What is pin bar candlestick sample:

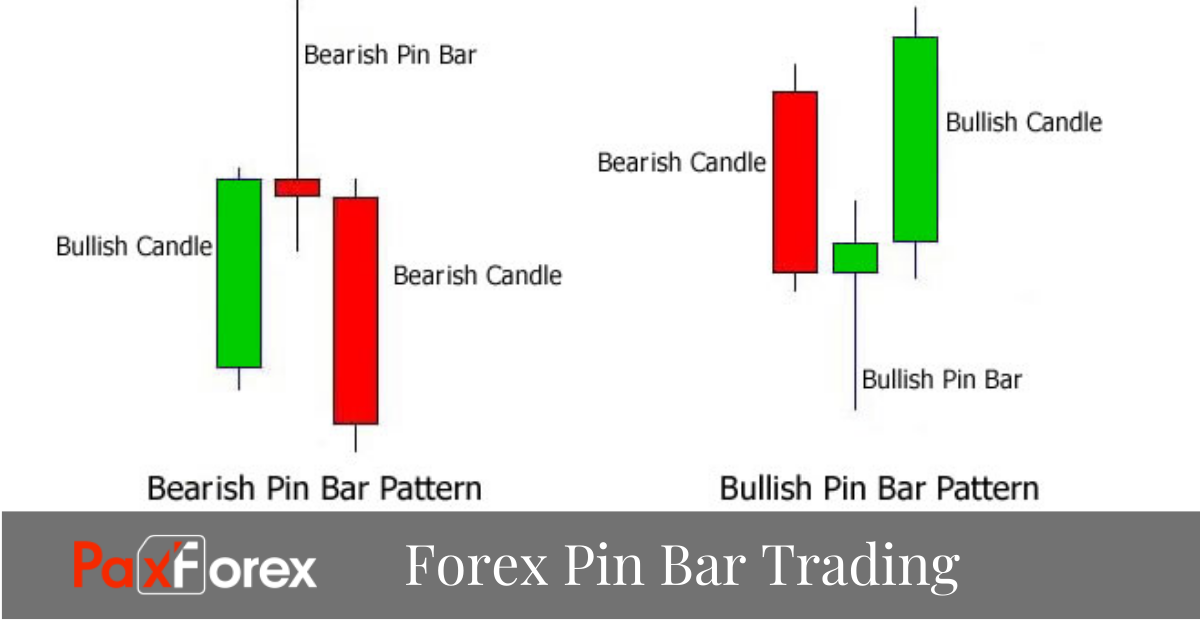

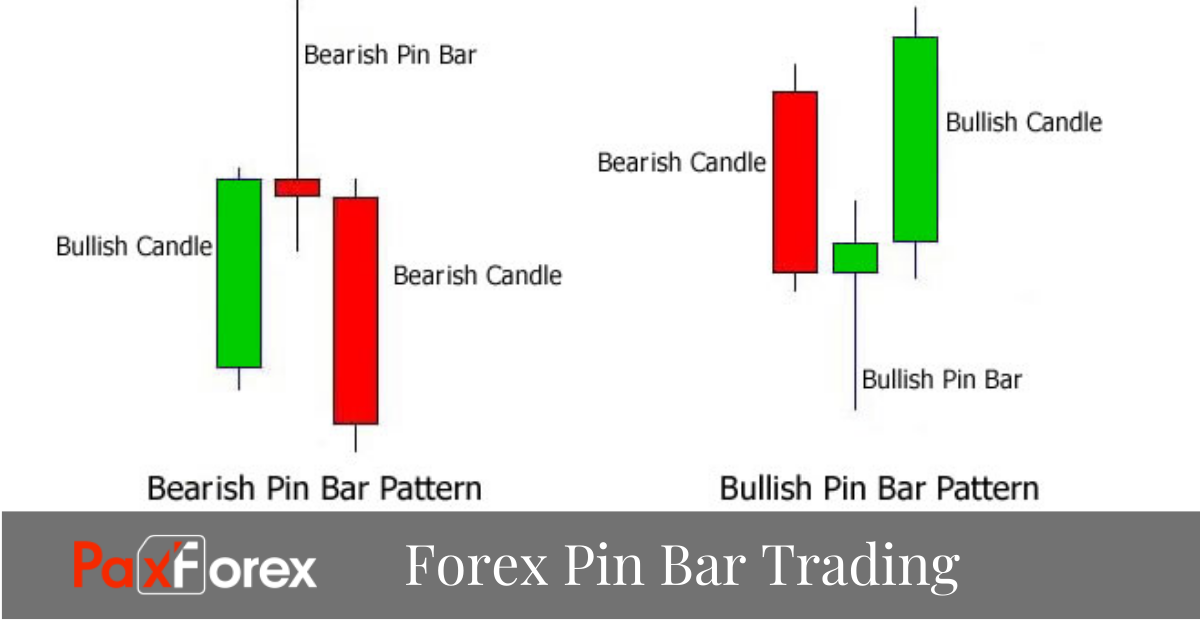

in bar, ya pinocchio bar, ek candlestick sample hai jo maali tajaweez (economic markets) ki technical analysis mein istemal hota hai. Yeh aik candlestick se mutasir hota hai jiska jismah (body) chhota hota hai, matlab kholne aur bandhne ki keemat aapas mein qareeb hoti hai, aur iske sath ek lambhi wick hoti hai, jo ke jismah se bahar (ya to upar ya neeche) nikalti hai. Wick, keemat ko naqisih (reject) karne ko darust karti hai aur isey marketplace mein mukhalif mor par jane ka ishara samjha jata hai.

Pin bar ke key capabilities hain:

1. Chhota Jismah: Kholne aur bandhne ki keemat aapas mein qareeb hoti hai, iska matlab hai ke jismah chhota hota hai.

2. Lambhi Wick: Jismah se bahar nikalne wali lambhi wick, keemat ko naqisih karne ko darust karti hai aur yeh mukhalif mor (reversal) ka ishara ho sakta hai.

Kaise Kaam Karta Hai: Jab market mein pin bar ban jata hai, to yeh investors ko yeh ishara deta hai ke ab market mein mukhalif mor aa sakta hai. Agar pin bar upar ki taraf nikla hai, to yeh suggeset karta hai ke consumers control mein hain aur ab dealers ka zor kamzor ho sakta hai. Upar ki taraf nikli hui lambhi wick, sellers ki koshish ko dikha sakti hai ke woh price ko neeche le jane mein asafal rahe hain.

Neche ki taraf nikli hui pin bar mein, yeh ishara hota hai ke dealers manage mein hain aur ab customers ka zor kamzor ho sakta hai. Iski lambhi wick neche ki taraf, customers ki koshish ko dikha sakti hai ke woh rate ko oopar le jane mein asafal rahe hain.

