INTRODUCTION

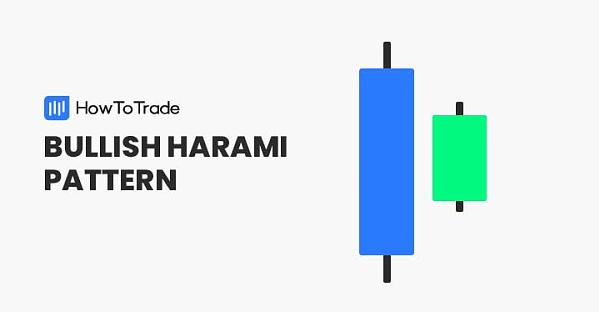

Bulish harami candlestick pattern ek technical analysis indicator hai jo ek bearish trend ke reversal ko signal karta hai. Yah pattern ek long bearish candle aur uske baad ek small bullish candle se banta hai.

Bulish harami pattern ke liye kuchh important conditions hain:

. First candle ek bearish candle honi chahiye.

. Second candle ek bullish candle honi chahiye.

. Second candle ki body first candle ki body ke andar honi chahiye.

Second candle ki shadow first candle ki shadow se choti honi chahiye.

Yahan ek example diya gaya hai:

```

Day 1 | Open | High | Low | Close

---|---|---|---|---|

1 | 100 | 105 | 95 | 100

2 | 100 | 102 | 98 | 101

```

Yeh pattern ek bullish reversal ka signal deta hai. Is pattern ko dekhkar trader ko lagta hai ki bearish trend ka end ho raha hai aur bullish trend shuru ho raha hai.

Bulish harami pattern ko trade karne ke liye kuchh strategies hain:

* Ek strategy ye hai ki second candle ke close ke baad market ki price ko follow karna. Agar price second candle ke high ko break karti hai to trader long position le sakta hai.

* Ek aur strategy ye hai ki second candle ke close ke baad market ki price ko ek specific level tak follow karna. Agar price us level ko break karti hai to trader long position le sakta hai.

Bulish harami pattern ek reliable pattern hai lekin ise trade karne se pehle kuchh important factors ko consider karna chahiye. Jaise ki, market ka trend, pattern ki strength, aur other technical indicators.

Conclusion

Dear friends aaj humne aapko jis pattern ke bare mein bataya hai vah bahut hi informative lecture raha hai ummid karte Hain ki aapko hamara lecture Pasand aaya hoga

Bulish harami candlestick pattern ek technical analysis indicator hai jo ek bearish trend ke reversal ko signal karta hai. Yah pattern ek long bearish candle aur uske baad ek small bullish candle se banta hai.

Bulish harami pattern ke liye kuchh important conditions hain:

. First candle ek bearish candle honi chahiye.

. Second candle ek bullish candle honi chahiye.

. Second candle ki body first candle ki body ke andar honi chahiye.

Second candle ki shadow first candle ki shadow se choti honi chahiye.

Yahan ek example diya gaya hai:

```

Day 1 | Open | High | Low | Close

---|---|---|---|---|

1 | 100 | 105 | 95 | 100

2 | 100 | 102 | 98 | 101

```

Yeh pattern ek bullish reversal ka signal deta hai. Is pattern ko dekhkar trader ko lagta hai ki bearish trend ka end ho raha hai aur bullish trend shuru ho raha hai.

Bulish harami pattern ko trade karne ke liye kuchh strategies hain:

* Ek strategy ye hai ki second candle ke close ke baad market ki price ko follow karna. Agar price second candle ke high ko break karti hai to trader long position le sakta hai.

* Ek aur strategy ye hai ki second candle ke close ke baad market ki price ko ek specific level tak follow karna. Agar price us level ko break karti hai to trader long position le sakta hai.

Bulish harami pattern ek reliable pattern hai lekin ise trade karne se pehle kuchh important factors ko consider karna chahiye. Jaise ki, market ka trend, pattern ki strength, aur other technical indicators.

Conclusion

Dear friends aaj humne aapko jis pattern ke bare mein bataya hai vah bahut hi informative lecture raha hai ummid karte Hain ki aapko hamara lecture Pasand aaya hoga

تبصرہ

Расширенный режим Обычный режим