What is Double Top candlestick?

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic double top candlestick Pattern ke bare me btao ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge me izafa Kare ge

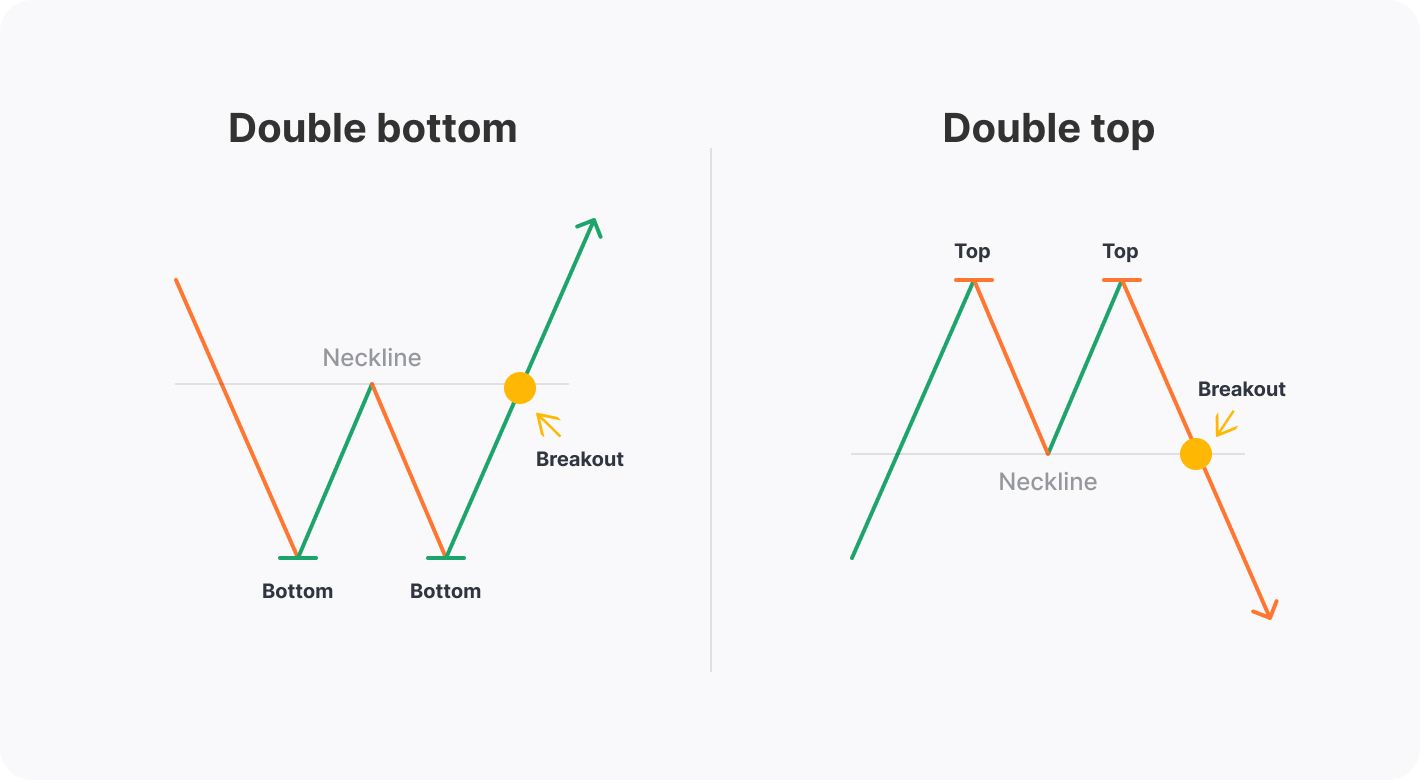

Double Top candlestick pattern ek technical analysis concept hai jo market charts par dekha jata hai aur yeh ek reversal pattern ko represent card hai. Is the pattern mein do consecutive high points hot hain jo ek dusre ke bohot qareeb hot hain, aur inke buk mein ek low point hota hai. Yeh market ke trend ki reversal ko indicate kar sakta hai.

