Definition;

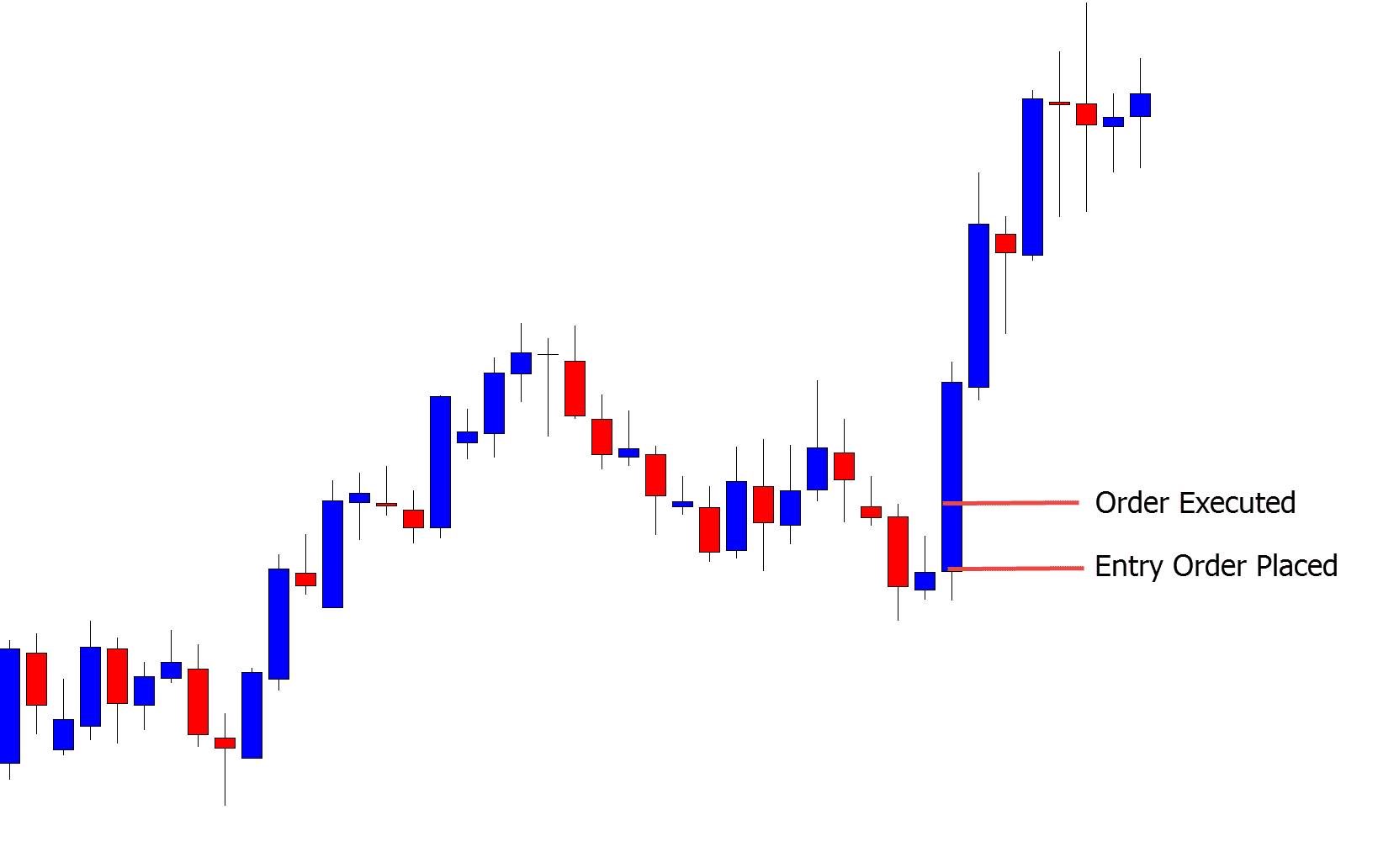

kise he ap sab log aj is thread me apko me Pakistan Forex Trading ke ak bhot he important topic slippage ke bare me btao ga or me umeed karta ho ke jo informationme apse share karo ga wo apke knowledge or experience me zaror izafa late ge .Slippage ka matlab hai jab aap Forex market mein trade kar rahay hote hain aur aapka order aapke expected price se thora sa difference ke saath execute hota hai. The difference usually market volatility, liquidity, order execution speed ke wajah se hota hai. Explanation

Slippage aam taur par high volatility wale samay mein hota hai jab market mein sudden price movements hote hain. For example, koi important economic news ya geopolitical event strike announce hota hai, tab market mein zor daar movement hoti hai aur traders to orders to execute hone mein time lag saakta hai. Iss wakt, aapka order uss price par execute ho sakta hai jo aapne expect nahi kiya tha.Yeh situation khaas tor par jab hoti hai jab aap market mein kisi specific price par enter ya exit karne ki koshish kar rahe hote hain. For example, agar aap ek specific price par buy ya sell order place kar rahe hain aur market mein sudden fluctuation hoti hai, toh aapka order wahi execute ho sakta hai, lekin different price par.

significance

Slippage impacts traders to par hota hai trading strategies and profits. Agar aap ek scalper hain jo choti-choti price movements with profit kama raha hai, toh slip aapke liye major ho sakta hai kyunki small price differences aapke overall profit ko influence kar sakte hain.Slippage ko avoid karna mushkil ho sakta hai, lekin kuch tareekay hote hain jinse aap isko minimize kar sakte hain. Aap fast and reliable internet connection ka istemal kar sakte hain, jisse aapke orders jaldi ho executions. Moreover, aap market mein kam volatile waqt mein trading kar sakte hain ya limit orders ka istemal karke slippage ko kam kar sakte hain. Limit orders mein aap specific price par buy ya sell karne ka order place karte hain, lekin yeh Guarantee nahi karta ki aapka order execute ho hi jayega.

Slippage ek common occurrence hai Forex market mein, aur har trader ko iske saath deal karna padta hai. Isliye, trading karte waqt slippage ka hona ek important factor hai jo traders ko consider karna chahiye.

تبصرہ

Расширенный режим Обычный режим