Introduction

Dosto jaisa ke aap jante hain ke moving Average indicator forex market main price ke movement ko analysis karne ka aik famous indicator hay waise to moving Average indicator ke kai tarah se use kya jata hay magar aaj hum jis strategy par discuss karenge us ko moving Average Crossover kaha jata hay ayye detail main janne ke koshish karte hain

Moving Average Crossover kya hota hai?

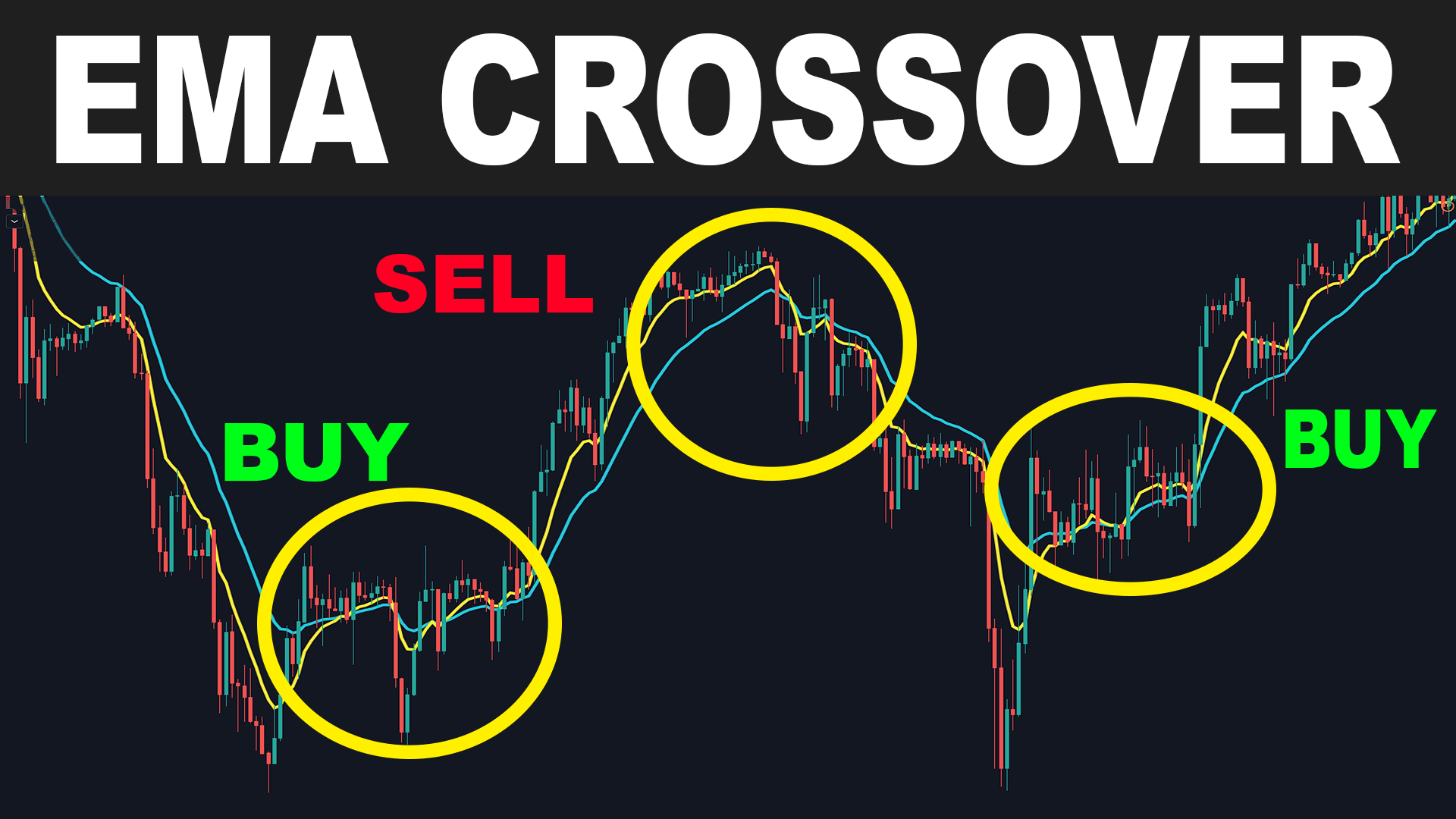

Moving Average Crossover ek technical analysis ka indicator hai jo stock prices ke trend ko identify karne ke liye use kiya jata hai. Yah indicator do moving averages ko use karta hai, jinke different time periods hote hain. Jab ek moving average dusre moving average ke upar se cross karta hai, to ise crossover kaha jata hai.

Moving Average Crossover trading strategy

Moving Average Crossover trading strategy mein, traders stock prices ke trend ko identify karne ke liye moving averages ka use karte hain. Jab ek moving average dusre moving average ke upar se cross karta hai, to traders ise trend change ka signal samjhte hain.

