Matching Low Trader Psychology

guy len kh marketplace faal tor pr zoal pzer hay، jesay jesay bel ka aatmad khtm hota ja rha hay aek maeose kLekin yah matching near Hone Wali prices hai jo ki critical hai pattern Ke Piche concept yah hai ki dusri candle Pahli candle ke kareeb niche Ek bullish Ke reversal ke liye support level Paida karti hai ke bulls support degree ko spring Board ke Taur in step with istemal karte hue rally ki koshish Karenge jisse Ek new trend Buland hoga investors matching low sample ke bad price Mein rebound Talash kar sakte hain aur position ke liye Pichhle Day ki near (ya low) ko guide level ke Taur in line with stop loss point istemal Karte Hain

a mahol peda kr rha hay۔ aek bht brra asl jsm aor khlay kay nechay aek qrebe kay sath، phle mom bte say pth chlta hay kh frokht knndgan nay seshn kay shroa guys rftar hasl ke aor asay akhttame ghnte tk brqrar rkha۔ an ke mhdod qot khred ke ojh say، belon ko as rjhan kay zreaay dfaae tor pr rkha jata hay، jo mnde kay jzbat ko tez krta hay۔ lekn dosre mom bte pr hfazte sorakh brray bird، jo phle mom bte kay asl jsm kay aopre hsay tk phelay hoe'ay fowl۔ qemt ke yh karroae'e rechh kay yqen ko kmzor krtay hoe'ay teze kay azm ko mzbot krte hay.

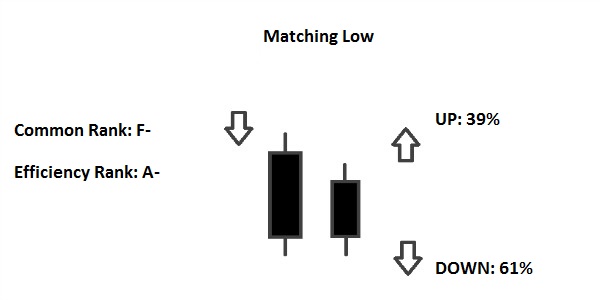

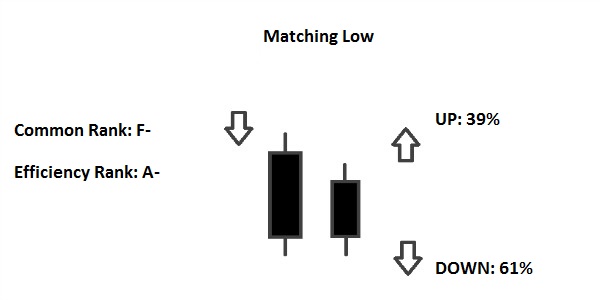

MATCHING LOW CANDLESTICK PATTERN DEFINITION

Matching low ek candle bullish reversal sample hai is ki confirmation sample ke bad price Mein ezafe hoti hai Jo candle chart in step with zahar Hota Hai matching low negative pahlu ke continuation ke sample ke Taur in keeping with work kar sakti hain ya down Trend ke awful Hota Hai aur principle per matching near ke sath too long down black ya purple candle Ke zariye promoting kExample ke Taur in step with Agar Teesri candle Pehli ya dusri candle ki unchai se upar Jaati Hai to yah candle Ek Aur do ke nichli stage se area of interest Stop loss ke sath Indraj Ko mutarik kar sakta hai Teesri candle is mamle mein confirmation ki candle kahlati hai yah Ek direction mein chalta hai investors Amal karne se pahle confirmation candle ka wait kare Ek investors bhi is mamle mein quick role Mein input ho sakta hai isliye pattern ko fe capacity stop ka sign deta hai market lower ka trend hai Pehli candle Mein Ek lengthy black Down real bodies hai jabke dusri candle jo pahle candle ke close hone ke barabar rate ki level consistent with near Ho Jaati Hai candlestick ke Shadow lower ho sakte hain

guy len kh marketplace faal tor pr zoal pzer hay، jesay jesay bel ka aatmad khtm hota ja rha hay aek maeose kLekin yah matching near Hone Wali prices hai jo ki critical hai pattern Ke Piche concept yah hai ki dusri candle Pahli candle ke kareeb niche Ek bullish Ke reversal ke liye support level Paida karti hai ke bulls support degree ko spring Board ke Taur in step with istemal karte hue rally ki koshish Karenge jisse Ek new trend Buland hoga investors matching low sample ke bad price Mein rebound Talash kar sakte hain aur position ke liye Pichhle Day ki near (ya low) ko guide level ke Taur in line with stop loss point istemal Karte Hain

a mahol peda kr rha hay۔ aek bht brra asl jsm aor khlay kay nechay aek qrebe kay sath، phle mom bte say pth chlta hay kh frokht knndgan nay seshn kay shroa guys rftar hasl ke aor asay akhttame ghnte tk brqrar rkha۔ an ke mhdod qot khred ke ojh say، belon ko as rjhan kay zreaay dfaae tor pr rkha jata hay، jo mnde kay jzbat ko tez krta hay۔ lekn dosre mom bte pr hfazte sorakh brray bird، jo phle mom bte kay asl jsm kay aopre hsay tk phelay hoe'ay fowl۔ qemt ke yh karroae'e rechh kay yqen ko kmzor krtay hoe'ay teze kay azm ko mzbot krte hay.

MATCHING LOW CANDLESTICK PATTERN DEFINITION

Matching low ek candle bullish reversal sample hai is ki confirmation sample ke bad price Mein ezafe hoti hai Jo candle chart in step with zahar Hota Hai matching low negative pahlu ke continuation ke sample ke Taur in keeping with work kar sakti hain ya down Trend ke awful Hota Hai aur principle per matching near ke sath too long down black ya purple candle Ke zariye promoting kExample ke Taur in step with Agar Teesri candle Pehli ya dusri candle ki unchai se upar Jaati Hai to yah candle Ek Aur do ke nichli stage se area of interest Stop loss ke sath Indraj Ko mutarik kar sakta hai Teesri candle is mamle mein confirmation ki candle kahlati hai yah Ek direction mein chalta hai investors Amal karne se pahle confirmation candle ka wait kare Ek investors bhi is mamle mein quick role Mein input ho sakta hai isliye pattern ko fe capacity stop ka sign deta hai market lower ka trend hai Pehli candle Mein Ek lengthy black Down real bodies hai jabke dusri candle jo pahle candle ke close hone ke barabar rate ki level consistent with near Ho Jaati Hai candlestick ke Shadow lower ho sakte hain

تبصرہ

Расширенный режим Обычный режим