Definition

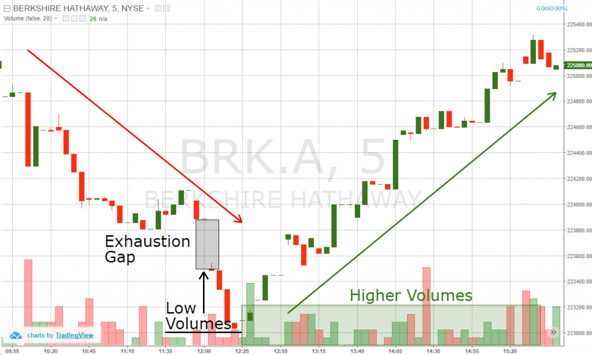

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic kicker candlestick Pattern ke bare me btao ga .Kicker Candlestick Pattern ek technical analysis ka concept hai jo ke financial markets mein istemal hota hai, khas kar stock market mein. Yeh pattern price action analysis ka hissa hai aur traders ke liye market trends ko samajhne mein madad karta hai.

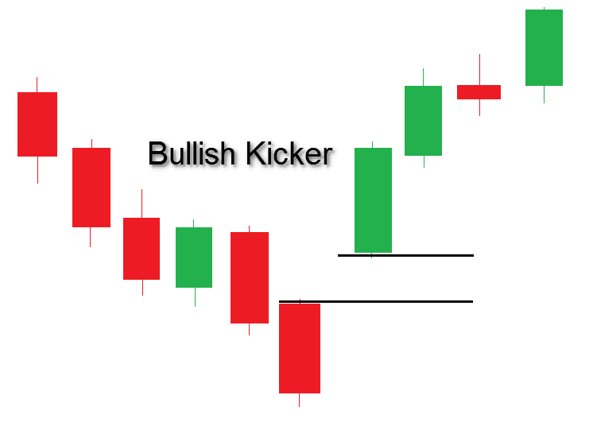

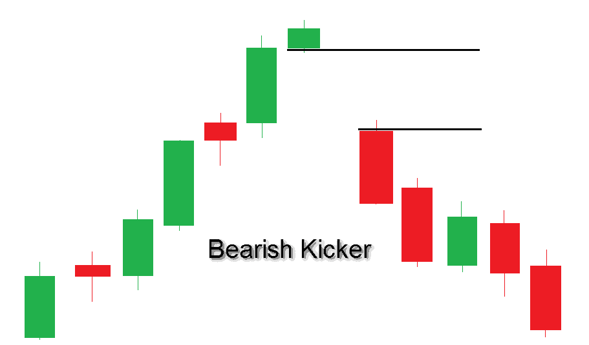

Kicker Candlestick Pattern as the basic idea yeh hai ke jab ek uptrend ya downtrend change sharply hota hai, toh yeh ek strong reversal signal provide card hai. Is pattern mein do consecutive candlesticks shamil hote hain – ek initial candlestick, jo current trend ko represent karta hai, aur doosra candlestick, jo ek strong reversal ko darust karti hai.

Explanation

Agar hum is pattern ko detail mein samjhein toh pehla candlestick trend ke mutabiq hota hai, jabke doosra candlestick ek opposite direction mein hota hai aur uski opening price pehle candlestick ki closing price ke barabar ya usse kareeb hoti hai. Yeh sudden change in market sentiment ko darust karta hai.

Kicker Candlestick Pattern ka asal maqsad market mein hone wale drastic changes ko pehchan'na hai. Is a pattern ko samajhne ke liye merchants ko market ki movement ko watch closely karna party hai, taake woh instant exchange ko pehchan sakein.

Significance

Yeh pattern Khaas tor par short term traders ke liye useful ho sakta hai jo market mein hone wale sharp reversals par focus karte hain. Agar kisi stock ya ya financial instrument mein Kicker Candlestick Pattern dikhe, toh traders is signal par amal karke apne trading strategies co adjust kar sakte hain.

Iske baawajood, hamesha yaad rakha jaaye to financial markets unpredictable hoti hain aur ek pattern by pura bharosa karne se pehle doosre technical indicators aur market trends ka bhi ghor karna zaroori hai.

In conclusion, Kicker Candlestick Pattern ek strong reversal signal hai jo traders ko market mein hone wale significant changes ke baare mein agah karta hai. Lekin, isko samajhne aur istemal karne se pehle thorough market analysis ki zarurat hoti hai.

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic kicker candlestick Pattern ke bare me btao ga .Kicker Candlestick Pattern ek technical analysis ka concept hai jo ke financial markets mein istemal hota hai, khas kar stock market mein. Yeh pattern price action analysis ka hissa hai aur traders ke liye market trends ko samajhne mein madad karta hai.

Kicker Candlestick Pattern as the basic idea yeh hai ke jab ek uptrend ya downtrend change sharply hota hai, toh yeh ek strong reversal signal provide card hai. Is pattern mein do consecutive candlesticks shamil hote hain – ek initial candlestick, jo current trend ko represent karta hai, aur doosra candlestick, jo ek strong reversal ko darust karti hai.

Explanation

Agar hum is pattern ko detail mein samjhein toh pehla candlestick trend ke mutabiq hota hai, jabke doosra candlestick ek opposite direction mein hota hai aur uski opening price pehle candlestick ki closing price ke barabar ya usse kareeb hoti hai. Yeh sudden change in market sentiment ko darust karta hai.

Kicker Candlestick Pattern ka asal maqsad market mein hone wale drastic changes ko pehchan'na hai. Is a pattern ko samajhne ke liye merchants ko market ki movement ko watch closely karna party hai, taake woh instant exchange ko pehchan sakein.

Significance

Yeh pattern Khaas tor par short term traders ke liye useful ho sakta hai jo market mein hone wale sharp reversals par focus karte hain. Agar kisi stock ya ya financial instrument mein Kicker Candlestick Pattern dikhe, toh traders is signal par amal karke apne trading strategies co adjust kar sakte hain.

Iske baawajood, hamesha yaad rakha jaaye to financial markets unpredictable hoti hain aur ek pattern by pura bharosa karne se pehle doosre technical indicators aur market trends ka bhi ghor karna zaroori hai.

In conclusion, Kicker Candlestick Pattern ek strong reversal signal hai jo traders ko market mein hone wale significant changes ke baare mein agah karta hai. Lekin, isko samajhne aur istemal karne se pehle thorough market analysis ki zarurat hoti hai.

تبصرہ

Расширенный режим Обычный режим