Wedge Chart Pattern:

Wedge chart pattern ek technical analysis pattern ha jo aapko samjha raha ha jab kisi financial instrument ki price, jaise ki forex market me currency pair, ek slope wali trend line kedarmiyan ek consolidation phase ma hoti ha. Isma ek line support level aur doosri line resistance level ko represent karti ha. Ise wedge kehte ha kyunki trendlines ek tiha tarah ka shape banate ha, jiske ant tak narrow hoti ha. Ye pattern market ma consolidation ya phir nirnay na karne ki avastha ko darshata ha, jissey aksar kisi mahatvapurna breakout ki peshakash hoti ha.

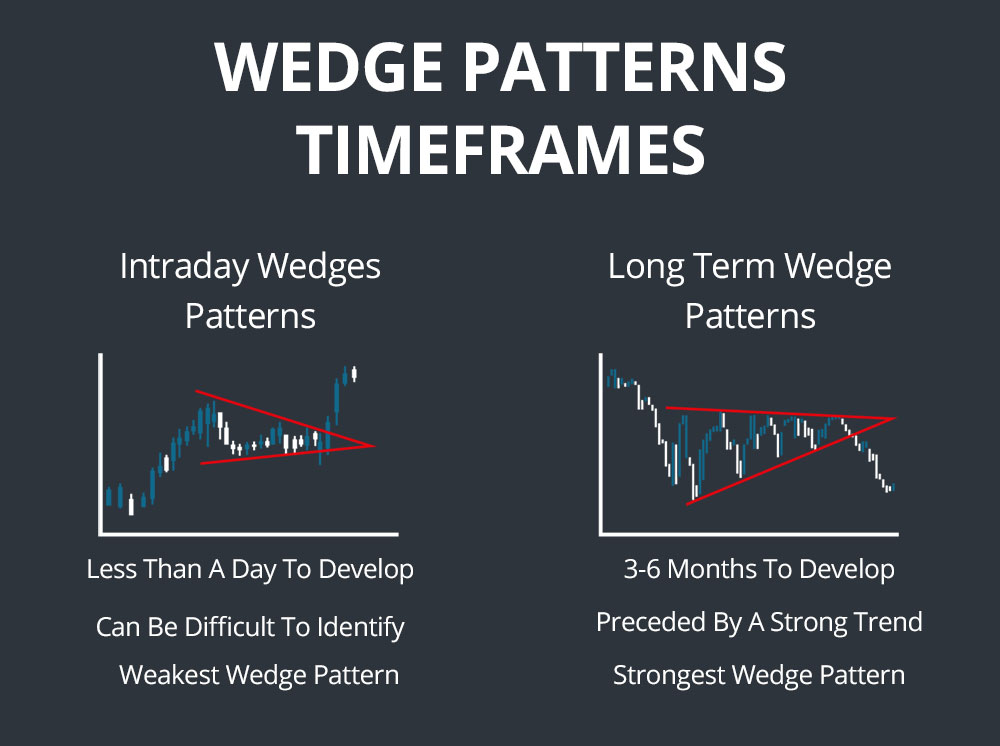

Wedge Chart Pattern ke Types:

Is hisse ma, hum traders ke dwara paaye jaa sakte ha wedge chart pattern ke alag alag prakar ma pravesh karte ha. Yahaan do mukhya prakar hote ha: badhti hui wedge aur ghatte hui wedge. Ek badhti hui wedge tab hoti ha jab support line ki slope resistance line se jyaada tej hoti ha, jissey yeh darshaata ha ki bullish momentum kam hota ha. Vipreet rup se, ek ghatte hue wedge tab hoti ha jab resistance line ki slope support line se jyaada tej hoti ha, jissey yeh sanket karta ha ki bearish momentum kam ho raha ha. Inn prakaron ko samajhna mahatvapurna ha upcoming breakout ki sambhavna ki disha ki pahchaan ke liye.

Wedge Chart Pattern ki Characteristics:

Is hisse ma hum trader ko Dhyaan dene ki chunori prastut karne waale wedge chart pattern ki mukhya visheshataaon par tika kar rahe ha. Pehle toh, milte jhulte trendlines sahi roop se define hone chahiye aur har trendline ko kam se kam do sthaanon tak touch karna chahiye. Issey pattern ki मान्यता सुनिश्चित hoti ha. Dusri baat, wedge ki formation ke dauran volume dhire-dhire ghatna chahiye. Kam volume market ki gatividhi ma kami ko darshata ha aur consolidation phase ko siddh karta ha. Ant ma, wedge pattern se breakout am taur par volume ma vriddhi ke saath hota ha, jissey market sentiment ma majboot parivartan hota ha.

