 ho, iske risk tolerance level ke mutabiq.

- Pip management: Pip management aik long-term trading strategy hai jo risks aur rewards ko control karne mein madad karta hai, technical analysis tools jese ke support aur resistance levels, trend lines, candlestick patterns, aur moving averages ke istemal se realistic stop-loss aur take-profit orders set karke. Maslan, aik trader apne stop-loss order ko apne entry price ke neeche kisi support level ya trend line par set kar sakta hai, aur take-profit order ko apne entry price ke upar kisi resistance level ya trend line par set kar sakta hai, taake waqt ke sath apne otential rewards ko ziyaada aur potential risks ko kam kiya ja sake.

تبصرہ

Расширенный режим Обычный режим