Aslam u alaikum,

Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Trailing stop aik maqbool rissk managment taknik hai jo forex trading mein istemaal hoti hai jo taajiron ko –apne mumkina nuqsanaat ko mehdood karne aur –apne munafe ki hifazat karne ki ijazat deti hai. yeh aik qisam ka stap las order hai jo tajir ke haq mein currency ke jore ki qeemat bherne par khud bakhud adjust ho jata hai .

Yahan yeh hai ke yeh kaisay kaam karta hai :

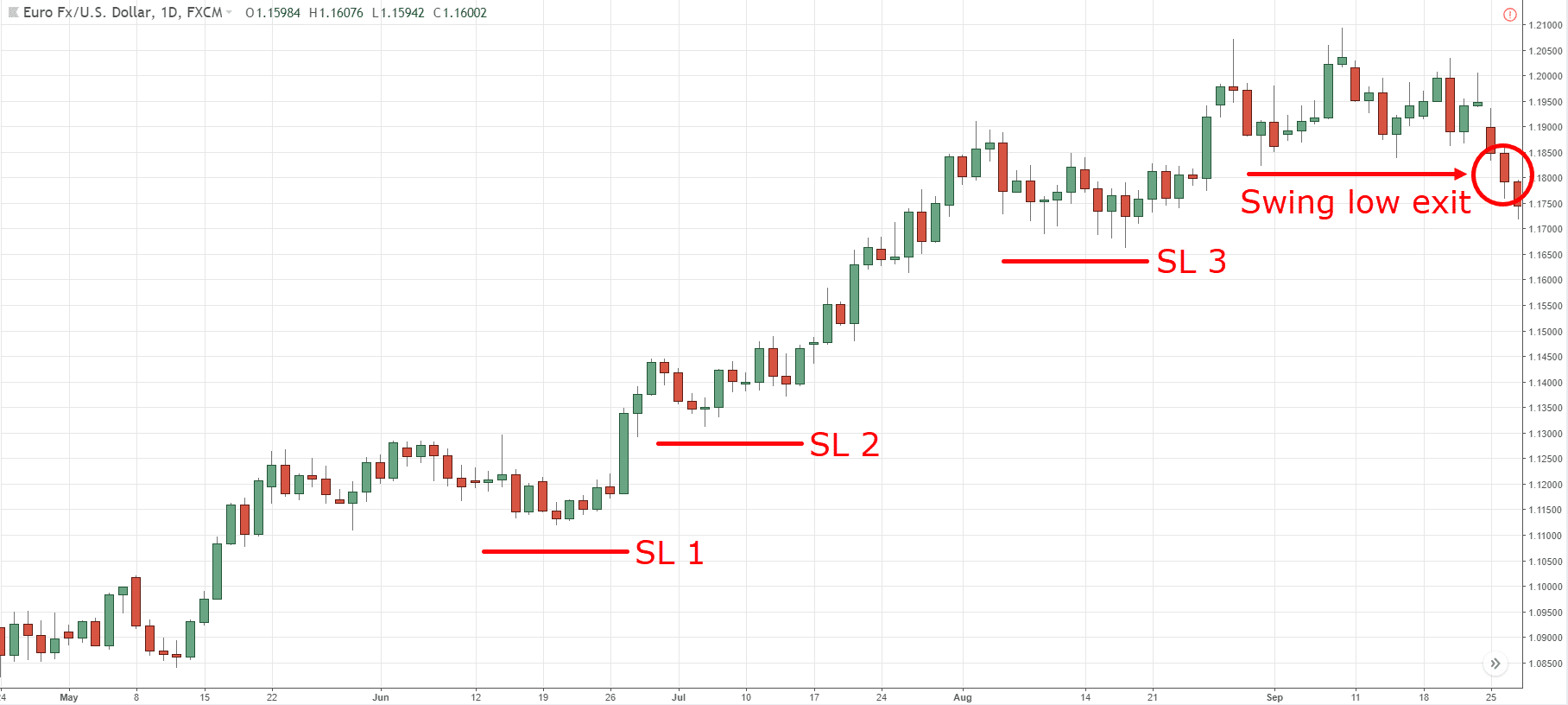

Farz karen ke aik tajir 1. 2000 ki qeemat par currency jora kharidata hai aur 50 pips ka Trailing stop set karta hai. is ka matlab hai ke agar currency pear ki qeemat 50 pip ( 1. 2050 tak ) barh jati hai, to stop las order khud bakhud 1. 2000 mein adjust ho jaye ga.

Agar qeemat mein izafah jari rehta hai, to Trailing stop is ke sath oopar ki taraf adjust hota rahay ga, hamesha mojooda market qeemat se 50 pips ka faasla barqarar rakhay ga. is ka matlab yeh hai ke agar qeemat achanak gir jati hai, to tajir ki position Trailing stop qeemat par khud bakhud band ho jaye gi, aur un ke mumkina nuqsanaat ko mehdood kar diya jaye ga.

Trailing stops mufeed hain kyunkay yeh taajiron ko munafe mein band karne ki ijazat dete hain aur phir bhi currency pear ko un ke haq mein jane ke liye kamrah dete hain. qeemat bherne ke sath hi stap las order ko khud bakhud adjust kar ke, traders market ki musalsal nigrani kiye baghair –apne munafe ki hifazat kar satke hain.

Purpose of Trailing Stop in Forex Trading

forex trading mein Trailing stop istemaal karne ka maqsad taajiron ko un ke mumkina nuqsanaat ko mehdood karne aur un ke munafe ki hifazat mein madad karna hai.

