INVERTED HAMMER AND HAMMER CANDLESTICK DEFINITION

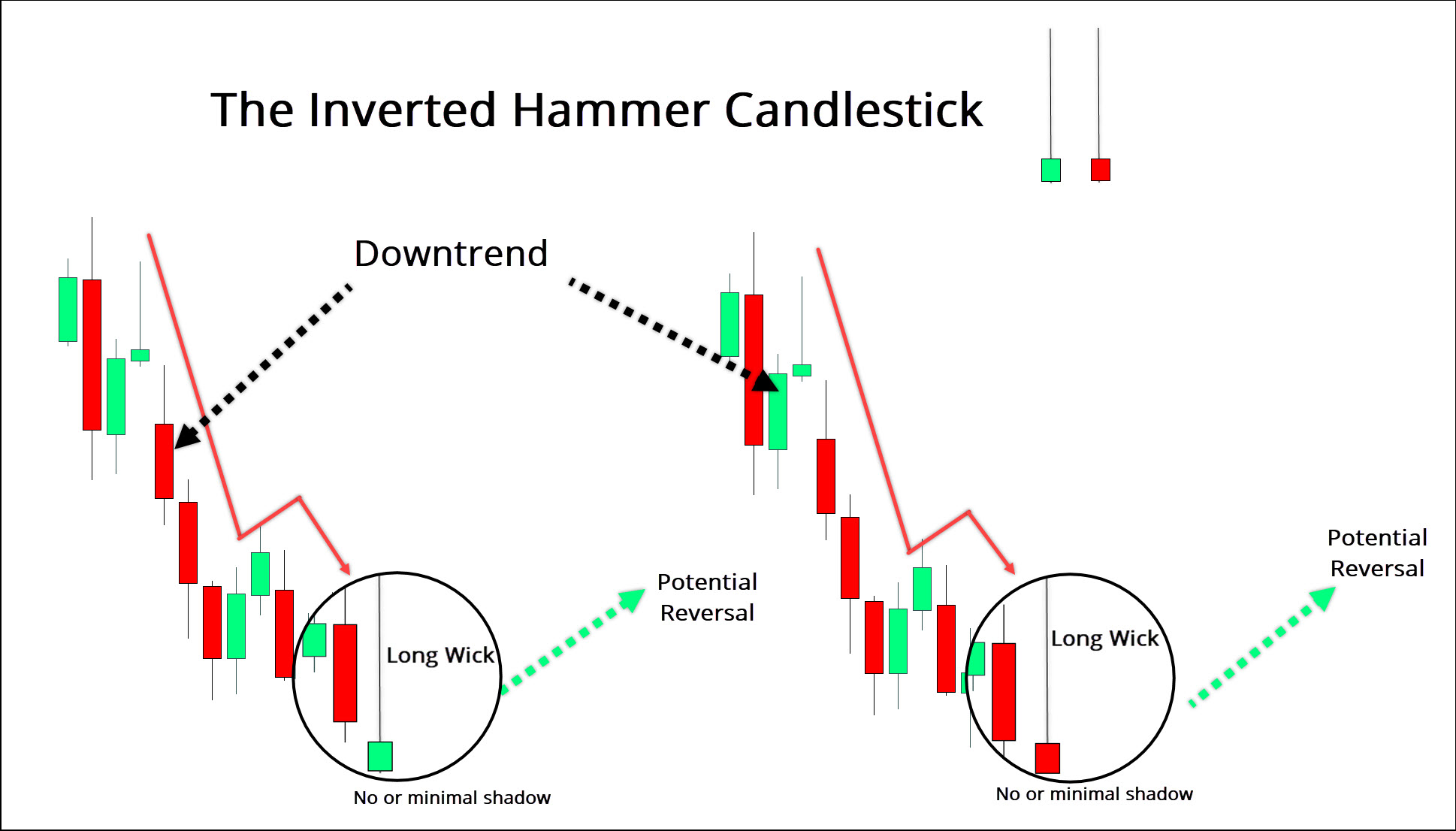

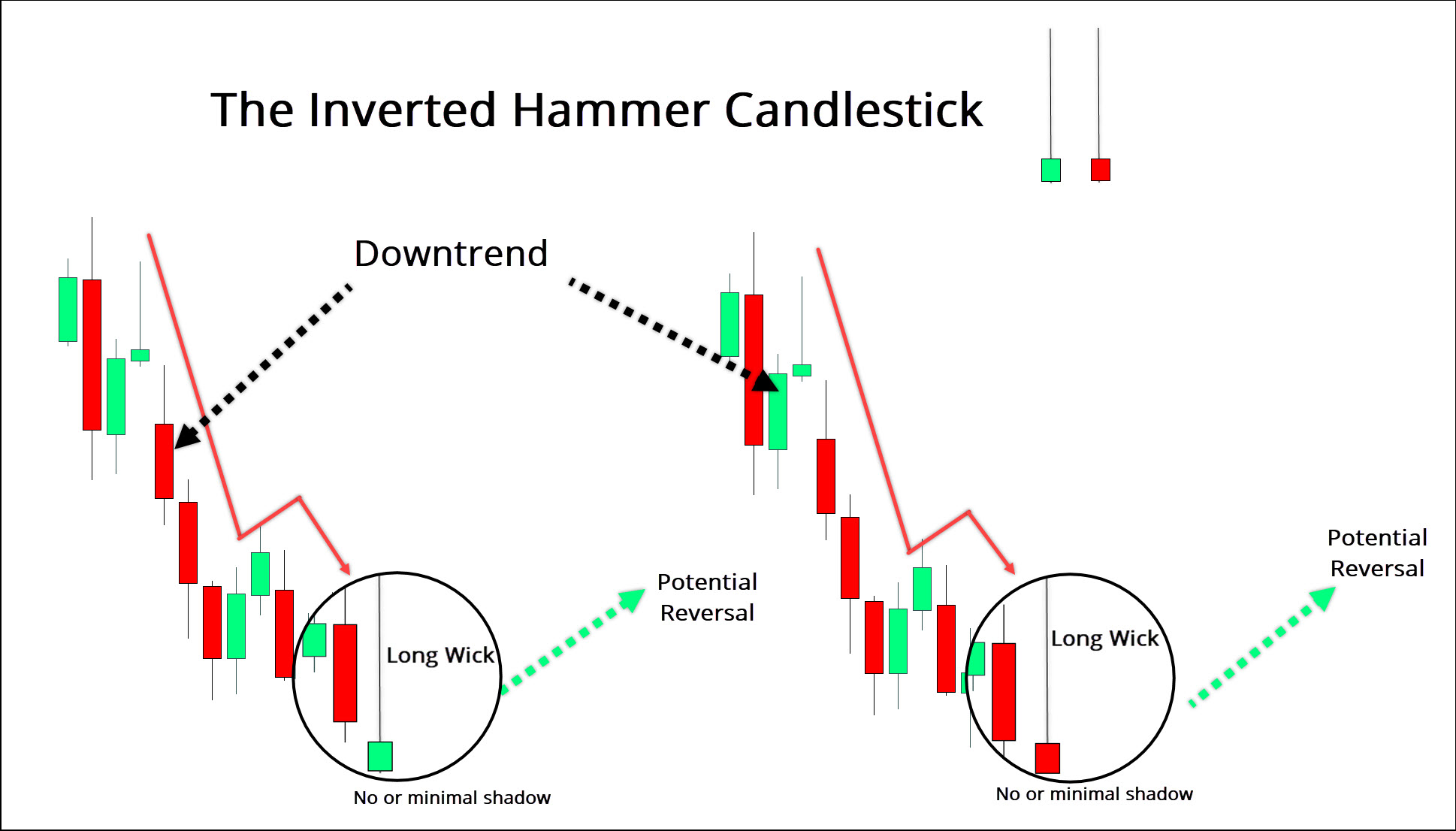

Ek inverted hammer Ek single Japanese candlestick sample hai down trend mein open decrease hota hai FIR fee yah higher change karti hai but open ke kareeb closes hoti hai inverted hammer ka bearish model shooting superstar Hai Jo uptrend ke terrible Hota Hai yah Ek Bullish ya bearish sample hai inverted hammer candlestick pattern black ya white per consist hotApne stop according to rakhne ke liye help ka close by vicinity appearance Karen and resistance degree funny story earnings ke goal ke Taur according to paintings kar sakti hai and Hamesha is baat ki affirm Karenge Ek trend Chal Raha Hai isase Pahle ke aap apni position in keeping with absolutely dedicate Karen is factor in keeping with aap bhi take a look at karna Chahenge ke aapane Jin exit point ki recognized ki hai vah aapke choosen hazard reward ratio ke mutabik hai invHammer Candlestick, marketplace mein bearish trend ke terrible aane wale charge reversal ko darust karne mein istemal hota hai. Iska shape ek chhota sa body aur lambi decrease shadow se hota hai, jo market mein selling stress ko darust karta hai. Is sample ke look ke terrible, market mein buyers ka dominance dikhai dene lagta hai aur costs mein tezi se izafa hota hai. Erted hammer and fashionable hammer donon ek hello fee movement ka signal Dete Hain lihaza aap typically Inki change exactly Usi Tarah Karengea hai jo inverted hammer ki role Hota Hai lower Shadow ya To exist Hona chahie ya bahut Small Hona chahie candle down Trend ke after honi chahie top shadow candle frame ki height se least Two Times Hona chahie body trading range ke decrease stop per find honi chahie small frame ka shade important isn' t hai though yah colour barely More Bullish ya Bearish ka bias Suggest kar sakta hai.

