Piercing Line Candlestick Pattern

"Piercing Line Candlestick Pattern" ek technical analysis tool hai jo market trends ko samajhne mein aur price reversals ko identify karne mein madad karta hai. Yeh pattern bearish trend ke bad hone wale possible reversal ko darust karna mein istemal hota hai. Piercing Line Candlestick Pattern mein do candlesticks shamil hote hain.

Yahan kuch key points hain Piercing Line Candlestick Pattern ke bare mein:

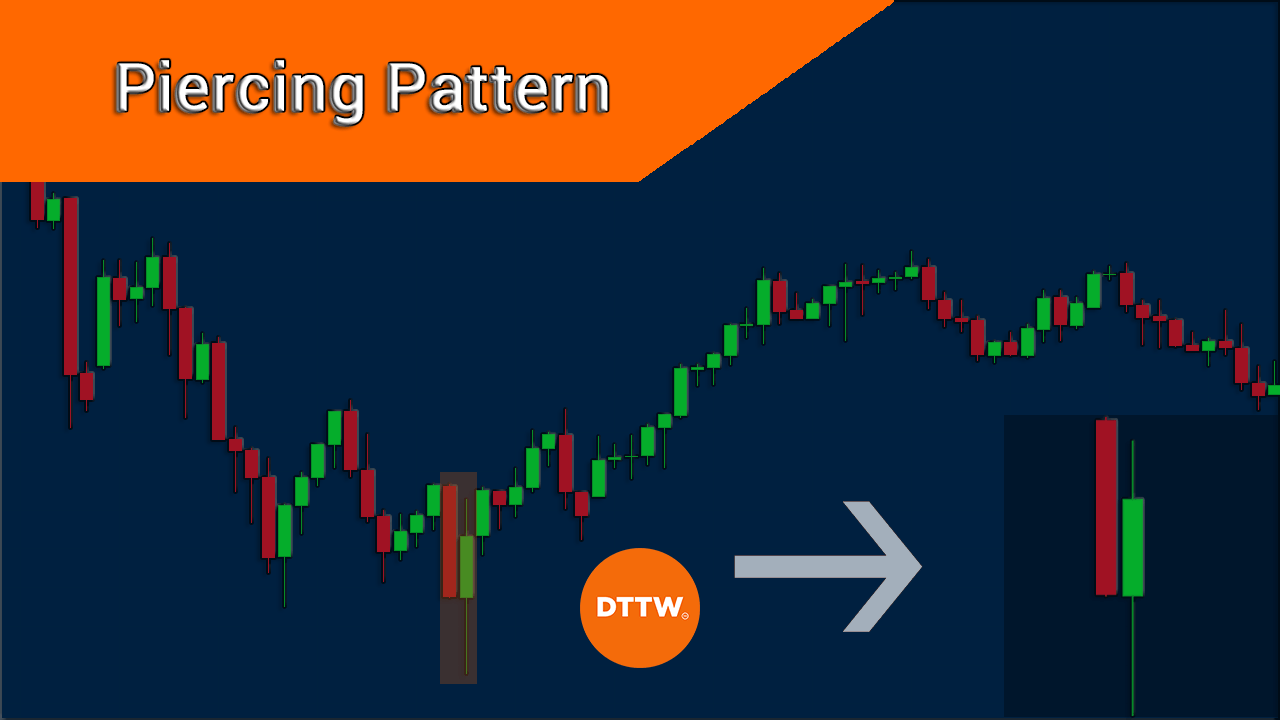

- Pehla Candlestick (Bearish): Pehla candlestick downward (girawat) trend ko represent karta hai. Ismein market down ja rahi hoti hai.

- Dusra Candlestick (Bullish): Dusra candlestick pehle wale bearish candlestick ke neeche open hota hai lekin phir upward move karta hai aur pehle candlestick ke adhe se zyada area ko cover karta hai. Iski body pehle candlestick ki body ko penetrate karta hai.

Piercing Line Candlestick Pattern, market mein bearish trend ke baad hone wale possible bullish reversal ko signal karta hai. Ye traders ko indicate karta hai ke bearish pressure kamzor ho sakti hai aur bullish momentum barh sakta hai.

Hamesha yaad rahe ke, candlestick patterns ke istemal mein doosre technical indicators aur market conditions ka bhi khayal rakhna zaroori hai. Trading decisions lene se pehle, confirmatory signals aur risk management ka bhi khayal rakha jana chahiye.

Piercing Line Candlestick Pattern" ke saath trading karte waqt, kuch zaroori points hain jo traders ko yaad rakhna chahiye:

Confirmation Ke Liye Wait Karein: Piercing Line pattern ke signals ko confirm karne ke liye traders ko intezaar karna chahiye. Doosre technical indicators aur price action signals ke saath ise combine karein.

Volume Analysis: Volume analysis bhi karein. Agar piercing line ke saath high volume hoti hai, toh pattern ka asar zyada hota hai.

Entry, Stop-Loss, aur Take-Profit Levels Set Karein: Entry point set karte waqt, stop-loss aur take-profit levels ko bhi set karna important hai. Risk management ka dhyan rakhein.

Trend Confirmation: Piercing line pattern ke appearance se pehle, overall trend ko bhi confirm karein. Agar market overall trend ke against move kar raha hai, toh pattern ka asar kam ho sakta hai.

Piercing Line vs. Dark Cloud Cover: Piercing Line bullish reversal ko darust karta hai, jabki Dark Cloud Cover (bearish reversal pattern) downtrend ke baad aata hai. Dono patterns mein do candlesticks hote hain, lekin unke shapes aur market interpretation mein farq hota hai.

Note: Piercing Line pattern ke istemal mein prudent approach aur risk management ka dhyan rakhein. Market conditions aur doosre technical factors ko bhi analyze karein pattern ke signals ko confirm karne ke liye.

تبصرہ

Расширенный режим Обычный режим