Trailing stap ke istemaal ke chand ahem fawaid yeh hain :

Minimize losses : Trailing stop ke istemaal ka aik ahem faida yeh hai ke yeh nuqsanaat ko kam karne mein madad kar sakta hai. currency ke jore ki qeemat tajir ke haq mein bherne par stop las order ko khud bakhud adjust kar ke, agar market achanak un ke khilaaf ho jati hai to tajir –apne mumkina nuqsanaat ko mehdood kar sakta hai .

Protect profits

Trailing stop istemaal karne ka aik aur ahem faida yeh hai ke yeh munafe ki hifazat mein madad karsaktha hai. qeemat ke tajir ke haq mein bherne ke sath hi munafe ko band karne ke liye stop las order ko adjust karkay, tajir is baat ko yakeeni bana sakta hai ke agar market achanak palat jati hai to woh –apne munafe se mahroom nah hon.

Reduce emotions

Trailing stop jazbati tijarat ko kam karne mein bhi madad kar satke hain. chunkay stap las order market ki naqal o harkat ki bunyaad par khud bakhud adjust ho jata hai, tajir khauf ya lalach ki bunyaad par zabardast faislay karne se bach satke hain .

Save time :

Akhir mein, peechay anay walay stop taajiron ka waqt bacha satke hain. chunkay stap loss order khud bakhud adjust ho jata hai, is liye taajiron ko is baat ko yakeeni bananay ke liye market ki musalsal nigrani karne ki zaroorat nahi hai ke un ki pozishnin mehfooz hain .

Majmoi tor par, forex trading mein Trailing stop istemaal karne ka maqsad taajiron ko khatray ka intizam karne aur un ke munafe ki hifazat karne mein madad karna hai, jabkay jazbati tijarat ko kam karna aur waqt ki bachat karna hai.

Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Trailing stop aik maqbool rissk managment taknik hai jo forex trading mein istemaal hoti hai jo taajiron ko –apne mumkina nuqsanaat ko mehdood karne aur –apne munafe ki hifazat karne ki ijazat deti hai. yeh aik qisam ka stap las order hai jo tajir ke haq mein currency ke jore ki qeemat bherne par khud bakhud adjust ho jata hai .

Yahan yeh hai ke yeh kaisay kaam karta hai :

Farz karen ke aik tajir 1. 2000 ki qeemat par currency jora kharidata hai aur 50 pips ka Trailing stop set karta hai. is ka matlab hai ke agar currency pear ki qeemat 50 pip ( 1. 2050 tak ) barh jati hai, to stop las order khud bakhud 1. 2000 mein adjust ho jaye ga.

Agar qeemat mein izafah jari rehta hai, to Trailing stop is ke sath oopar ki taraf adjust hota rahay ga, hamesha mojooda market qeemat se 50 pips ka faasla barqarar rakhay ga. is ka matlab yeh hai ke agar qeemat achanak gir jati hai, to tajir ki position Trailing stop qeemat par khud bakhud band ho jaye gi, aur un ke mumkina nuqsanaat ko mehdood kar diya jaye ga.

Trailing stops mufeed hain kyunkay yeh taajiron ko munafe mein band karne ki ijazat dete hain aur phir bhi currency pear ko un ke haq mein jane ke liye kamrah dete hain. qeemat bherne ke sath hi stap las order ko khud bakhud adjust kar ke, traders market ki musalsal nigrani kiye baghair –apne munafe ki hifazat kar satke hain.

Purpose of Trailing Stop in Forex Trading

forex trading mein Trailing stop istemaal karne ka maqsad taajiron ko un ke mumkina nuqsanaat ko mehdood karne aur un ke munafe ki hifazat mein madad karna hai.

Trailing stap ke istemaal ke chand ahem fawaid yeh hain :

Minimize losses : Trailing stop ke istemaal ka aik ahem faida yeh hai ke yeh nuqsanaat ko kam karne mein madad kar sakta hai. currency ke jore ki qeemat tajir ke haq mein bherne par stop las order ko khud bakhud adjust kar ke, agar market achanak un ke khilaaf ho jati hai to tajir –apne mumkina nuqsanaat ko mehdood kar sakta hai .

Protect profits

Trailing stop istemaal karne ka aik aur ahem faida yeh hai ke yeh munafe ki hifazat mein madad karsaktha hai. qeemat ke tajir ke haq mein bherne ke sath hi munafe ko band karne ke liye stop las order ko adjust karkay, tajir is baat ko yakeeni bana sakta hai ke agar market achanak palat jati hai to woh –apne munafe se mahroom nah hon.

Reduce emotions

Trailing stop jazbati tijarat ko kam karne mein bhi madad kar satke hain. chunkay stap las order market ki naqal o harkat ki bunyaad par khud bakhud adjust ho jata hai, tajir khauf ya lalach ki bunyaad par zabardast faislay karne se bach satke hain .

Save time :

Akhir mein, peechay anay walay stop taajiron ka waqt bacha satke hain. chunkay stap loss order khud bakhud adjust ho jata hai, is liye taajiron ko is baat ko yakeeni bananay ke liye market ki musalsal nigrani karne ki zaroorat nahi hai ke un ki pozishnin mehfooz hain .

Majmoi tor par, forex trading mein Trailing stop istemaal karne ka maqsad taajiron ko khatray ka intizam karne aur un ke munafe ki hifazat karne mein madad karna hai, jabkay jazbati tijarat ko kam karna aur waqt ki bachat karna hai.

تبصرہ

Расширенный режим Обычный режим