Money Flow Index (MFI) Indicator in Forex Trading

1. Introduction to Money Flow Index (MFI)

Money Flow Index (MFI) ek momentum oscillator hai jo market ke buying aur selling pressure ko measure karta hai. Yeh indicator price aur volume ko combine karta hai, jo traders ko market ke strength ya weakness ko samajhne mein madad karta hai.

2. How Money Flow Index (MFI) Works

- Calculation of MFI: MFI formula price aur volume ke basis par hota hai.

- Interpreting MFI Values: MFI values range from 0 to 100. Higher values indicate strong buying pressure and lower values indicate strong selling pressure.

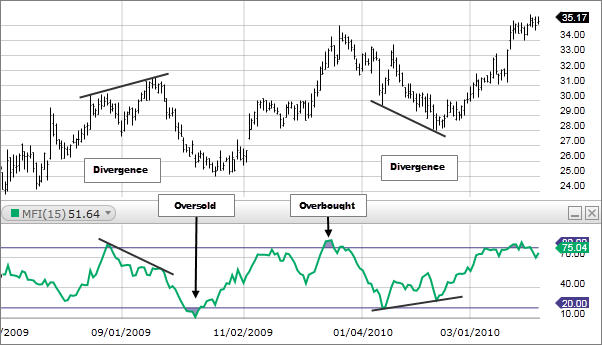

- Overbought and Oversold Conditions: MFI 80 se upar jana overbought condition ko show karta hai, jisse ki price reversal expected ho sakta hai. Similarly, MFI 20 se neeche jaane par oversold condition indicate hoti hai, jahan price ka bounce back possible hai.

- Divergence with Price: MFI ki readings ko price movements ke saath compare karke divergence track ki ja sakti hai, indicating potential trend reversals.

- Confirmation with Other Indicators: MFI ko doosre indicators ke saath combine karke confirm kiya ja sakta hai, jaise ki RSI, MACD, ya Price Action.

- Overbought and Oversold Zones: MFI ke overbought aur oversold zones ko use karke entry aur exit points identify kiya ja sakta hai.

- MFI Crossings: MFI ki line ke crossings, jaise ki MFI ka 14-day simple moving average, bhi trading signals provide karte hain.

- False Signals: MFI, volatile markets mein false signals generate kar sakta hai.

- Single Indicator Reliance: Sirf MFI par depend karke trading decisions lena risky ho sakta hai, isliye doosre confirmatory indicators ki bhi zaroorat hoti hai.

Money Flow Index (MFI) ek valuable tool hai market ki strength ya weakness ko analyze karne ke liye, lekin iska istemal karte waqt caution aur doosre indicators ke saath consider karna important hai. MFI ke saath risk management aur market analysis ko combine karke traders effective trading strategies develop kar sakte hain.

تبصرہ

Расширенный режим Обычный режим