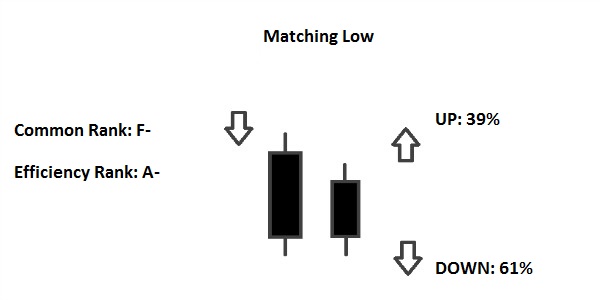

Matching Low Candlestick Pattern ki Wazahat:

1. Mabadi (Basics):

Matching Low, ya "Matching Lows" ke naam se jana jane wala pattern, ek bullish reversal signal hai jo candlestick charts mein nazar aata hai. Yeh pattern do consecutive days ke "lows" ko milata julta dikhaata hai.

2. Components (Hissaat) of the Pattern:

- Pehli Candle: Yeh ek downtrend mein dikhai deti hai aur typically bearish (red ya black) hoti hai. Iski close price nicha hota hai.

- Dusri Candle: Ismein price gap down ke baad open hoti hai, lekin day ke dauran price upar ki taraf move karti hai. Dusra candle pehle wale bearish candle ke low ke qareeb close hoti hai, lekin neeche se ek bhi tick upar nahi jaati.

3. Interpretation (Tawil):

Matching Low pattern ka matlab hota hai ke current downtrend mein potential exhaustion (thakan) dikh rahi hai aur bullish trend ka chance hai. Is pattern ko dekh kar traders buying ya long positions consider kar sakte hain.

4. Trading Implications (Karobar Ke Asraat):

- Entry: Agar aap Matching Low pattern ko identify karte hain, toh aapko buying ya long positions enter karne ka signal milta hai.

- Stop Loss: Protective stop loss ko set karne ke liye aap pehli candle ki low ya pattern ke end ki taraf ek level decide kar sakte hain.

- Target Price: Aap target price ke liye pehle resistance level ya recent highs ko dekh sakte hain.

5. Precautions (Ehtiyaat):

- Always ek confirmatory signal ka wait karein, jaise ki ek aur bullish candle ya kisi aur technical indicator ka confirmation.

- Har trade ke liye risk management ke principles ko follow karein.

6. Conclusion (Ikhtetaam):

Matching Low pattern, agar sahi dhang se identify kiya jaye, ek mazboot bullish reversal signal provide karta hai. Lekin, jaise ki har trading pattern ya strategy ke saath hota hai, iska bhi sahi dhang se istemal aur risk management ke saath trading karna zaroori hai.

https://www.google.com/imgres?imgurl...UQMygEegQIARBa

تبصرہ

Расширенный режим Обычный режим