Assalamualaikum!

Dear friend main umeed krta hon k ap sab kheriat sy hon gy our forex market mn acha kam kr rhe hon gy dosto aj ka hmara topic bhot he important h aj hm bullish pennant Chart pattern k bary mn tafseel sy discuss krien gy ye chart pattern Kya hota h our is ko market mn kasy confirm kea Jata h our is per kasy trade lety h.

What is Bullish Pennant Chart Pattern?

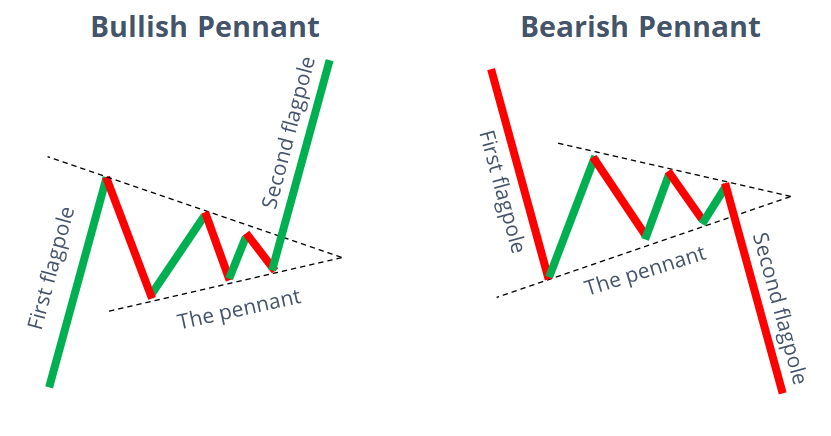

Bullish Pennant ek technical analysis ka chart pattern hai jo market mein uptrend ke doran aata hai. Is pattern ka naam "bullish" is wajah se hai kyunki yeh ek bullish continuation pattern hai, yaani ke yeh uptrend ke jari rakhne ka ishara deta hai. Bullish Pennant ka concept ek mastaqil flag ya pataka ke sath juda hota hai. Is pattern ko samajhne ke liye, hume iske formation, pehchan, aur trading strategies ko detail se dekhna hoga.

Pehchan (Identification):

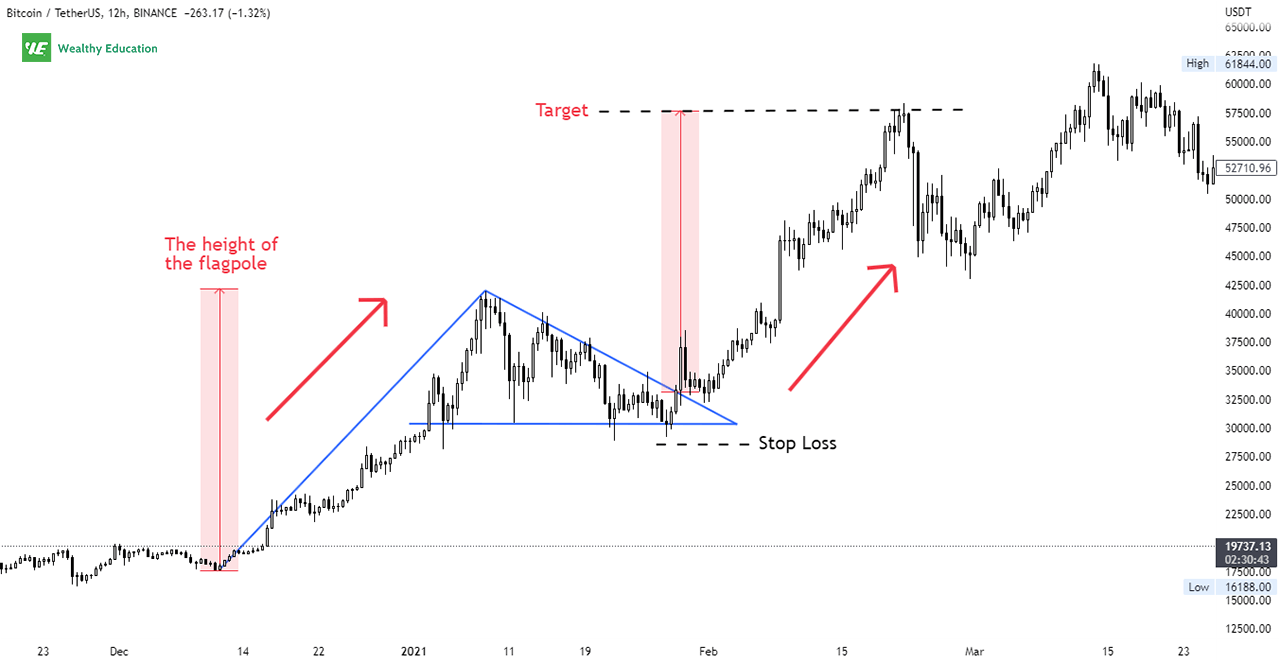

Bullish Pennant ko pehchanne ke liye, humein market mein pehle se hi ek strong uptrend ka hona zaruri hai. Uptrend mein prices mein constant izafa hota hai, jise trendline se dekha ja sakta hai. Jab yeh uptrend ek certain muddat tak jari rehta hai, to sudden mein prices mein thori si girawat hoti hai.