Wedge Chart Pattern ke liye Trading Strategies:

Yahaan, traders alag alag trading strategies sikhenge jo wedge chart pattern ki pahchaan karne par upyog ki jaa sakti ha. Ek lokpriya approach ha ki wedge ka breakout ka intezaar karein aur breakout ki disha ma trade ma pravesh karein. For example, agar price resistance line se breakout kare, toh trader long ja sakta ha, aur aage ki bullish momentum ki ummeed karein. Ek aur strategy ha ki stop order ko resistance line ke upar ya support line ke neeche rakhe, jahaan breakout ki disha ki ummeed karein. Ye trader ko potential price moves ko capture karne ma madad karta ha aur risk ko sahi tarike se handle karne ma sahayak ha.

Wedge Chart Pattern aur Doosre Chart Patterns ka Sath:

Is hisse ma, hum forex trading ma wedge chart pattern ko doosre am taur par istemaal kiye jaane wale chart patterns se tulna karte ha. Jabki wedge patterns aur triangles aur channels ma kuch similarities hote ha, lekin unka alag alag visheshataayein hoti ha. Wedge patterns ki avadharana tend lines ke bich kam samay tak hoti ha aur ye aksar continuation patterns ke roop ma maana jaata ha, jisse mool trend ki pehle se chale aane se pehle ek samayik rookh darshaata ha. Vipareet rup se, triangles lambi avadharana ke hote ha aur ye continuation aur reversal patterns dono ko signal kar sakte ha. Channels, jo parallel trendlines se bane hote ha, am taur par sthapit trends ki pahcha

Wedge chart pattern ek technical analysis pattern ha jo aapko samjha raha ha jab kisi financial instrument ki price, jaise ki forex market me currency pair, ek slope wali trend line kedarmiyan ek consolidation phase ma hoti ha. Isma ek line support level aur doosri line resistance level ko represent karti ha. Ise wedge kehte ha kyunki trendlines ek tiha tarah ka shape banate ha, jiske ant tak narrow hoti ha. Ye pattern market ma consolidation ya phir nirnay na karne ki avastha ko darshata ha, jissey aksar kisi mahatvapurna breakout ki peshakash hoti ha.

Wedge Chart Pattern ke Types:

Is hisse ma, hum traders ke dwara paaye jaa sakte ha wedge chart pattern ke alag alag prakar ma pravesh karte ha. Yahaan do mukhya prakar hote ha: badhti hui wedge aur ghatte hui wedge. Ek badhti hui wedge tab hoti ha jab support line ki slope resistance line se jyaada tej hoti ha, jissey yeh darshaata ha ki bullish momentum kam hota ha. Vipreet rup se, ek ghatte hue wedge tab hoti ha jab resistance line ki slope support line se jyaada tej hoti ha, jissey yeh sanket karta ha ki bearish momentum kam ho raha ha. Inn prakaron ko samajhna mahatvapurna ha upcoming breakout ki sambhavna ki disha ki pahchaan ke liye.

Wedge Chart Pattern ki Characteristics:

Is hisse ma hum trader ko Dhyaan dene ki chunori prastut karne waale wedge chart pattern ki mukhya visheshataaon par tika kar rahe ha. Pehle toh, milte jhulte trendlines sahi roop se define hone chahiye aur har trendline ko kam se kam do sthaanon tak touch karna chahiye. Issey pattern ki मान्यता सुनिश्चित hoti ha. Dusri baat, wedge ki formation ke dauran volume dhire-dhire ghatna chahiye. Kam volume market ki gatividhi ma kami ko darshata ha aur consolidation phase ko siddh karta ha. Ant ma, wedge pattern se breakout am taur par volume ma vriddhi ke saath hota ha, jissey market sentiment ma majboot parivartan hota ha.

Wedge Chart Pattern ke liye Trading Strategies:

Yahaan, traders alag alag trading strategies sikhenge jo wedge chart pattern ki pahchaan karne par upyog ki jaa sakti ha. Ek lokpriya approach ha ki wedge ka breakout ka intezaar karein aur breakout ki disha ma trade ma pravesh karein. For example, agar price resistance line se breakout kare, toh trader long ja sakta ha, aur aage ki bullish momentum ki ummeed karein. Ek aur strategy ha ki stop order ko resistance line ke upar ya support line ke neeche rakhe, jahaan breakout ki disha ki ummeed karein. Ye trader ko potential price moves ko capture karne ma madad karta ha aur risk ko sahi tarike se handle karne ma sahayak ha.

Wedge Chart Pattern aur Doosre Chart Patterns ka Sath:

Is hisse ma, hum forex trading ma wedge chart pattern ko doosre am taur par istemaal kiye jaane wale chart patterns se tulna karte ha. Jabki wedge patterns aur triangles aur channels ma kuch similarities hote ha, lekin unka alag alag visheshataayein hoti ha. Wedge patterns ki avadharana tend lines ke bich kam samay tak hoti ha aur ye aksar continuation patterns ke roop ma maana jaata ha, jisse mool trend ki pehle se chale aane se pehle ek samayik rookh darshaata ha. Vipareet rup se, triangles lambi avadharana ke hote ha aur ye continuation aur reversal patterns dono ko signal kar sakte ha. Channels, jo parallel trendlines se bane hote ha, am taur par sthapit trends ki pahcha

تبصرہ

Расширенный режим Обычный режим