Definition;

kise he ap sab log me bilkul thek or khariyat see how or is thread me apko Demarker

indicator ke bare me btao ga.

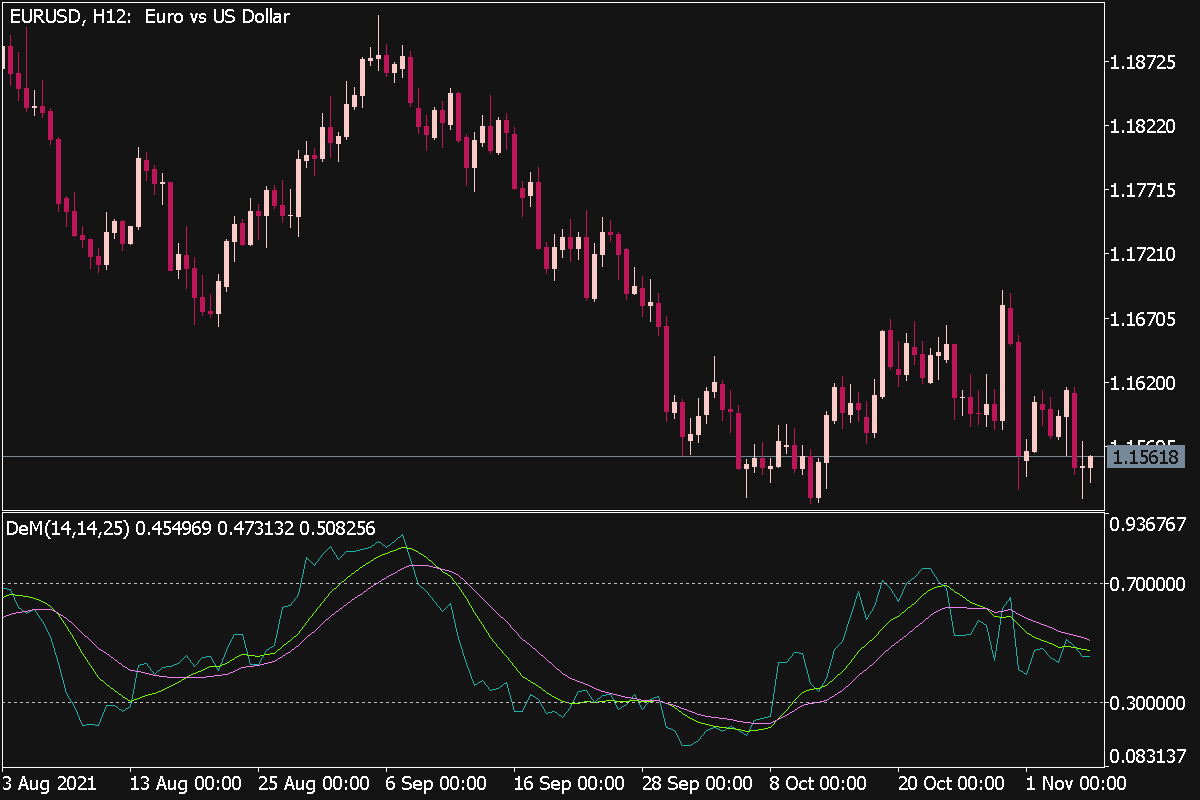

Demarker indicator forex mein ek technical analysis tool hai jo market to momentum and turning points what to identify karne mein madad card hai. Yeh indicator primarily market ke overbought ya oversold conditions ko detect karne ke liye istemal hota hai.

Explanation

Demarker indicator ka naam RSI (Relative Strength Index) ki tarah aata hai, lekin iska focus market ke high aur low points par hota hai. Iska basic market concept ke recent price bars ki closing prices ko comparison karne par tika hota hai.

Indicator Demarker 0 se 1 tak ki range mein hota hai, jisme 0.3 se neeche values ki oversold conditions ko hain jabki cards indicate 0.7 values ki overbought values ko hain cards show. Isme se 0.5 ke as-paas hone wala level critical hota hai aur yeh batata hai ke market mein potential reversal hone wala hai.

Jab Demarker 0.7 indicator se upar chala jata hai, to yeh suggest card hai ke market overbought hai aur selling pressure badh sakti hai. Is the situation mein merchants ko sales opportunities par focus karna chahiye.

Wahi agar indicator Demarker 0.3 se neeche jaata hai, to yeh samjha jata hai ke market oversold hai aur buying pressure badh sakti hai. Is case mein traders ko shopping opportunities par dhyan dena important hota hai.

Significance

Yeh indicator market trends ko bhi identify karne mein madad karta hai. Agar market mein uptrend hai aur Demarker indicator high values keep kar raha hai to suggest card hai ke uptrend strong hai. Vaise hi, downtrend mein low values indicate karte hain ke downtrend strong hai.

Ek important point hai ke traders ko Demarker indicator ke signals ko confirm karne ke liye doosre technical indicators aur price action ka bhi istemal karna chahiye. Har ek indicator ki tarah, Demarker indicator bhi kabhi-kabhi false signals generate kar sakta hai, isliye cautious approach aur risk management ka istemal zaroori hai.

kise he ap sab log me bilkul thek or khariyat see how or is thread me apko Demarker

indicator ke bare me btao ga.

Demarker indicator forex mein ek technical analysis tool hai jo market to momentum and turning points what to identify karne mein madad card hai. Yeh indicator primarily market ke overbought ya oversold conditions ko detect karne ke liye istemal hota hai.

Explanation

Demarker indicator ka naam RSI (Relative Strength Index) ki tarah aata hai, lekin iska focus market ke high aur low points par hota hai. Iska basic market concept ke recent price bars ki closing prices ko comparison karne par tika hota hai.

Indicator Demarker 0 se 1 tak ki range mein hota hai, jisme 0.3 se neeche values ki oversold conditions ko hain jabki cards indicate 0.7 values ki overbought values ko hain cards show. Isme se 0.5 ke as-paas hone wala level critical hota hai aur yeh batata hai ke market mein potential reversal hone wala hai.

Jab Demarker 0.7 indicator se upar chala jata hai, to yeh suggest card hai ke market overbought hai aur selling pressure badh sakti hai. Is the situation mein merchants ko sales opportunities par focus karna chahiye.

Wahi agar indicator Demarker 0.3 se neeche jaata hai, to yeh samjha jata hai ke market oversold hai aur buying pressure badh sakti hai. Is case mein traders ko shopping opportunities par dhyan dena important hota hai.

Significance

Yeh indicator market trends ko bhi identify karne mein madad karta hai. Agar market mein uptrend hai aur Demarker indicator high values keep kar raha hai to suggest card hai ke uptrend strong hai. Vaise hi, downtrend mein low values indicate karte hain ke downtrend strong hai.

Ek important point hai ke traders ko Demarker indicator ke signals ko confirm karne ke liye doosre technical indicators aur price action ka bhi istemal karna chahiye. Har ek indicator ki tarah, Demarker indicator bhi kabhi-kabhi false signals generate kar sakta hai, isliye cautious approach aur risk management ka istemal zaroori hai.

تبصرہ

Расширенный режим Обычный режим