Lot Size Ki Tafseel:

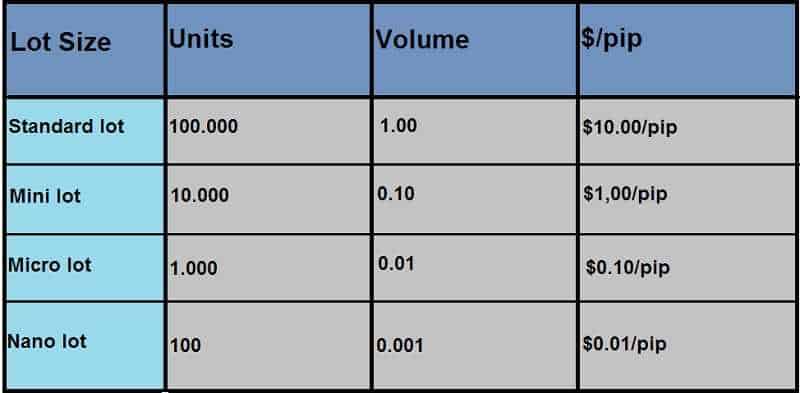

Lot size, forex trading mein istemal hone wali aik measurement hai jo darust trading position ka andaza lagane mein madadgar hoti hai. Har trade ke liye ek specific lot size tay karna zaruri hai, aur ye trading account ki maaliyat aur risk tolerance par mabni hoti hai.

Kya Hai Lot Size:

Lot size ko samajhna ahem hai, kyun ke ye tijarat mein mojood maaliyat ka aik aham hissa hai. Lot size woh maqdar hoti hai jo aap currency pair ki trading mein istemaal karna chahte hain.

Lot Size Calculation Formula:

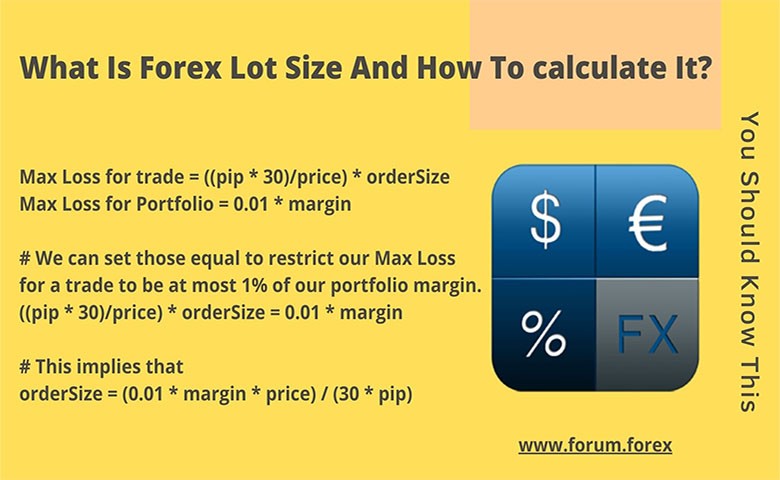

Lot size ka tayyun karnay ka aik aham formula hota hai:

\[ \text{Lot Size} = \frac{\text{Account Equity} \times \text{Risk Percentage}}{\text{Stop Loss in Pips} \times \text{Pip Value}} \]

Is formula ke zariye traders apne account ki maaliyat, risk percentage, stop loss aur pip value ka hisaab laga kar apne liye sahi lot size tay kar sakte hain.

Risk Management aur Lot Size:

Lot size ka sahi tayyun karna risk management ka aham hissa hai. Sahi risk percentage aur stop loss ke saath, traders apne nuksan ko control mein rakh sakte hain.

Lot Size aur Leverage Ka Taalluq:

Leverage istemal kar ke traders apne trading ki purchasing power ko barha sakte hain. Lekin, zyada leverage istemal karne se lot size bhi barh jata hai, jo ke ziada risk ko bhi darust karta hai.

Conclusion:

Lot size calculation forex trading mein ek ahem tool hai jo traders ko apne risk ko manage karne mein madadgar hota hai. Sahi lot size ka tayyun karke, traders apni tijarat ko behtar taur par chala sakte hain aur nuksan se bach sakte hain.

Lot size, forex trading mein istemal hone wali aik measurement hai jo darust trading position ka andaza lagane mein madadgar hoti hai. Har trade ke liye ek specific lot size tay karna zaruri hai, aur ye trading account ki maaliyat aur risk tolerance par mabni hoti hai.

Kya Hai Lot Size:

Lot size ko samajhna ahem hai, kyun ke ye tijarat mein mojood maaliyat ka aik aham hissa hai. Lot size woh maqdar hoti hai jo aap currency pair ki trading mein istemaal karna chahte hain.

Lot Size Calculation Formula:

Lot size ka tayyun karnay ka aik aham formula hota hai:

\[ \text{Lot Size} = \frac{\text{Account Equity} \times \text{Risk Percentage}}{\text{Stop Loss in Pips} \times \text{Pip Value}} \]

Is formula ke zariye traders apne account ki maaliyat, risk percentage, stop loss aur pip value ka hisaab laga kar apne liye sahi lot size tay kar sakte hain.

Risk Management aur Lot Size:

Lot size ka sahi tayyun karna risk management ka aham hissa hai. Sahi risk percentage aur stop loss ke saath, traders apne nuksan ko control mein rakh sakte hain.

Lot Size aur Leverage Ka Taalluq:

Leverage istemal kar ke traders apne trading ki purchasing power ko barha sakte hain. Lekin, zyada leverage istemal karne se lot size bhi barh jata hai, jo ke ziada risk ko bhi darust karta hai.

Conclusion:

Lot size calculation forex trading mein ek ahem tool hai jo traders ko apne risk ko manage karne mein madadgar hota hai. Sahi lot size ka tayyun karke, traders apni tijarat ko behtar taur par chala sakte hain aur nuksan se bach sakte hain.

:max_bytes(150000):strip_icc()/dotdash_Final_Standard_Lot_Apr_2020-01-133fbce6dddf4c5fbe6be4fb72e0c734.jpg)

تبصرہ

Расширенный режим Обычный режим