TRIANGLE CHART IN FOREX:-

Triangle chart pattern ek technical analysis tool hai jo financial markets mein istemal hoti hai. Yeh pattern market ke price movements ko analyze karne mein madad karta hai. Triangle chart pattern ek consolidation phase ko darust karta hai jab market mein uncertainty hoti hai aur traders confuse hote hain ke market ka trend kis direction mein ja raha hai.

Triangle chart pattern doosre chart patterns ki tarah hota hai, lekin isme price ke movements ko ek triangle shape mein represent kiya jata hai. Isme typically price ek specific range mein move karta hai, aur jab yeh range chhota hota hai, to triangle formation hoti hai. Is pattern ki wazahat ke liye aam taur par teen prakar ke triangles istemal hote hain:

TRIANGLE CHART KI BUNIYAAD IN FOREX :-

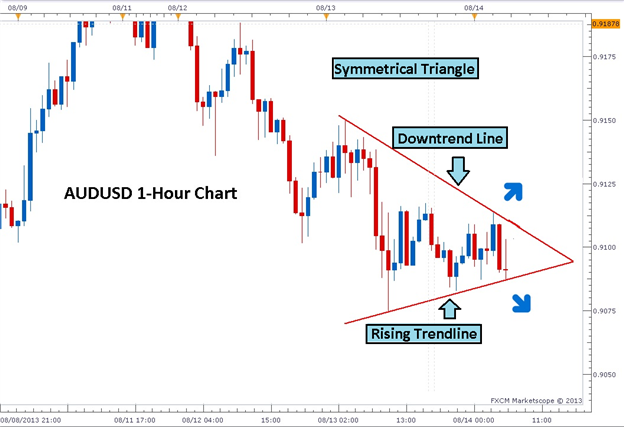

- Symmetrical Triangle (Hamwar Musallas):

- Isme price higher highs aur lower lows banata hai, lekin overall range tighten hoti hai.

- Traders ko is pattern mein breakout ka wait karna padta hai, jab price triangle ke borders se bahar nikal jata hai.

- Agar breakout upper side hota hai, toh yeh bullish signal deta hai, jabki agar lower side hota hai, toh yeh bearish signal hota hai.

- Ascending Triangle (Bartari Musallas):

- Isme price higher lows banata hai lekin highs constant rehte hain.

- Yeh pattern bullish hota hai, aur breakout jab upper side hota hai, toh traders ko buy ki taraf le ja sakta hai.

- Descending Triangle (Kam Hone Wala Musallas):

- Isme price lower highs banata hai lekin lows constant rehte hain.

- Yeh pattern bearish hota hai, aur breakout jab lower side hota hai, toh traders ko sell ki taraf le ja sakta hai.

Triangle chart pattern ki wazahat karne mein, traders ko breakout point ka wait karna chahiye. Breakout ke baad, market mein strong movement hoti hai, jo ki traders ke liye trading opportunities create karta hai. Lekin yaad rahe, chart patterns ke istemal mein hamesha risk management ko mad e nazar rakhein aur dusre technical indicators ke sath istemal karein.

تبصرہ

Расширенный режим Обычный режим