INTRODUCTION

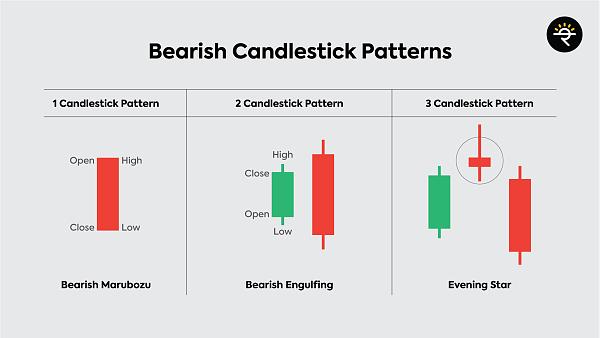

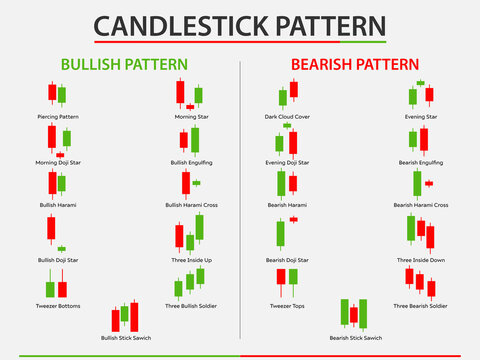

Barish candlestick pattern ek bearish reversal pattern hai jo uptrend ke end per aata hai. Is pattern mein, do candlesticks hoti hain:

Is pattern ki reliability is baat per depend karti hai ki dusri candlestick ki body pahli candlestick ki body ko poori tarah se engulf karti hai. Agar dusri candlestick ki body pahli candlestick ki body ko poori tarah se engulf karti hai, to pattern ko aur bhi reliable mana jata hai.

Barish candlestick pattern ka matlab hai ki buyers ka pressure kam ho raha hai aur sellers ka pressure badh raha hai. Is pattern ke aane ke baad, market mein bearish sentiment badh sakta hai aur prices niche ja sakti hain.

How to trade

Barish candlestick pattern ko trade karne ke liye, aap is pattern ke aane ke baad market mein short position le sakte hain. Aap ek stop loss order set kar sakte hain jo is pattern ke aane ke baad market mein price ke upar ho.

Yahan ek example diya gaya hai barish candlestick pattern ka:

EXAMPLE

Date | Open | High | Low | Close ------- | -------- | -------- | -------- | -------- 2023-07-20 | 100 | 105 | 95 | 102 2023-07-21 | 102 | 103 | 98 | 99

Is example mein, pahli candlestick bullish hai, yani uski body uptrend ke sath hai. Dusri candlestick bearish hai, yani uski body uptrend ke khilaf hai. Dusri candlestick ki body pahli candlestick ki body ko poori tarah se engulf karti hai. Isliye, yah barish candlestick pattern hai.

Barish candlestick pattern ek powerful bearish reversal pattern hai. Is pattern ko trade karne ke liye, aapko market mein bearish sentiment ke liye tayyar hona chahiye.

CONCLUSION

Ummid karta Hun ki aapko barish candle stick pattern ki samajh a Gai Hogi is topic ko gaur se padhe Taki aapko trading Karne ka tarika samajh a sake aur aapke knowledge mein izaafa ho sake..

Barish candlestick pattern ek bearish reversal pattern hai jo uptrend ke end per aata hai. Is pattern mein, do candlesticks hoti hain:

- Pahli candlestick bullish hoti hai, yani uski body uptrend ke sath hoti hai.

- Dusri candlestick bearish hoti hai, yani uski body uptrend ke khilaf hoti hai.

Is pattern ki reliability is baat per depend karti hai ki dusri candlestick ki body pahli candlestick ki body ko poori tarah se engulf karti hai. Agar dusri candlestick ki body pahli candlestick ki body ko poori tarah se engulf karti hai, to pattern ko aur bhi reliable mana jata hai.

Barish candlestick pattern ka matlab hai ki buyers ka pressure kam ho raha hai aur sellers ka pressure badh raha hai. Is pattern ke aane ke baad, market mein bearish sentiment badh sakta hai aur prices niche ja sakti hain.

How to trade

Barish candlestick pattern ko trade karne ke liye, aap is pattern ke aane ke baad market mein short position le sakte hain. Aap ek stop loss order set kar sakte hain jo is pattern ke aane ke baad market mein price ke upar ho.

Yahan ek example diya gaya hai barish candlestick pattern ka:

EXAMPLE

Date | Open | High | Low | Close ------- | -------- | -------- | -------- | -------- 2023-07-20 | 100 | 105 | 95 | 102 2023-07-21 | 102 | 103 | 98 | 99

Is example mein, pahli candlestick bullish hai, yani uski body uptrend ke sath hai. Dusri candlestick bearish hai, yani uski body uptrend ke khilaf hai. Dusri candlestick ki body pahli candlestick ki body ko poori tarah se engulf karti hai. Isliye, yah barish candlestick pattern hai.

Barish candlestick pattern ek powerful bearish reversal pattern hai. Is pattern ko trade karne ke liye, aapko market mein bearish sentiment ke liye tayyar hona chahiye.

CONCLUSION

Ummid karta Hun ki aapko barish candle stick pattern ki samajh a Gai Hogi is topic ko gaur se padhe Taki aapko trading Karne ka tarika samajh a sake aur aapke knowledge mein izaafa ho sake..

تبصرہ

Расширенный режим Обычный режим