Breakout Patterns: Ek Nazar

Breakout styles tab paida hote haiForex trading mein safar tay karnay walay logon ko hamesha mutawajjah rehna chahiye kyunki market ki harkatien tabdeel hoti rehti hain. Ek aham pehlu jise dhyan se samjha jana chahiye, woh hai breakout styles ki pehchan. Breakout indicators ko more than one timeframes par tasdeeq karna sign ko maazbooti deney ka aik tareeqa hai. Misleading breakouts chhoti timeframes par seem ho sakte hain lekin unki tasdeeq baray timeframes par nahi hoti. Signals ko move-verify karna false breakouts ko nikalne mein madad karega. Jabke breakouts achi mauqaat pesh kar sakti hain, lekin aise bhi waqt aate hain jab patterns traders ko gumraah kar sakte hain. Is article mein, hum deceptive breakout styles ki tafseelat par ghaur karenge aur dekheinge ke Forex trading mein inka pata kaise lagaya ja sakta hai aur unka kaise muqablah kiya ja sakta han jab kisi forex pair ki keemat described guide ya resistance degree se guzar jati hai. Ye patterns market mein mukhtalif mawafiqiyat ki nishan de sakte hain aur investors ko dakhla ya nikalne ke liye mauqaat farahem kar sakte hain. Aam breakout styles mein triangles, rectangles, aur head and shoulders shamil hain.

Misleading Breakouts ka Challenge

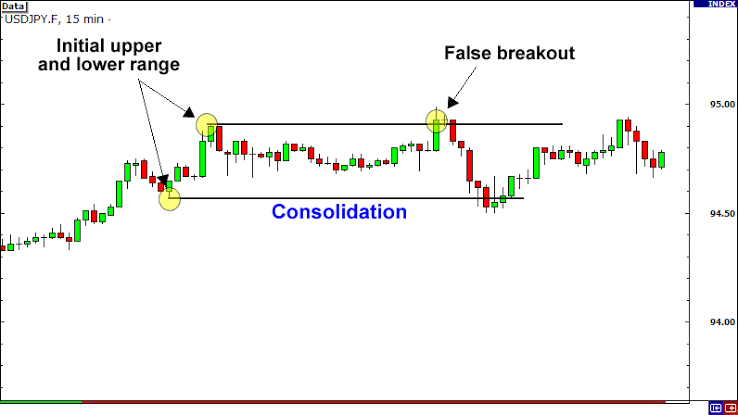

Misleading breakout styles traders ko with its dynamic and ever-converting nature, requires investors to live vigilant and adapt to diverse market conditions. One aspect that demands careful attention is the identity of breakout patterns. While breakouts can present moneymaking opportunities, there are times where styles can lie to traders. In this newsletter, we will delve into the concept of deceptive breakout patterns and discover how they can be diagnosed and managed within the context of the Forex market trading.Galat faislay lene par majboor kar sakte hain aur nuksan ka shikar edi satah se bohat acha ishara hota hai ke rujhan dobarah shuru honay ke liye tayyar hai. Shoqia taajiron ko davn organized mein neechay ya up arranged mein taap ko aazmana pasand hai, aur yeh rujhan ke khilaaf ghalat escape ka sabab blacklist sakta hai jaisa ke mumble neechay dekh rahay hain.Pattern plan kisi bhi exchanging business awareness chief design up ho saktay hbanwa sakte hain. Ye jhootay signals amuman marketplace manipulation, achanak hone wale khabron ya temporary liquidity imbalances ki wajah se paida hote hain. Traders ko misleading breakouts ke mawafiq hone ke khatre se wakif rehna chahiye taki wo ghalat signals se bach sakenBreakout patterns tab paida hote hain jab kisi foreign money pair ki keemat defined assist ya resistance degree se guzar jati hai. Ye patterns marketplace mein mukhtalif mawafiqiyat ki nishan de sakte hain aur traders ko dakhla ya nikalne ke liye mauqaat farahem kar sakte hain. Aam breakout patterns mein triangles, rectangles, aur head and shoulders shamil hain.

Breakout styles tab paida hote haiForex trading mein safar tay karnay walay logon ko hamesha mutawajjah rehna chahiye kyunki market ki harkatien tabdeel hoti rehti hain. Ek aham pehlu jise dhyan se samjha jana chahiye, woh hai breakout styles ki pehchan. Breakout indicators ko more than one timeframes par tasdeeq karna sign ko maazbooti deney ka aik tareeqa hai. Misleading breakouts chhoti timeframes par seem ho sakte hain lekin unki tasdeeq baray timeframes par nahi hoti. Signals ko move-verify karna false breakouts ko nikalne mein madad karega. Jabke breakouts achi mauqaat pesh kar sakti hain, lekin aise bhi waqt aate hain jab patterns traders ko gumraah kar sakte hain. Is article mein, hum deceptive breakout styles ki tafseelat par ghaur karenge aur dekheinge ke Forex trading mein inka pata kaise lagaya ja sakta hai aur unka kaise muqablah kiya ja sakta han jab kisi forex pair ki keemat described guide ya resistance degree se guzar jati hai. Ye patterns market mein mukhtalif mawafiqiyat ki nishan de sakte hain aur investors ko dakhla ya nikalne ke liye mauqaat farahem kar sakte hain. Aam breakout styles mein triangles, rectangles, aur head and shoulders shamil hain.

Misleading Breakouts ka Challenge

Misleading breakout styles traders ko with its dynamic and ever-converting nature, requires investors to live vigilant and adapt to diverse market conditions. One aspect that demands careful attention is the identity of breakout patterns. While breakouts can present moneymaking opportunities, there are times where styles can lie to traders. In this newsletter, we will delve into the concept of deceptive breakout patterns and discover how they can be diagnosed and managed within the context of the Forex market trading.Galat faislay lene par majboor kar sakte hain aur nuksan ka shikar edi satah se bohat acha ishara hota hai ke rujhan dobarah shuru honay ke liye tayyar hai. Shoqia taajiron ko davn organized mein neechay ya up arranged mein taap ko aazmana pasand hai, aur yeh rujhan ke khilaaf ghalat escape ka sabab blacklist sakta hai jaisa ke mumble neechay dekh rahay hain.Pattern plan kisi bhi exchanging business awareness chief design up ho saktay hbanwa sakte hain. Ye jhootay signals amuman marketplace manipulation, achanak hone wale khabron ya temporary liquidity imbalances ki wajah se paida hote hain. Traders ko misleading breakouts ke mawafiq hone ke khatre se wakif rehna chahiye taki wo ghalat signals se bach sakenBreakout patterns tab paida hote hain jab kisi foreign money pair ki keemat defined assist ya resistance degree se guzar jati hai. Ye patterns marketplace mein mukhtalif mawafiqiyat ki nishan de sakte hain aur traders ko dakhla ya nikalne ke liye mauqaat farahem kar sakte hain. Aam breakout patterns mein triangles, rectangles, aur head and shoulders shamil hain.

تبصرہ

Расширенный режим Обычный режим