Ask aur Bid Prices:

Tijarat Mein Istemal Hone Wale Qeematayn

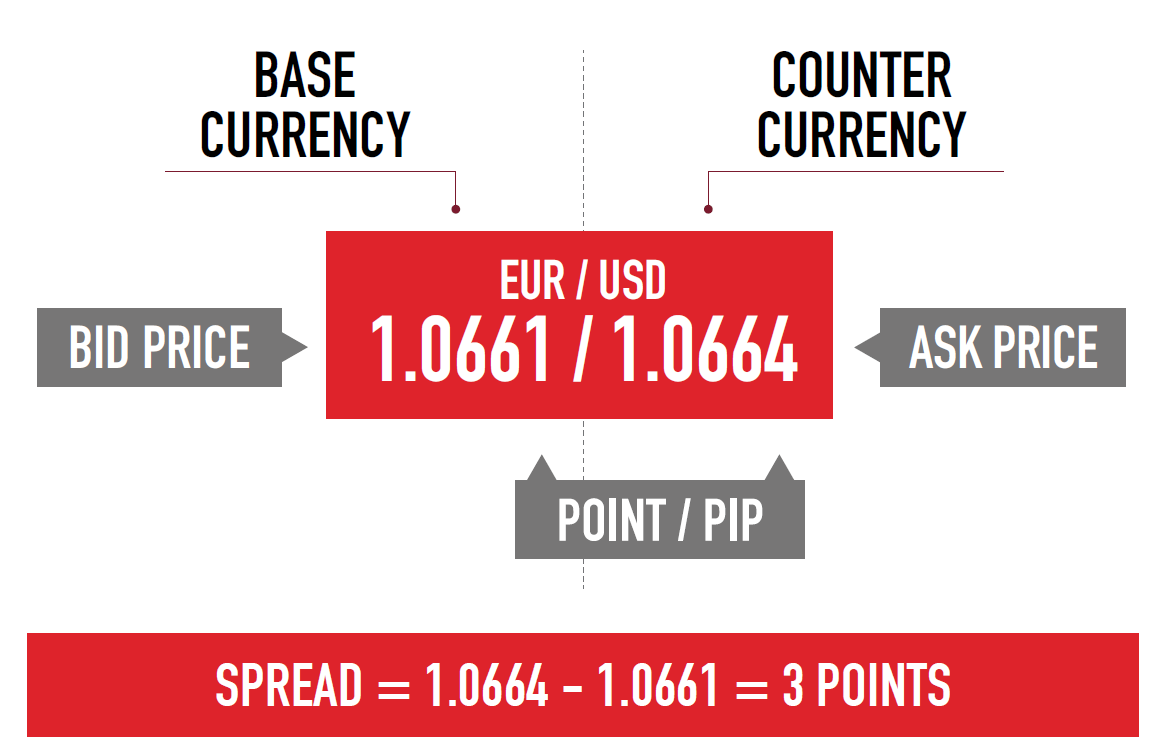

Tijarat mein, Ask aur Bid prices do ahem qeematayn hain jo ke stocks, forex, aur doosre financial instruments mein istemal hoti hain. Yeh dono terms trading market mein mojood hoti hain aur investors ko bataati hain ke ek asset ko khareedne aur bechne ke liye kis qeemat par tajaweez (order) di ja rahi hai.

- Ask Price (Poochh Qeemat):

Misaal: Agar ek stock ka Bid price $50 hai aur Ask price $51 hai, toh yeh matlab hai ke aapko woh stock $51 par khareedna hoga.

Bid Price (Tajaweez Qeemat):

Bid price woh qeemat hai jo kisi asset ko bechne ke liye tajaweez di ja rahi hai. Yani, agar aap apni cheez ko bechna chahte hain, toh aapko woh qeemat tajaweez karni hogi jo buyers (khareedne wale) de rahe hain. Bid price market ke buyers dvara tajaweez di jati hai. Bid price hamesha thodi si kam hoti hai as compared to the ask price.

Misaal: Agar ek stock ka Ask price $51 hai aur Bid price $50 hai, toh yeh matlab hai ke koi aap se woh stock $50 par khareedna chahta hai.

Ask aur Bid Spread:

Ask aur Bid prices ke darmiyan ka farq ko "spread" kehte hain. Spread woh difference hai jo Ask price aur Bid price ke darmiyan hota hai. Spread ke zyada hona market ki liquidity aur volatility ko darust karta hai. Kam spread ka hona traders ke liye behtar hota hai, kyun ke woh kam qeemat par khareedne aur bechne mein asani mehsoos karte hain.

Ask aur Bid prices tijarat mein ahem hain aur inka theek taur par samajhna traders ke liye zaroori hai, taake woh sahi waqt par apne trading decisions le sakein.

تبصرہ

Расширенный режим Обычный режим