What is piercing line?

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic piercing line candlestick Pattern ke bare me btao ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge or experience me zaror izafa Kare.Piercing Line candlestick pattern ek technical analysis tool hai jo traders ko market to potential turning points ko identify karne mein madad card hai. Ye pattern commonly downtrend ke baad aane wale bull reversal ko darust karnay ke liye istemal hota hai. Piercing Line candlestick pattern ek do-candle pattern hai aur iski pehli candle bearish hoti hai jabke dusri candle bullish hoti hai.

Explanation

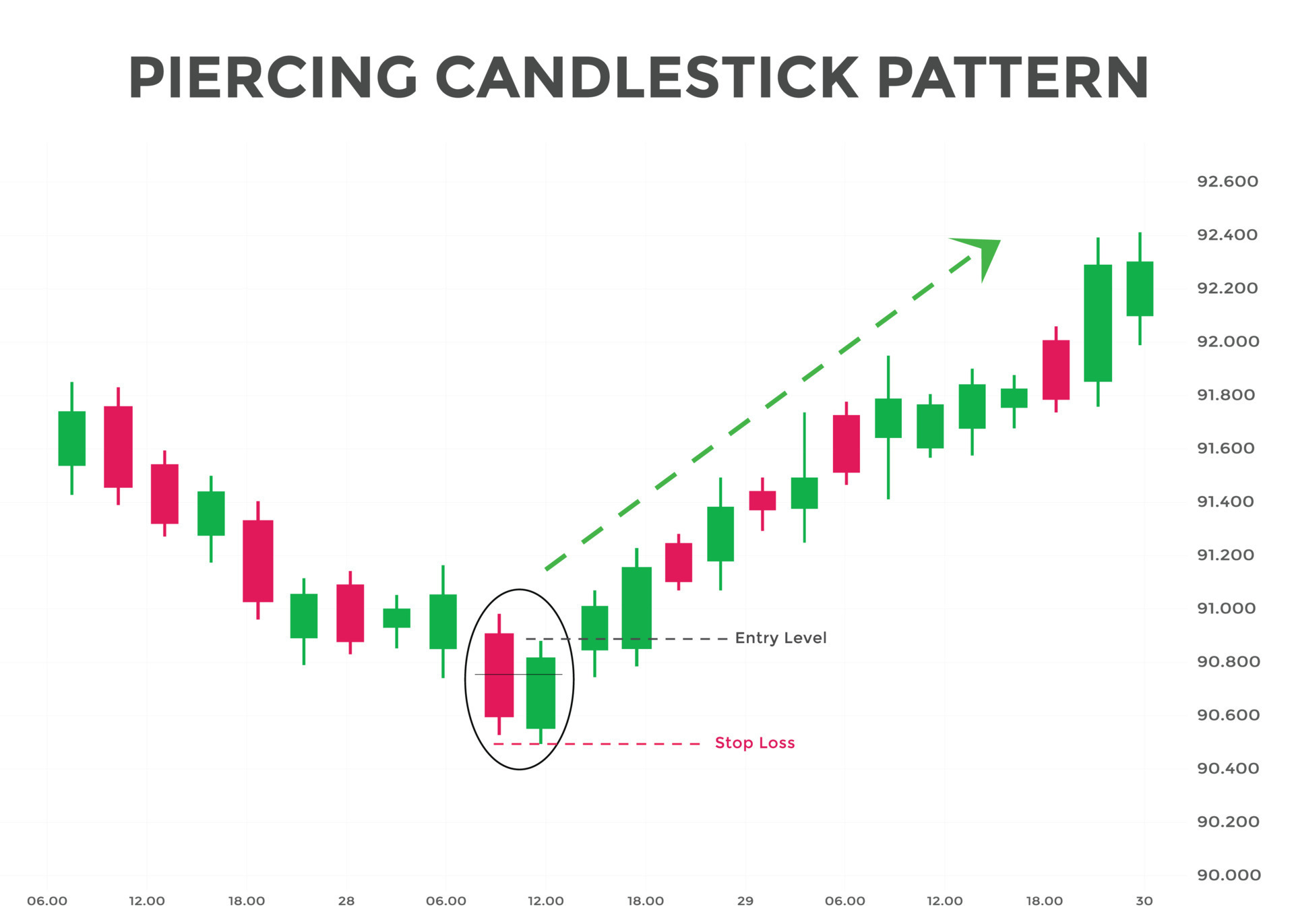

Is pattern ko samajhne ke liye, hamein pehle do alag alag candles dekhne hote hain. Pehli candle bearish hoti hai, yani ke iska closing price lower hota hai opening price se. Dusri candle, jo ke bullish hai, shuru hoti hai pehli candle ke neeche, lekin iski closing price pehli candle ke buk mein hoti hai.

