Fundamental Factors Market Par Kaise Asar Dalte Hain

Kai factors asay shares ki keemat aur issuer ki marketplace capitalization par asar dalte hain: maslan, mehengai, key rate, rozgaar, aur sanati output. Koi bhi iqtisadi factor jo supply ko kam ya demand ko barha de, keemat ko buland karay ga. Ulat, koi component jo deliver ko barhaye ya demand ko kam kare, woh stocks ko buland karega aur fees ko kam karay ga.Misal ke tor par, China mein coronavirus ke chalte scientific masks ki demand barh gayi - unki keemat buland hui. Masks banane wali clinical businesses ki inventory fees bhi buland hui.Isi doran, duniya bhar mein Chinese vacationer businesses ki tadad zero tak gir gayi hai, is wajah se tour corporations nuksan utha rahe hain. Fundamental elements marketplace ko mukhtalif tareeqon se asar dalte hain. Amuman, kuch agencies jeet ti hain aur kuch haar jati hain.

Explaination

Fundamental evaluation ek stock ki qeemat ka faisla karne ka insaaf hai jo ek agency ki sehat ke mali aur iqtisadi performance, jamaatana siyasi mahol, aur bazaar ki haqeeqat par mabni hota hai, jo Doosre numayendeh phenomena mein recessions ki announcements, session ke baad politicians ki remarks, ghair mutawaqqa managment ke faislay, scandals, sanctions, muqablay, leaders ke darmiyan negotiation ke natayej, monetary boards mein guftago, aur sarkari organizations mein sharikat ka barah-e-raast hissa lena shamil hai: ye ek mumkin tareeqa hai financial system ko bachane ka jo shares ki essential analysis mein istemal hone chahiye.Ek aur misal. Former U.S. President Donald Trump ne Twitter ko bohat istemal kiya. Unke tweets ne stock aur commodity markets ke fees par asar dala. Maslan, 25 February 2020 ko, unhone likha ke coronavirus United States mein manage mein hai. U.S. Inventory indices ne aise assertion par girawat se react ki.Ke united states of americaindustry ko asar daal sakti hai jisme business enterprise ka kaam hota hai.Ye analysis technical evaluation ka ulta hai, jisme buyers keemat ki harkaton par bharosa karte hain. Unka khayal hai ke keemat pehle se hi sab kuch ko mad e nazar rakhti hai jo isay asar daal sakta hai: bazaar ki jazbat, tajaweez analysts ki, news historical past, karobaar ke mustaqbil, aur kamiyabi. Isliye, iqtisadi elements par tawajju dena zaroori nahihai.Fundamentalists, sab se pehle, economic statements par ghaur karte hain jisse woh faisla karte hain ke corporation kitni achhi ya buri kar rahi hai. Woh bhi industry aur mulk ke statistics, mausam ke factors, aur poora marketplace dekhte hain.