**Explanation of Double Top :**

Double Top pattern ka pehla high point ek bull trend mein hota hai, jo ke market mein tezi ko darust karti hai. Jab yeh point reach hota hai, traders ko yeh signal milta hai ke market mein bull phase hai.

Phir market mein ek temporary pullback hota hai, jiski wajah se price gir kar doosra high point banata hai. Yeh doosra high point pehle wale high point ke bohot qareeb hota hai. Iske baad market mein ek aur reversal hota hai jise downtrend kehte hain.

Is pattern ko confirm karne ke liye, market traders ke neeche girne wale low point ki breaking ka wait karte hain. Agar price us low point ko break kar leta hai, to yeh confirm hota hai ke double top pattern complete ho gaya hai aur market mein downtrend shuru ho gaya hai.

**Significance**

Double Top pattern ka identification karna traders ke liye important hota hai kyunki isse future price movement ka idea milta hai. Agar yeh pattern sahi taur par identify hota hai, to traders isse future mein hone wale bear movement se bachne ke liye apne positions adjust kar sakte hain.

Lekin, har pattern ki tarah, yeh bhi 100% confirm nahi hota aur market conditions par depends karta hai. Kuch traders doosre technical indicators aur tools ka bhi istemal karte hain double top pattern ko confirm karne ke liye.

**Akhri Kehna:**

Double Top candlestick pattern ek useful tool hai market trends ko samajhne mein, lekin iska istemal keval ek puzzle piece ke roop mein kiya jaana chahiye. Traders ko hamesha market conditions risk tolerance aur doosre factors ko madde nazar rakhte shade apne trading decisions lene chahiye.

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic double top candlestick Pattern ke bare me btao ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge me izafa Kare ge

Double Top candlestick pattern ek technical analysis concept hai jo market charts par dekha jata hai aur yeh ek reversal pattern ko represent card hai. Is the pattern mein do consecutive high points hot hain jo ek dusre ke bohot qareeb hot hain, aur inke buk mein ek low point hota hai. Yeh market ke trend ki reversal ko indicate kar sakta hai.

**Explanation of Double Top :**

Double Top pattern ka pehla high point ek bull trend mein hota hai, jo ke market mein tezi ko darust karti hai. Jab yeh point reach hota hai, traders ko yeh signal milta hai ke market mein bull phase hai.

Phir market mein ek temporary pullback hota hai, jiski wajah se price gir kar doosra high point banata hai. Yeh doosra high point pehle wale high point ke bohot qareeb hota hai. Iske baad market mein ek aur reversal hota hai jise downtrend kehte hain.

Is pattern ko confirm karne ke liye, market traders ke neeche girne wale low point ki breaking ka wait karte hain. Agar price us low point ko break kar leta hai, to yeh confirm hota hai ke double top pattern complete ho gaya hai aur market mein downtrend shuru ho gaya hai.

**Significance**

Double Top pattern ka identification karna traders ke liye important hota hai kyunki isse future price movement ka idea milta hai. Agar yeh pattern sahi taur par identify hota hai, to traders isse future mein hone wale bear movement se bachne ke liye apne positions adjust kar sakte hain.

Lekin, har pattern ki tarah, yeh bhi 100% confirm nahi hota aur market conditions par depends karta hai. Kuch traders doosre technical indicators aur tools ka bhi istemal karte hain double top pattern ko confirm karne ke liye.

**Akhri Kehna:**

Double Top candlestick pattern ek useful tool hai market trends ko samajhne mein, lekin iska istemal keval ek puzzle piece ke roop mein kiya jaana chahiye. Traders ko hamesha market conditions risk tolerance aur doosre factors ko madde nazar rakhte shade apne trading decisions lene chahiye.

تبصرہ

Расширенный режим Обычный режим