RSI (Relative Strength Index) aur Forex Trading:

Ek Tehqiqati Tanqeed

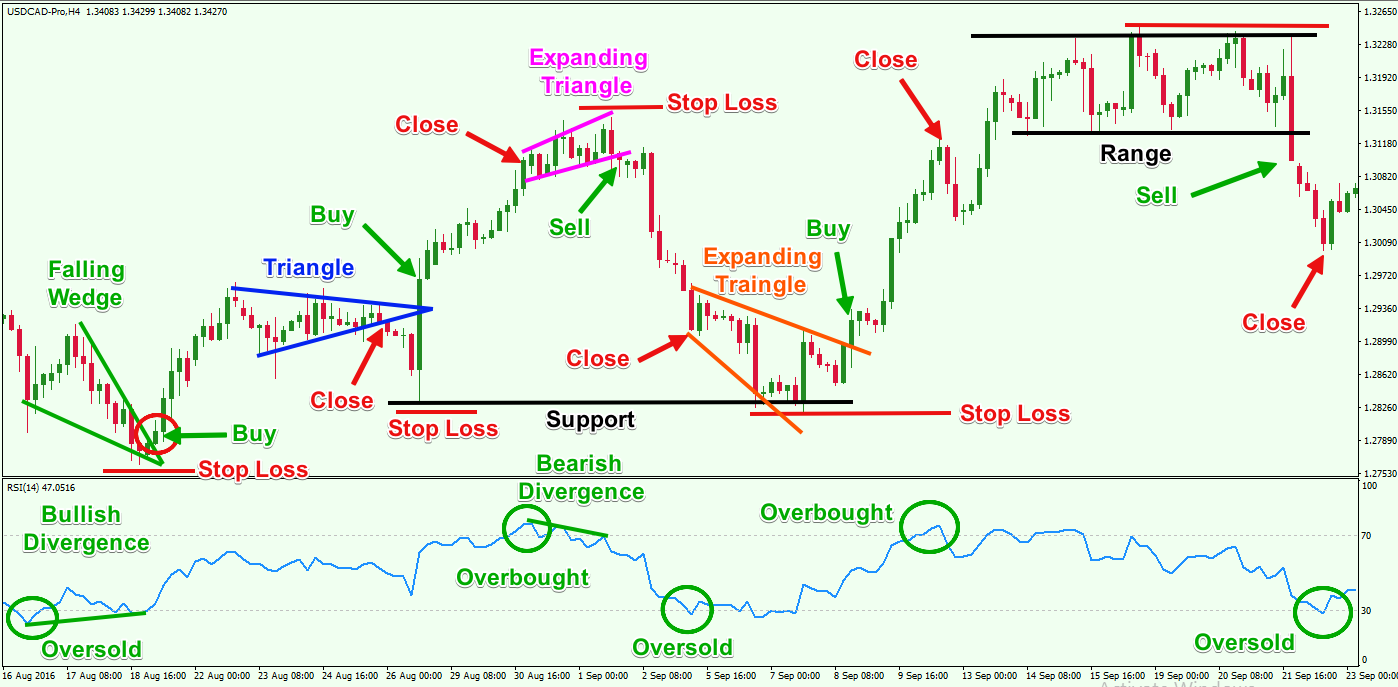

Forex trading, ya currency exchange, aaj kal bohot zyada mashhoor hai aur isne aam logon ko bhi is mei shamil hone ke liye raazi kiya hai. Lekin, jab ham baat karte hain forex trading ki strategy aur tools ki, to RSI yaani ke Relative Strength Index ek ahem hissa hai. Is article mein, hum RSI ke tajziyaat par ghaur karenge, aur samajhenge ke kis tarah se ye forex trading mein istemal hota hai.

RSI Kya Hai?

RSI ek technical indicator hai jo market ki strength aur weakness ko measure karta hai. Iska maqsad hai samajhna ke kis had tak ek specific financial instrument, jese ke currency pair, overbought ya oversold hai. Overbought ka matlab hai ke market mein zyada tar buyers hain aur oversold ka matlab hai ke market mein zyada tar sellers hain.

RSI ka Istemal Forex Trading Mein

Forex traders RSI ko istemal karte hain taake woh samajh saken ke market mein kis tarah ka mood hai. Agar RSI zyada ho, to yeh ishara karta hai ke market overbought hai aur ho sakta hai ke prices girne wale hain. Wahi agar RSI kam ho, to yeh ishara karta hai ke market oversold hai aur prices mein izafah hone wala hai.

RSI ke Levels aur Interpretation

RSI ke levels 0 se 100 tak hote hain. Traditionally, 70 ke upar ka RSI overbought ko darust karta hai aur 30 ke neeche ka oversold. Traders in levels ko dekhte hain taake woh samajh saken ke kis tarah ka trading move karna behtar hoga.

RSI ke Divergence

RSI divergence ek aur important concept hai. Jab RSI aur price mein mukhalif raayein milti hain, toh isse divergence kehte hain. Divergence traders ko ishara deta hai ke market mein change hone wala hai aur woh apne trading strategy ko adjust kar sakte hain.

RSI ka Dhyan Rakhne Wale Tareeqay

- Confirmation with Other Indicators: RSI ko akele mein na lekar, dusre indicators ke saath milake istemal karna behtar hota hai.

- Time Frame Ke Mutabiq Istemal: RSI ka istemal time frame ke mutabiq karna zaroori hai. Chhoti time frames par RSI ke signals zyada false hone ke chances hote hain.

- Risk Management: RSI ke signals par poora bharosa na karte hue, ek mazboot risk management strategy bhi banana zaroori hai.

RSI ek powerful tool hai jo traders ko market ki health ka andaza lagane mein madad karta hai. Lekin, yeh important hai ke isse akele mein na lekar, dusre factors ke saath milake istemal kiya jaye. Forex trading mein safalta hasil karne ke liye, knowledge, experience aur discipline ki zarurat hoti hai, aur RSI ek tool hai jo in sab cheezon ko madad karne mein aata hai.

تبصرہ

Расширенный режим Обычный режим