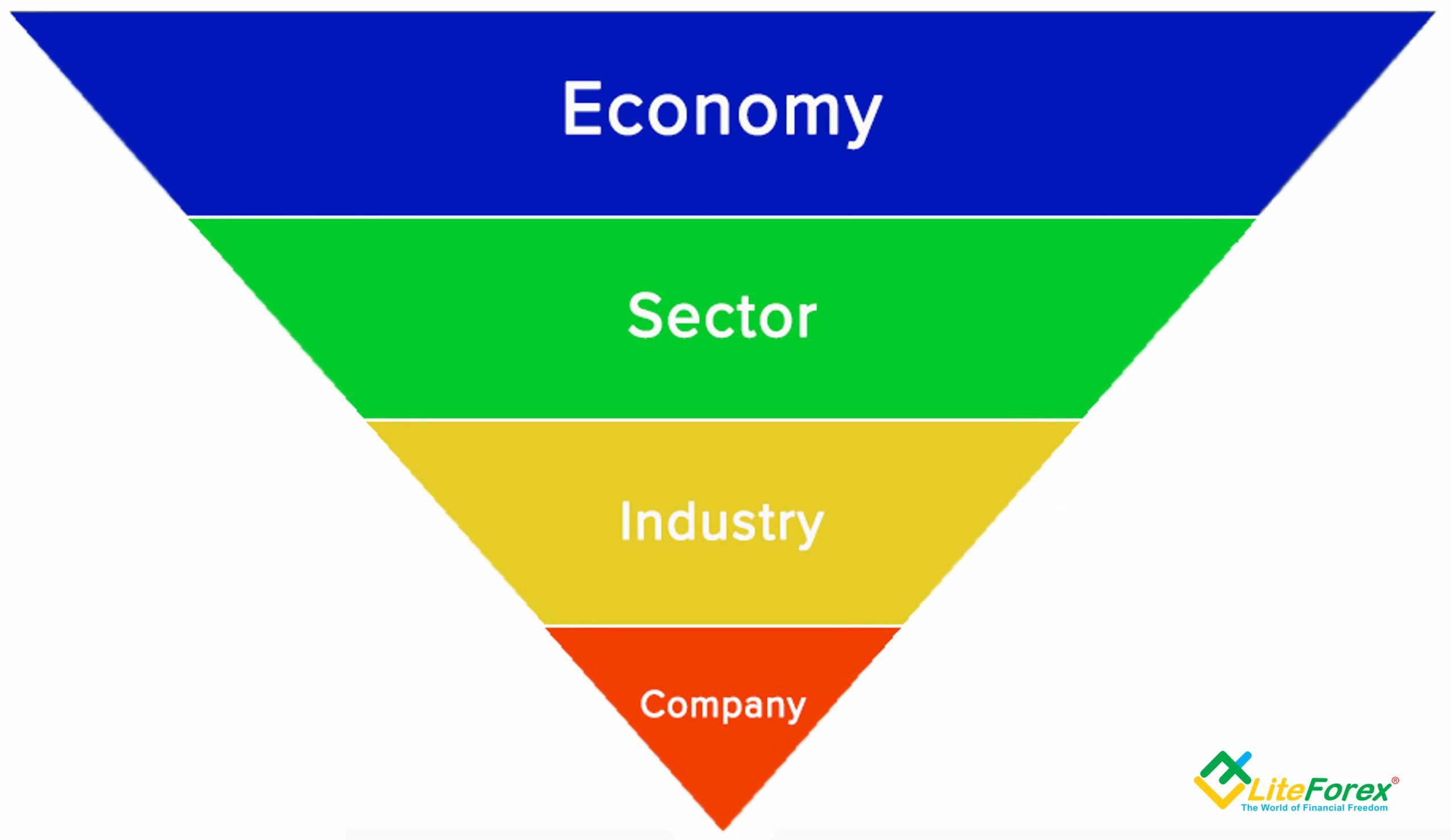

Fundamental Analysis Ka Structure

Fundamental analysis sirf corporation aur uske shares ka tajziya nahi karta, balki siasati aur iqtisadi factors par bhi ghaur karta hai. Iska classic dabasiya chaar mukhtasar marahil par mabni hmajboot ya kamzor karte hain, aur industrial financial institution quotes par asar dalte hain.Agar fee gir jata hai, to investors apne funds ko bank deposits se nikal kar stock market mein ziada munafa talash karte hain. Agar charge barh jata hai, to buyers stable aur cozy financial institution deposits ko pasand karte hain aur kam invota hai. Ye aksar wohi log istemal karte hain jo bade team of workers ke analysts ke sath institutional buyers hote hain.Institutional traders aksar top-down valuations karte hain. Jabke personal investors zyadatar 'bottom-up' opinions behavior karte hain aur company ke securities ki tajziya par zyada tawajju dete hain industry aur macroeconomic evaluation ke bajaye.

Kai factors asay shares ki keemat aur issuer ki marketplace capitalization par asar dalte hain: maslan, mehengai, key rate, rozgaar, aur sanati output. Koi bhi iqtisadi factor jo supply ko kam ya demand ko barha de, keemat ko buland karay ga. Ulat, koi component jo deliver ko barhaye ya demand ko kam kare, woh stocks ko buland karega aur fees ko kam karay ga.Misal ke tor par, China mein coronavirus ke chalte scientific masks ki demand barh gayi - unki keemat buland hui. Masks banane wali clinical businesses ki inventory fees bhi buland hui.Isi doran, duniya bhar mein Chinese vacationer businesses ki tadad zero tak gir gayi hai, is wajah se tour corporations nuksan utha rahe hain. Fundamental elements marketplace ko mukhtalif tareeqon se asar dalte hain. Amuman, kuch agencies jeet ti hain aur kuch haar jati hain.

Explaination

Fundamental evaluation ek stock ki qeemat ka faisla karne ka insaaf hai jo ek agency ki sehat ke mali aur iqtisadi performance, jamaatana siyasi mahol, aur bazaar ki haqeeqat par mabni hota hai, jo Doosre numayendeh phenomena mein recessions ki announcements, session ke baad politicians ki remarks, ghair mutawaqqa managment ke faislay, scandals, sanctions, muqablay, leaders ke darmiyan negotiation ke natayej, monetary boards mein guftago, aur sarkari organizations mein sharikat ka barah-e-raast hissa lena shamil hai: ye ek mumkin tareeqa hai financial system ko bachane ka jo shares ki essential analysis mein istemal hone chahiye.Ek aur misal. Former U.S. President Donald Trump ne Twitter ko bohat istemal kiya. Unke tweets ne stock aur commodity markets ke fees par asar dala. Maslan, 25 February 2020 ko, unhone likha ke coronavirus United States mein manage mein hai. U.S. Inventory indices ne aise assertion par girawat se react ki.Ke united states of americaindustry ko asar daal sakti hai jisme business enterprise ka kaam hota hai.Ye analysis technical evaluation ka ulta hai, jisme buyers keemat ki harkaton par bharosa karte hain. Unka khayal hai ke keemat pehle se hi sab kuch ko mad e nazar rakhti hai jo isay asar daal sakta hai: bazaar ki jazbat, tajaweez analysts ki, news historical past, karobaar ke mustaqbil, aur kamiyabi. Isliye, iqtisadi elements par tawajju dena zaroori nahihai.Fundamentalists, sab se pehle, economic statements par ghaur karte hain jisse woh faisla karte hain ke corporation kitni achhi ya buri kar rahi hai. Woh bhi industry aur mulk ke statistics, mausam ke factors, aur poora marketplace dekhte hain.

Fundamental Analysis Ka Structure

Fundamental analysis sirf corporation aur uske shares ka tajziya nahi karta, balki siasati aur iqtisadi factors par bhi ghaur karta hai. Iska classic dabasiya chaar mukhtasar marahil par mabni hmajboot ya kamzor karte hain, aur industrial financial institution quotes par asar dalte hain.Agar fee gir jata hai, to investors apne funds ko bank deposits se nikal kar stock market mein ziada munafa talash karte hain. Agar charge barh jata hai, to buyers stable aur cozy financial institution deposits ko pasand karte hain aur kam invota hai. Ye aksar wohi log istemal karte hain jo bade team of workers ke analysts ke sath institutional buyers hote hain.Institutional traders aksar top-down valuations karte hain. Jabke personal investors zyadatar 'bottom-up' opinions behavior karte hain aur company ke securities ki tajziya par zyada tawajju dete hain industry aur macroeconomic evaluation ke bajaye.

تبصرہ

Расширенный режим Обычный режим