"Piercing Line" ka naam isliye hai kyunki dusri candle pehli candle ko aik had tak pierce karti hai, yaani uski range mein enter karti hai. Iska matlab hai ke market ne ek strong selling phase ke baad achanak se buyers ka checking lena shuru kiya hai, yes ke potential trend reversal ka ishara ho sakta hai.

Importance

Piercing Line candlestick pattern ko confirm karne ke liye, traders aksar volume aur dusre technical indicators ka bhi istemal karte hain. Pattern agar ye higher volume ke saath aata hai, toh iska meaning aur bhi barh jata hai.

Traders are role model ko dekhte hain takay woh samajh sakein ke bear trend khatam ho sakta hai aur ab bull trend shuru hone wala hai. Je tarah se, Piercing Line candlestick pattern traders ko entry points suggest karne mein madad karta hai.

Yeh important hai ke is pattern ko dusre market signals aur factors ke saath milake interpret kiya jaye. Technical analysis ka istemal karte waqt, traders ko hamesha market to overall context ko bhi madde nazar rakhte hue decision leni chahiye.

Conclusion

In conclusion, the Piercing Line candlestick pattern ek reversal signal provides card hai jo bearish trend ke baad hone wale potential bullish reversal ko highlight card hai. Traders ko chahiye ke je pattern ko sahi tarah se samajhe aur dusre confirming signals ke saath istemal karein takay unki trading decision mein accuracy aaye.

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic piercing line candlestick Pattern ke bare me btao ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge or experience me zaror izafa Kare.Piercing Line candlestick pattern ek technical analysis tool hai jo traders ko market to potential turning points ko identify karne mein madad card hai. Ye pattern commonly downtrend ke baad aane wale bull reversal ko darust karnay ke liye istemal hota hai. Piercing Line candlestick pattern ek do-candle pattern hai aur iski pehli candle bearish hoti hai jabke dusri candle bullish hoti hai.

Explanation

Is pattern ko samajhne ke liye, hamein pehle do alag alag candles dekhne hote hain. Pehli candle bearish hoti hai, yani ke iska closing price lower hota hai opening price se. Dusri candle, jo ke bullish hai, shuru hoti hai pehli candle ke neeche, lekin iski closing price pehli candle ke buk mein hoti hai.

"Piercing Line" ka naam isliye hai kyunki dusri candle pehli candle ko aik had tak pierce karti hai, yaani uski range mein enter karti hai. Iska matlab hai ke market ne ek strong selling phase ke baad achanak se buyers ka checking lena shuru kiya hai, yes ke potential trend reversal ka ishara ho sakta hai.

Importance

Piercing Line candlestick pattern ko confirm karne ke liye, traders aksar volume aur dusre technical indicators ka bhi istemal karte hain. Pattern agar ye higher volume ke saath aata hai, toh iska meaning aur bhi barh jata hai.

Traders are role model ko dekhte hain takay woh samajh sakein ke bear trend khatam ho sakta hai aur ab bull trend shuru hone wala hai. Je tarah se, Piercing Line candlestick pattern traders ko entry points suggest karne mein madad karta hai.

Yeh important hai ke is pattern ko dusre market signals aur factors ke saath milake interpret kiya jaye. Technical analysis ka istemal karte waqt, traders ko hamesha market to overall context ko bhi madde nazar rakhte hue decision leni chahiye.

Conclusion

In conclusion, the Piercing Line candlestick pattern ek reversal signal provides card hai jo bearish trend ke baad hone wale potential bullish reversal ko highlight card hai. Traders ko chahiye ke je pattern ko sahi tarah se samajhe aur dusre confirming signals ke saath istemal karein takay unki trading decision mein accuracy aaye.

تبصرہ

Расширенный режим Обычный режим