Introduction:

Stomach candlestick pattern technical analysis mein aham indicator hai. Iske signals ko samajh kar apki trading strategy ko behtar banaya ja sakta hai.

Stomach Pattern Ko Pehchanay:

Choti body wali candle ko dekhein, jo market ke indecision ko darust karti hai. Ye pattern market mein neutral stance ko darust karti hai.

Stomach Pattern Ki Ahmiyat:

Ye pattern potential reversal ya consolidation ko darust karta hai, jo apko trading decisions mein ehtiyaat baratne ki zaroorat ko barhata hai.

Pattern Ko Tasdeeq Karna:

Stomach pattern ko tasdeeq karne ke liye aas paas ke candles ko analyze karein. Supportive patterns ya trend indicators signal ko majbooti dete hain.

Trading Strategies:

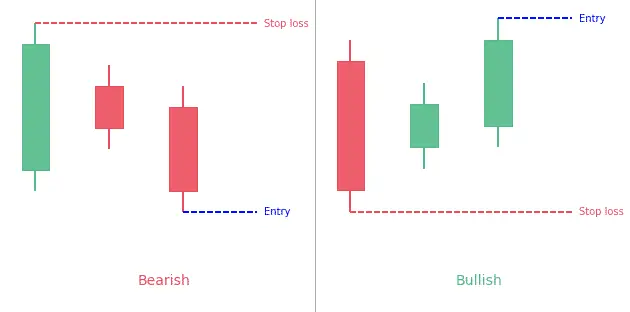

1. Reversal Trading: Stomach pattern ko ek reversal ki tayyari samjhein. Isko doosre reversal signals ke saath jor kar ek mazboot strategy banayein.

2. Consolidation Trading: Jab market trendless ho, Stomach pattern ko istemal karein taake potential consolidation phases ko pehchanein. Established range ke andar trade karein.

3. Risk Management: Stomach pattern ki tasdeeq par based stop-loss orders set karein. Proper position sizing se risk ko manage karein.

Real-time Examples:

Tareekhi charts explore karein aur dekhein ke Stomach pattern ne kaise market movements ko sahi taur par predict kiya.

Backtesting Strategies:

Stomach pattern ko incorporate karke apni trading strategy ko backtest karein, taake iski tareekhi effectiveness ko assess karein.

Continuous Learning:

Market trends par musallat rahein aur Stomach pattern ki samajh ko mazboot karne ke liye mutawazi taur par seekhte rahen.

Conclusion:

Stomach candlestick pattern ko apni trading toolkit mein shamil karna mushkil aur comprehensive approach ki zaroorat hai. Iske nuances ko samajhna apki trading mein kamyabi mein significant madad kar sakta hai.

Stomach candlestick pattern technical analysis mein aham indicator hai. Iske signals ko samajh kar apki trading strategy ko behtar banaya ja sakta hai.

Stomach Pattern Ko Pehchanay:

Choti body wali candle ko dekhein, jo market ke indecision ko darust karti hai. Ye pattern market mein neutral stance ko darust karti hai.

Stomach Pattern Ki Ahmiyat:

Ye pattern potential reversal ya consolidation ko darust karta hai, jo apko trading decisions mein ehtiyaat baratne ki zaroorat ko barhata hai.

Pattern Ko Tasdeeq Karna:

Stomach pattern ko tasdeeq karne ke liye aas paas ke candles ko analyze karein. Supportive patterns ya trend indicators signal ko majbooti dete hain.

Trading Strategies:

1. Reversal Trading: Stomach pattern ko ek reversal ki tayyari samjhein. Isko doosre reversal signals ke saath jor kar ek mazboot strategy banayein.

2. Consolidation Trading: Jab market trendless ho, Stomach pattern ko istemal karein taake potential consolidation phases ko pehchanein. Established range ke andar trade karein.

3. Risk Management: Stomach pattern ki tasdeeq par based stop-loss orders set karein. Proper position sizing se risk ko manage karein.

Real-time Examples:

Tareekhi charts explore karein aur dekhein ke Stomach pattern ne kaise market movements ko sahi taur par predict kiya.

Backtesting Strategies:

Stomach pattern ko incorporate karke apni trading strategy ko backtest karein, taake iski tareekhi effectiveness ko assess karein.

Continuous Learning:

Market trends par musallat rahein aur Stomach pattern ki samajh ko mazboot karne ke liye mutawazi taur par seekhte rahen.

Conclusion:

Stomach candlestick pattern ko apni trading toolkit mein shamil karna mushkil aur comprehensive approach ki zaroorat hai. Iske nuances ko samajhna apki trading mein kamyabi mein significant madad kar sakta hai.

تبصرہ

Расширенный режим Обычный режим