Common Crossover

Yahan kuchh common moving Average Crossover strategyes ke bare main details darj hain

Moving Average Crossover ka use kaise karein?

Moving Average Crossover ka use karne ke liye, aapko pehle apne trading style aur risk tolerance ke hisab se moving averages ki length select karni hogi. Aap short-term, medium-term, ya long-term moving averages ka use kar sakte hain.

Agar aap short-term trading karte hain, to aap short-term moving averages ka use kar sakte hain. Short-term moving averages ka time period 5 days, 10 days, ya 20 days ho sakta hai.Agar aap medium-term trading karte hain, to aap medium-term moving averages ka use kar sakte hain. Medium-term moving averages ka time period 50 days, 100 days, ya 200 days ho sakta hai.

Agar aap long-term trading karte hain, to aap long-term moving averages ka use kar sakte hain. Long-term moving averages ka time period 500 days, 1000 days, ya 2000 days ho sakta hai.Moving Average Crossover ka use karne ke liye, aapko apne trading platform mein moving averages ko add karna hoga. Aap moving averages ki settings kar sakte hain, jaise ki time period, type, aur smoothing.

Moving Average Crossover ki limitations

Moving Average Crossover ek effective trading strategy hai, lekin iski kuchh limitations bhi hain. Moving Average Crossover sirf trend change ka signal provide karta hai. Yah price action ko predict nahi karta hai.Agar aap moving average crossover strategy ka use kar rahe hain, to aapko apne trades ko manage karne ke liye aur indicators ka use karna chahiye.

Conclusion

Moving Average Crossover ek powerful trading tool hai jo traders ko stock prices ke trend ko identify karne mein madad kar sakta hai. Lekin is strategy ka use karne se pehle, aapko iski limitations ko samajhna chahiye.

Dosto jaisa ke aap jante hain ke moving Average indicator forex market main price ke movement ko analysis karne ka aik famous indicator hay waise to moving Average indicator ke kai tarah se use kya jata hay magar aaj hum jis strategy par discuss karenge us ko moving Average Crossover kaha jata hay ayye detail main janne ke koshish karte hain

Moving Average Crossover kya hota hai?

Moving Average Crossover ek technical analysis ka indicator hai jo stock prices ke trend ko identify karne ke liye use kiya jata hai. Yah indicator do moving averages ko use karta hai, jinke different time periods hote hain. Jab ek moving average dusre moving average ke upar se cross karta hai, to ise crossover kaha jata hai.

Moving Average Crossover trading strategy

Moving Average Crossover trading strategy mein, traders stock prices ke trend ko identify karne ke liye moving averages ka use karte hain. Jab ek moving average dusre moving average ke upar se cross karta hai, to traders ise trend change ka signal samjhte hain.

Common Crossover

Yahan kuchh common moving Average Crossover strategyes ke bare main details darj hain

- Long-term moving average crossover strategy: Is strategy mein, traders short-term moving average ko long-term moving average ke sath cross karne ka wait karte hain. Jab short-term moving average long-term moving average ke upar se cross karta hai, to traders long position lete hain.

- Short-term moving average crossover strategy: Is strategy mein, traders long-term moving average ko short-term moving average ke sath cross karne ka wait karte hain. Jab long-term moving average short-term moving average ke niche se cross karta hai, to traders short position lete hain.

Moving Average Crossover ka use kaise karein?

Moving Average Crossover ka use karne ke liye, aapko pehle apne trading style aur risk tolerance ke hisab se moving averages ki length select karni hogi. Aap short-term, medium-term, ya long-term moving averages ka use kar sakte hain.

Agar aap short-term trading karte hain, to aap short-term moving averages ka use kar sakte hain. Short-term moving averages ka time period 5 days, 10 days, ya 20 days ho sakta hai.Agar aap medium-term trading karte hain, to aap medium-term moving averages ka use kar sakte hain. Medium-term moving averages ka time period 50 days, 100 days, ya 200 days ho sakta hai.

Agar aap long-term trading karte hain, to aap long-term moving averages ka use kar sakte hain. Long-term moving averages ka time period 500 days, 1000 days, ya 2000 days ho sakta hai.Moving Average Crossover ka use karne ke liye, aapko apne trading platform mein moving averages ko add karna hoga. Aap moving averages ki settings kar sakte hain, jaise ki time period, type, aur smoothing.

Moving Average Crossover ki limitations

Moving Average Crossover ek effective trading strategy hai, lekin iski kuchh limitations bhi hain. Moving Average Crossover sirf trend change ka signal provide karta hai. Yah price action ko predict nahi karta hai.Agar aap moving average crossover strategy ka use kar rahe hain, to aapko apne trades ko manage karne ke liye aur indicators ka use karna chahiye.

Conclusion

Moving Average Crossover ek powerful trading tool hai jo traders ko stock prices ke trend ko identify karne mein madad kar sakta hai. Lekin is strategy ka use karne se pehle, aapko iski limitations ko samajhna chahiye.

تبصرہ

Расширенный режим Обычный режим