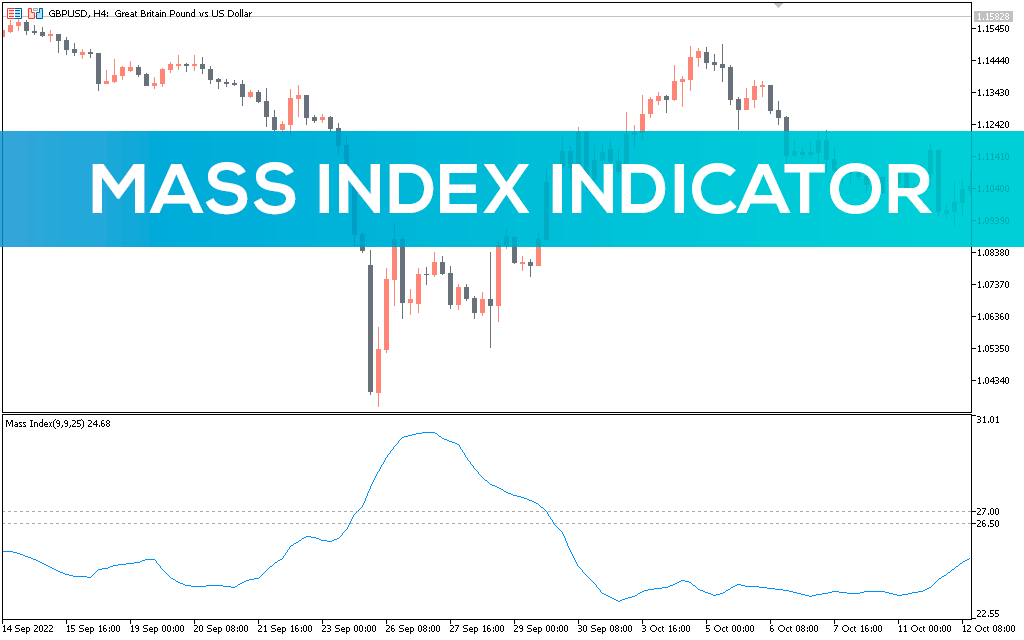

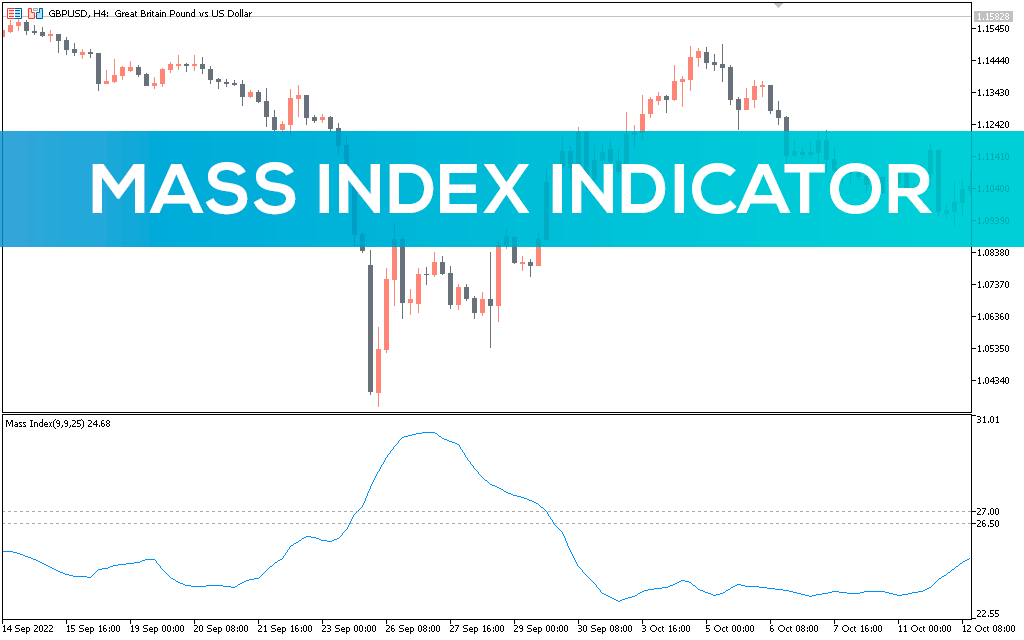

Mass Index candlestick styles:

Mass Index ki hesiyat se aik muayyan dour aam taur par 14 din ki kam tar wali harkat ko kam tar tez oonchay se minus karke hasil kiya jata hai, phir is nataij ko us dour ki tadad se taqseem kiya jaMass Index candlestick sample ka istemal karne ke ek faide ye hai ke ye traders ko market ki faaliyat ko mutaqqiyan karne ka ek doosra tareeqa farahem karta hai conventional signs jese ke moving averages ya Bollinger Bands ke alawaLekin traders ko yaad rakhna chahiye ke koi bhi akela technical analysis device hamesha se bharosa karne ke laiq nahi hota, kyun ke is par alag alag elements jese ke marketplace volatility, khabar activities, ya ghair mutawaqqa keemat ki harkat ke asarat ho sakte hain. Traders ko hamesha apne signals ko dakhil hone se pehle mazeed maloomat aur tajziya hasil karne ke liye more than one sources ka istemal karna chahiye, aur unhe apni trades ke liye potential nuqsaan ko kam karne ke liye stable threat control strategy ka hona chah. Technical signs aur candlestick charting techniques ke dono pe mabni hone ke liye, ye traders ko marketplace ki faaliyat ka ek zyada complete nazariya farahem karta hai jo unhe apni trades ke bare mein zyada maloomat hasil karne mein madad karta hai.