Trading Strategies: Pin bar ko samajhna aur istemal karna buyers ke liye ahem hai. Kai traders is pattern ko aid aur resistance stages ke sath mila kar istemal karte hain. Agar pin bar ek strong aid level ke bypass banta hai, to yeh ek bullish reversal ka ishara ho sakta hai. Upar ki taraf nikli hui lambhi wick, assist level ko bachane ka indication karta hai.

Vaise hi, agar pin bar ek robust resistance stage ke bypass banta hai, to yeh ek bearish reversal ka ishara ho sakta hai. Neche ki taraf nikli hui lambhi wick, resistance degree ko todne ki koshish ko dikha sakti hai.

Sawalat aur Khud Mukhalif: Pin bar pattern ke istemal mein kuch sawalat aur khud ko mukhalif hone ka tajurba bhi shamil hai. Kuch traders yeh dekhte hain ke market situations aur dusre technical signs ke sath pin bar ka istemal kitna mutabiq hai.

Introduction of the post.

Me umeid karta ho ap sab khareyat say ho gay aj me ap ko Pin Bar candlestick sample forex trading mein istemal hone wala aik bohat asar anda technical analysis device hai jo market developments mein capacity reversals ko pehchanne ke liye istemal hota hai. Ye pattern aik unmarried candle se bana hota hai, jisme lengthy tail ya wick aur chota frame hota hai. Tail better ya decrease fees ki inkar ko constitute karta hai, jisse ability reversal ka pata chalta hai. Candle ka body bullish ya bearish ho sakta hai, lekin sab se ahem baat tail ki length ka frame ke sath mutabiq hoti hay.Bullish pin bar ki long tail body ke neeche hoti hai, jabke bearish pin bar ki long tail frame ke ooper hoti hai. Ye pattern yeh batata hai ke customers ya sellers first of all manipulate mein the, lekin momentum ko sambhalne mein asar nahi kar sake, jisse robust rejection aur potential reversal ka pata chalta hai. Traders pin bars ki talash kartay hain jo key guide ya resistance tiers par hote hain, kyunke ye ability reversal ko aur tasdeeq karte hay.