Girawat ke baad, ek mastaqil rectangle ya parallelogram ke manind flag ban jata hai. Is flag ki shape market ki consolidation ko darust karti hai, jise traders Bullish Pennant kehte hain. Yeh flag, prices ke girne ke doran banti hai, jiski wajah se ek mastqil aur patla rectangle ya parallelogram ban jata hai.

Volume Analysis:

Bullish Pennant ke formation ke doran volume ka bhi ahem role hota hai. Normally, jab pennant banta hai, to trading volume mein girawat hoti hai. Yeh volume girawat, flag ke beech mein kamzor hone ka ishara hota hai aur yeh dikhaata hai ke market mein buying pressure kam ho rahi hai.

Continuation of Uptrend:

Bullish Pennant ka fundamental maqsad uptrend ko jari rakhna hota hai. Iske baad, jab prices flag ke upper trendline ko paar karte hain, to yeh traders ko ishara deta hai ke market mein phir se tezi aane wali hai. Is breakout ke baad, uptrend dobara shuru hota hai.

Trading Strategies:

Entry Point:

Bullish Pennant ke trading strategies mein entry point ka tay karna ahem hota hai. Traders usually flag ke upper trendline ko dekhte hain. Agar prices is trendline ko paar karte hain, to yeh ek potential entry point hai.

Stop-Loss:

Stop-loss order ko set karna bhi ahem hota hai. Yeh order traders ko nuksan se bachane mein madad karta hai agar market ka move unke expectations ke khilaf ho jata hai.

Target Price:

Target price set karte waqt, traders flag pole ko measure karte hain. Flag pole, flag ke starting point se lekar uske breakout point tak ka distance hota hai. Yeh distance traders ko future price target ka ek estimate dene mein madad karta hai.

Faida (Benefits) of Bullish Pennant:

Price Continuation Signal:

Bullish Pennant, ek strong uptrend ke continuation ka ishara karta hai. Iski madad se traders ko pata chalta hai ke market ka trend jari hai.

Risk Management:

Stop-loss orders ke istemal se, traders apne nuksan ko control mein rakh sakte hain. Bullish Pennant ke breakout ke baad, agar market opposite direction mein jaata hai, to stop-loss order traders ko protect karta hai.

Profit Potential:

Agar trader sahi time par entry karta hai, to Bullish Pennant se aane wale uptrend mein achha munafa kamaya ja sakta hai. Flag pole se target price ka estimate lagane se traders ko pata chalta hai ke kitna profit expect kiya ja sakta hai.

Nuksan (Drawbacks) of Bullish Pennant:

False Signals:

Kuch dafa, Bullish Pennant false signals bhi de sakta hai. Isliye, dusre technical indicators ka bhi istemal zaruri hai.

Market Conditions:

Market conditions ke badalne par, yeh pattern kam asar andaz hota hai. Kabhi-kabhi market mein uncertainty hoti hai jo Bullish Pennant ke signals ko kamzor bana deti hai.

Conclusion

Bullish Pennant ek technical analysis ka chart pattern hai jo market mein uptrend ke doran aata hai. Jab market mein strong uptrend hota hai, to thori si girawat ke baad Bullish Pennant ban jata hai, jise traders uptrend ke continuation ka ishara samajhte hain. Is pattern ki pehchan, volume analysis aur trading strategies ka istemal karke traders future price movements ko predict karte hain. Bullish Pennant ke istemal se traders apne entry points, stop-loss orders, aur target prices tay karte hain. Is pattern ke istemal se traders ko market trends ko samajhne mein madad milti hai aur munafa kamane ka potential bhi barh jata hai. Lekin, false signals aur market conditions ka bhi khayal rakhna zaroori hai.

Thanks for Attention

Dear friend main umeed krta hon k ap sab kheriat sy hon gy our forex market mn acha kam kr rhe hon gy dosto aj ka hmara topic bhot he important h aj hm bullish pennant Chart pattern k bary mn tafseel sy discuss krien gy ye chart pattern Kya hota h our is ko market mn kasy confirm kea Jata h our is per kasy trade lety h.