Ta hai. Jo hasil hone wala wide variety aata hai, usay 100 se zarb kiya jata hai takay percent ke hisab se maloomat hasil ho. Ye percentage maloomat phir aik alag chart par plot hoti hai keemat ke chart ke sath, jo ke Mass Index oscillator banati hai.

Using the Mass Index with different technical evaluation equipment:

Mass Index candlestick sample is oscillator ko istemal karti hai takay keemat ke chart aur Mass Index oscillator ke darmiyan mani ya mutabaat talash kare keemat ke reversals ya jari rakhne ke liyn styles ke ilawa trex candlestick pattern ek technical analysis tool hai jo monetary markets, jese ke stock market, foreign exchange, aur cryptocurrencies mein istemal hota hai. Yeh sample traders aur buyers ko market ke mood aur capacity trend reversals ka andaza lagane mein madad karta hai. Is pattern ki information, candlestick charts aur Mass Index indicator ko integrate karke ki jati hai.Aders Mass Index candlestick sample ke saath doosre technical evaluation equipment bhi istemal kar sakte hain takay apne alerts ko tasdeeq karen aur apni trades mein apne itminan ko barhayein. Maslan, wo transferring averages, assist aur resistance ranges, ya candlestick patterns jese hammers, dojis, ya engulfing styles ka istemal kar sakte hain ke apne indicators ko aur context aur tajziya farahem karne mein madad karein.E. Mani tab hoti hai jab keemat ke chart aur Mass Index oscillator ek dusre ke mukhalif rukh mein harkat karte hain, jo ke ishara karta hai ke fashion taqat har raha hai aur mumkin hai ke palat raha ho. Mutabaat tab hoti hai jab keemat ke chart aur Mass Index oscillator ek hello rukh mein harkat karte hain, jo ke ishara karta hai ke trend taqat hasil kar raha hai aur mumkin hai ke jari rahe.

Mass Index ki hesiyat se aik muayyan dour aam taur par 14 din ki kam tar wali harkat ko kam tar tez oonchay se minus karke hasil kiya jata hai, phir is nataij ko us dour ki tadad se taqseem kiya jaMass Index candlestick sample ka istemal karne ke ek faide ye hai ke ye traders ko market ki faaliyat ko mutaqqiyan karne ka ek doosra tareeqa farahem karta hai conventional signs jese ke moving averages ya Bollinger Bands ke alawaLekin traders ko yaad rakhna chahiye ke koi bhi akela technical analysis device hamesha se bharosa karne ke laiq nahi hota, kyun ke is par alag alag elements jese ke marketplace volatility, khabar activities, ya ghair mutawaqqa keemat ki harkat ke asarat ho sakte hain. Traders ko hamesha apne signals ko dakhil hone se pehle mazeed maloomat aur tajziya hasil karne ke liye more than one sources ka istemal karna chahiye, aur unhe apni trades ke liye potential nuqsaan ko kam karne ke liye stable threat control strategy ka hona chah. Technical signs aur candlestick charting techniques ke dono pe mabni hone ke liye, ye traders ko marketplace ki faaliyat ka ek zyada complete nazariya farahem karta hai jo unhe apni trades ke bare mein zyada maloomat hasil karne mein madad karta hai.

Ta hai. Jo hasil hone wala wide variety aata hai, usay 100 se zarb kiya jata hai takay percent ke hisab se maloomat hasil ho. Ye percentage maloomat phir aik alag chart par plot hoti hai keemat ke chart ke sath, jo ke Mass Index oscillator banati hai.

Using the Mass Index with different technical evaluation equipment:

Mass Index candlestick sample is oscillator ko istemal karti hai takay keemat ke chart aur Mass Index oscillator ke darmiyan mani ya mutabaat talash kare keemat ke reversals ya jari rakhne ke liyn styles ke ilawa trex candlestick pattern ek technical analysis tool hai jo monetary markets, jese ke stock market, foreign exchange, aur cryptocurrencies mein istemal hota hai. Yeh sample traders aur buyers ko market ke mood aur capacity trend reversals ka andaza lagane mein madad karta hai. Is pattern ki information, candlestick charts aur Mass Index indicator ko integrate karke ki jati hai.Aders Mass Index candlestick sample ke saath doosre technical evaluation equipment bhi istemal kar sakte hain takay apne alerts ko tasdeeq karen aur apni trades mein apne itminan ko barhayein. Maslan, wo transferring averages, assist aur resistance ranges, ya candlestick patterns jese hammers, dojis, ya engulfing styles ka istemal kar sakte hain ke apne indicators ko aur context aur tajziya farahem karne mein madad karein.E. Mani tab hoti hai jab keemat ke chart aur Mass Index oscillator ek dusre ke mukhalif rukh mein harkat karte hain, jo ke ishara karta hai ke fashion taqat har raha hai aur mumkin hai ke palat raha ho. Mutabaat tab hoti hai jab keemat ke chart aur Mass Index oscillator ek hello rukh mein harkat karte hain, jo ke ishara karta hai ke trend taqat hasil kar raha hai aur mumkin hai ke jari rahe.

تبصرہ

Расширенный режим Обычный режим