in bar, ya pinocchio bar, ek candlestick sample hai jo maali tajaweez (economic markets) ki technical analysis mein istemal hota hai. Yeh aik candlestick se mutasir hota hai jiska jismah (body) chhota hota hai, matlab kholne aur bandhne ki keemat aapas mein qareeb hoti hai, aur iske sath ek lambhi wick hoti hai, jo ke jismah se bahar (ya to upar ya neeche) nikalti hai. Wick, keemat ko naqisih (reject) karne ko darust karti hai aur isey marketplace mein mukhalif mor par jane ka ishara samjha jata hai.

Pin bar ke key capabilities hain:

1. Chhota Jismah: Kholne aur bandhne ki keemat aapas mein qareeb hoti hai, iska matlab hai ke jismah chhota hota hai.

2. Lambhi Wick: Jismah se bahar nikalne wali lambhi wick, keemat ko naqisih karne ko darust karti hai aur yeh mukhalif mor (reversal) ka ishara ho sakta hai.

Kaise Kaam Karta Hai: Jab market mein pin bar ban jata hai, to yeh investors ko yeh ishara deta hai ke ab market mein mukhalif mor aa sakta hai. Agar pin bar upar ki taraf nikla hai, to yeh suggeset karta hai ke consumers control mein hain aur ab dealers ka zor kamzor ho sakta hai. Upar ki taraf nikli hui lambhi wick, sellers ki koshish ko dikha sakti hai ke woh price ko neeche le jane mein asafal rahe hain.

Neche ki taraf nikli hui pin bar mein, yeh ishara hota hai ke dealers manage mein hain aur ab customers ka zor kamzor ho sakta hai. Iski lambhi wick neche ki taraf, customers ki koshish ko dikha sakti hai ke woh rate ko oopar le jane mein asafal rahe hain.

Trading Strategies: Pin bar ko samajhna aur istemal karna buyers ke liye ahem hai. Kai traders is pattern ko aid aur resistance stages ke sath mila kar istemal karte hain. Agar pin bar ek strong aid level ke bypass banta hai, to yeh ek bullish reversal ka ishara ho sakta hai. Upar ki taraf nikli hui lambhi wick, assist level ko bachane ka indication karta hai.

Vaise hi, agar pin bar ek robust resistance stage ke bypass banta hai, to yeh ek bearish reversal ka ishara ho sakta hai. Neche ki taraf nikli hui lambhi wick, resistance degree ko todne ki koshish ko dikha sakti hai.

Sawalat aur Khud Mukhalif: Pin bar pattern ke istemal mein kuch sawalat aur khud ko mukhalif hone ka tajurba bhi shamil hai. Kuch traders yeh dekhte hain ke market situations aur dusre technical signs ke sath pin bar ka istemal kitna mutabiq hai.

Introduction of the post.

Me umeid karta ho ap sab khareyat say ho gay aj me ap ko Pin Bar candlestick sample forex trading mein istemal hone wala aik bohat asar anda technical analysis device hai jo market developments mein capacity reversals ko pehchanne ke liye istemal hota hai. Ye pattern aik unmarried candle se bana hota hai, jisme lengthy tail ya wick aur chota frame hota hai. Tail better ya decrease fees ki inkar ko constitute karta hai, jisse ability reversal ka pata chalta hai. Candle ka body bullish ya bearish ho sakta hai, lekin sab se ahem baat tail ki length ka frame ke sath mutabiq hoti hay.Bullish pin bar ki long tail body ke neeche hoti hai, jabke bearish pin bar ki long tail frame ke ooper hoti hai. Ye pattern yeh batata hai ke customers ya sellers first of all manipulate mein the, lekin momentum ko sambhalne mein asar nahi kar sake, jisse robust rejection aur potential reversal ka pata chalta hai. Traders pin bars ki talash kartay hain jo key guide ya resistance tiers par hote hain, kyunke ye ability reversal ko aur tasdeeq karte hay.

تبصرہ

Расширенный режим Обычный режим