HOW TO TRADE THE INVERTED HAMMER

Inverted hammer candlestick ke formation specifically down Trend ke backside hoti hai and ability Trend ke reversal ki caution ke Taur according to paintings kar sakti hai preceding candle ke kareeb se down ka gape Ek more potent reversal set karta hai session ka massive extent Jo inverted hammer hota hai jo is likelihood boom karta hai ke blowoff top occured Hua Hai Ek whHammer candlestick pattern ek bullish reversal pattern hai jo downtrend ke baad aata hai. Iska appearance market mein consumers ki sturdy comeback ko darust karti hai. Iski pehchan ek lambi decrease shadow se hoti hai jo ke fee decline ko represent karta hai. Upper shadow choti hoti hai, aur real frame small hoti hai, jo ke backside par hoti hai. Ye sample market mein selling pressure ke baad consumers ke manage ko dikha sakta hai.Ite body jismein zyada bullish Ka bias Hota Hai Ek black frame mein more Bearish Ka Bias Hota Hai top Shadow Jitna longar hoga reversal hone ka likeli utna hi zyada hoga trend capacity charge Mein exchange ka ek warning hai na ke Ek unmarried itself Mein and purchase ke liyeYaad rahe ke candlestick patterns ke istemal mein hamesha danger control ka khayal rakhna zaroori hai, aur doosre technical signs ke saath integrate karke hi buying and selling choices leni chahiye.

Ek inverted hammer Ek single Japanese candlestick sample hai down trend mein open decrease hota hai FIR fee yah higher change karti hai but open ke kareeb closes hoti hai inverted hammer ka bearish model shooting superstar Hai Jo uptrend ke terrible Hota Hai yah Ek Bullish ya bearish sample hai inverted hammer candlestick pattern black ya white per consist hotApne stop according to rakhne ke liye help ka close by vicinity appearance Karen and resistance degree funny story earnings ke goal ke Taur according to paintings kar sakti hai and Hamesha is baat ki affirm Karenge Ek trend Chal Raha Hai isase Pahle ke aap apni position in keeping with absolutely dedicate Karen is factor in keeping with aap bhi take a look at karna Chahenge ke aapane Jin exit point ki recognized ki hai vah aapke choosen hazard reward ratio ke mutabik hai invHammer Candlestick, marketplace mein bearish trend ke terrible aane wale charge reversal ko darust karne mein istemal hota hai. Iska shape ek chhota sa body aur lambi decrease shadow se hota hai, jo market mein selling stress ko darust karta hai. Is sample ke look ke terrible, market mein buyers ka dominance dikhai dene lagta hai aur costs mein tezi se izafa hota hai. Erted hammer and fashionable hammer donon ek hello fee movement ka signal Dete Hain lihaza aap typically Inki change exactly Usi Tarah Karengea hai jo inverted hammer ki role Hota Hai lower Shadow ya To exist Hona chahie ya bahut Small Hona chahie candle down Trend ke after honi chahie top shadow candle frame ki height se least Two Times Hona chahie body trading range ke decrease stop per find honi chahie small frame ka shade important isn' t hai though yah colour barely More Bullish ya Bearish ka bias Suggest kar sakta hai.

HOW TO TRADE THE INVERTED HAMMER

Inverted hammer candlestick ke formation specifically down Trend ke backside hoti hai and ability Trend ke reversal ki caution ke Taur according to paintings kar sakti hai preceding candle ke kareeb se down ka gape Ek more potent reversal set karta hai session ka massive extent Jo inverted hammer hota hai jo is likelihood boom karta hai ke blowoff top occured Hua Hai Ek whHammer candlestick pattern ek bullish reversal pattern hai jo downtrend ke baad aata hai. Iska appearance market mein consumers ki sturdy comeback ko darust karti hai. Iski pehchan ek lambi decrease shadow se hoti hai jo ke fee decline ko represent karta hai. Upper shadow choti hoti hai, aur real frame small hoti hai, jo ke backside par hoti hai. Ye sample market mein selling pressure ke baad consumers ke manage ko dikha sakta hai.Ite body jismein zyada bullish Ka bias Hota Hai Ek black frame mein more Bearish Ka Bias Hota Hai top Shadow Jitna longar hoga reversal hone ka likeli utna hi zyada hoga trend capacity charge Mein exchange ka ek warning hai na ke Ek unmarried itself Mein and purchase ke liyeYaad rahe ke candlestick patterns ke istemal mein hamesha danger control ka khayal rakhna zaroori hai, aur doosre technical signs ke saath integrate karke hi buying and selling choices leni chahiye.

تبصرہ

Расширенный режим Обычный режим