What is Bullish Pennant Chart Pattern?

Bullish Pennant ek technical analysis ka chart pattern hai jo market mein uptrend ke doran aata hai. Is pattern ka naam "bullish" is wajah se hai kyunki yeh ek bullish continuation pattern hai, yaani ke yeh uptrend ke jari rakhne ka ishara deta hai. Bullish Pennant ka concept ek mastaqil flag ya pataka ke sath juda hota hai. Is pattern ko samajhne ke liye, hume iske formation, pehchan, aur trading strategies ko detail se dekhna hoga.

Pehchan (Identification):

Bullish Pennant ko pehchanne ke liye, humein market mein pehle se hi ek strong uptrend ka hona zaruri hai. Uptrend mein prices mein constant izafa hota hai, jise trendline se dekha ja sakta hai. Jab yeh uptrend ek certain muddat tak jari rehta hai, to sudden mein prices mein thori si girawat hoti hai.

Girawat ke baad, ek mastaqil rectangle ya parallelogram ke manind flag ban jata hai. Is flag ki shape market ki consolidation ko darust karti hai, jise traders Bullish Pennant kehte hain. Yeh flag, prices ke girne ke doran banti hai, jiski wajah se ek mastqil aur patla rectangle ya parallelogram ban jata hai.

Volume Analysis:

Bullish Pennant ke formation ke doran volume ka bhi ahem role hota hai. Normally, jab pennant banta hai, to trading volume mein girawat hoti hai. Yeh volume girawat, flag ke beech mein kamzor hone ka ishara hota hai aur yeh dikhaata hai ke market mein buying pressure kam ho rahi hai.

Continuation of Uptrend:

Bullish Pennant ka fundamental maqsad uptrend ko jari rakhna hota hai. Iske baad, jab prices flag ke upper trendline ko paar karte hain, to yeh traders ko ishara deta hai ke market mein phir se tezi aane wali hai. Is breakout ke baad, uptrend dobara shuru hota hai.

Trading Strategies:

Entry Point:

Bullish Pennant ke trading strategies mein entry point ka tay karna ahem hota hai. Traders usually flag ke upper trendline ko dekhte hain. Agar prices is trendline ko paar karte hain, to yeh ek potential entry point hai.

Stop-Loss:

Stop-loss order ko set karna bhi ahem hota hai. Yeh order traders ko nuksan se bachane mein madad karta hai agar market ka move unke expectations ke khilaf ho jata hai.

Target Price:

Target price set karte waqt, traders flag pole ko measure karte hain. Flag pole, flag ke starting point se lekar uske breakout point tak ka distance hota hai. Yeh distance traders ko future price target ka ek estimate dene mein madad karta hai.

Faida (Benefits) of Bullish Pennant:

Price Continuation Signal:

Bullish Pennant, ek strong uptrend ke continuation ka ishara karta hai. Iski madad se traders ko pata chalta hai ke market ka trend jari hai.

Risk Management:

Stop-loss orders ke istemal se, traders apne nuksan ko control mein rakh sakte hain. Bullish Pennant ke breakout ke baad, agar market opposite direction mein jaata hai, to stop-loss order traders ko protect karta hai.

Profit Potential:

Agar trader sahi time par entry karta hai, to Bullish Pennant se aane wale uptrend mein achha munafa kamaya ja sakta hai. Flag pole se target price ka estimate lagane se traders ko pata chalta hai ke kitna profit expect kiya ja sakta hai.

Nuksan (Drawbacks) of Bullish Pennant:

False Signals:

Kuch dafa, Bullish Pennant false signals bhi de sakta hai. Isliye, dusre technical indicators ka bhi istemal zaruri hai.

Market Conditions:

Market conditions ke badalne par, yeh pattern kam asar andaz hota hai. Kabhi-kabhi market mein uncertainty hoti hai jo Bullish Pennant ke signals ko kamzor bana deti hai.

Conclusion

Bullish Pennant ek technical analysis ka chart pattern hai jo market mein uptrend ke doran aata hai. Jab market mein strong uptrend hota hai, to thori si girawat ke baad Bullish Pennant ban jata hai, jise traders uptrend ke continuation ka ishara samajhte hain. Is pattern ki pehchan, volume analysis aur trading strategies ka istemal karke traders future price movements ko predict karte hain. Bullish Pennant ke istemal se traders apne entry points, stop-loss orders, aur target prices tay karte hain. Is pattern ke istemal se traders ko market trends ko samajhne mein madad milti hai aur munafa kamane ka potential bhi barh jata hai. Lekin, false signals aur market conditions ka bhi khayal rakhna zaroori hai.

Thanks for Attention

تبصرہ

Расширенный режим Обычный режим