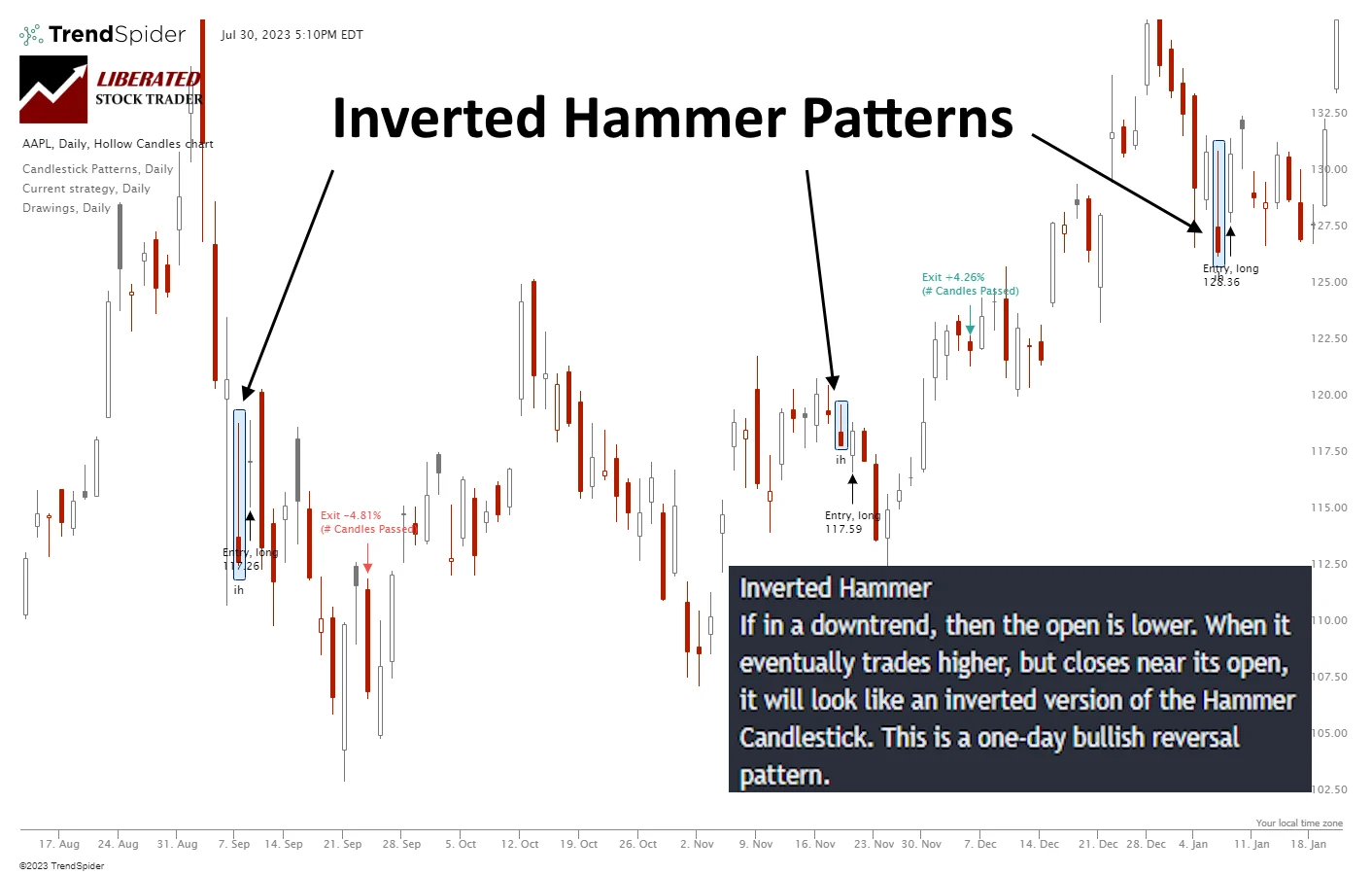

"Inverted Hammer" candlestick pattern bearish reversal pattern hai jo typically downtrend ke baad aata hai aur price ke potential reversal ko indicate karta hai.

Is pattern ko identify karne ke liye, yeh steps follow kiye jaate hain:

- Candle Shape: Inverted Hammer ek single candle pattern hota hai jo typically upper shadow (ya wick) aur chhoti si lower body ke saath hota hai. Lower shadow nahi hota ya bohot chhota hota hai.

- Location: Inverted Hammer pattern downtrend ke baad dikhta hai aur typically nichlay prices ke near form hota hai.

- Upper Shadow: Inverted Hammer ke upper shadow upper wick ke length ki taraf indicate karta hai, yeh upper shadow typically body se zyada hota hai.

- Lower Body: Lower body chhoti si hoti hai ya phir negligible hoti hai, jo ki upper shadow se neechay hoti hai.

Inverted Hammer pattern ke trading strategy mein, traders is pattern ke confirmations aur additional signals ka wait karte hain, jaise ke:

- Confirmation: Inverted Hammer pattern ko confirm karne ke liye, traders doosre bullish confirmatory signals ki talaash karte hain jaise ke kisi support level ka confirm break, higher volume, ya phir kisi technical indicator ka bullish crossover.

- Entry Point: Traders typically is pattern ke upper shadow ke upar entry point set karte hain ya phir confirmatory signal ke baad entry karte hain.

- Stop Loss aur Target: Trade ke start mein stop loss set karna zaroori hai taki agar trade opposite direction mein chala gaya to nuksan se bacha ja sake. Target level set karna bhi important hai, jo previous resistance level ya phir technical analysis ke zariye decide kiya ja sakta hai.

Yeh pattern keval ek part hai trading decision ke, isliye sirf is pattern par rely na karein. Always proper risk management aur technical analysis ka istemal karein trading ke liye.

تبصرہ

Расширенный режим Обычный режим