Support aur Resistance Ke Forex Trading Mein Ahmiyat"

Introduction: Forex trading, ya foreign exchange trading, aik aise field hai jahan currencies ki trading hoti hai. Is field mein traders ko market trends ka bharosa rehna bohot zaroori hai. Yeh trends ko samajhne mein 'Support' aur 'Resistance' do ahem tools hote hain. Yeh tools traders ko market movement mein madad dete hain aur unhein sahi decisions lene mein help karte hain.

Support aur Resistance Ki Tafseelat:

Support aur Resistance, dono hi market analysis ke do mukhtalif pehlu hain. In dono ko samajhna traders ke liye zaroori hai takay woh market ke future predictions kar sakein aur apne trades ko better taur par manage kar sakein.

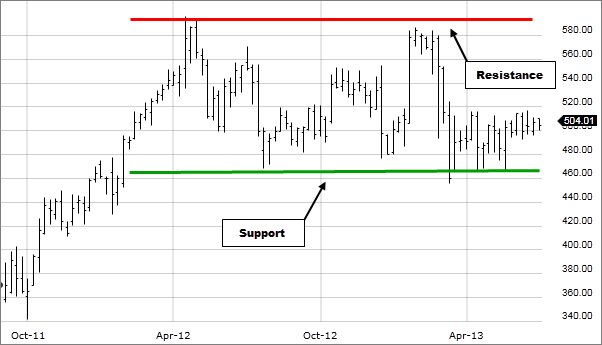

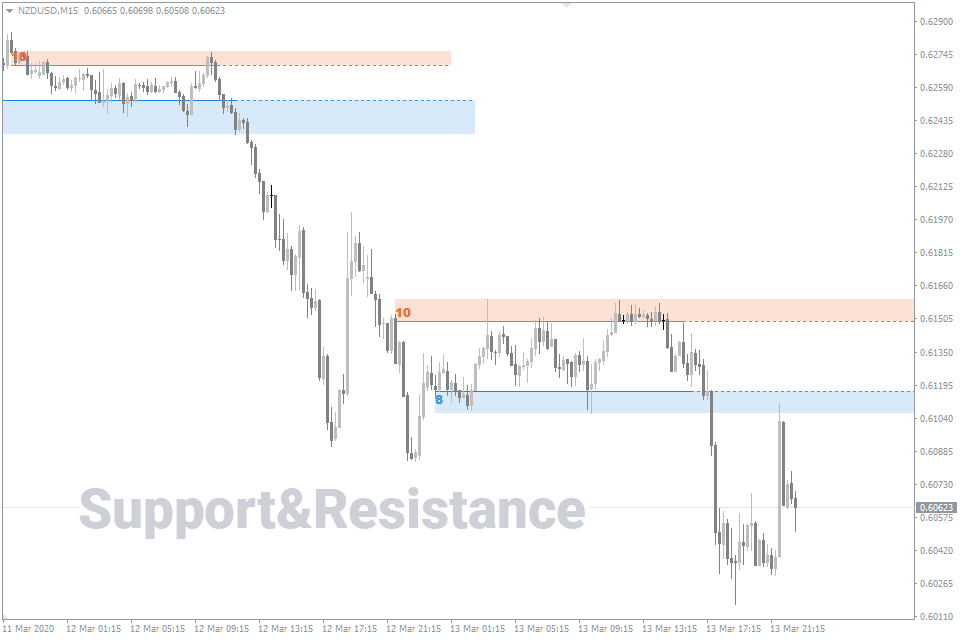

- Support (Sahara): Support level woh price level hota hai jahan se currency ya kisi aur asset ki keemat girne ke baad rok kar phir se upar uthne ka imkaan hota hai. Is level par traders ko lagta hai ke market is level ko accept karna shuru kar degi aur wahan se trend reversal ho sakta hai.

Jab kisi currency ka price support level tak pohanchta hai, to traders isay ek buying opportunity samajhte hain. Yeh unka belief hota hai ke price wahan se phir se upar ja sakta hai. Support levels ko identify karne ke liye traders historical price data aur technical analysis ka istemal karte hain.

- Resistance (Rukawat): Resistance level woh price level hota hai jahan se currency ya asset ki keemat barh kar rukti hai, aur phir wahan se girne ka imkaan hota hai. Traders ko lagta hai ke market is level ko cross nahi kar payegi aur wahan se price downward move karne ka chance hai.

Resistance levels ko identify karke traders selling opportunities dhundhte hain, kyun ke woh ummeed karte hain ke price wahan se neeche jaayegi. Technical analysis mein, traders charts aur indicators ka istemal karte hain takay woh resistance levels ko sahi taur par recognize kar sakein.

Conclusion: Support aur Resistance levels forex trading mein ahem tools hain jo traders ko market ke dynamics ko samajhne mein madad karte hain. In levels ko samajh kar traders apne trading strategies ko behtar bana sakte hain aur apne trades ko sahi taur par manage kar sakte hain. Yeh ahem hai ke traders apne knowledge ko barqarar rakhen aur market analysis mein istemal karte waqt sabr aur tahqiqat ka istemal karen, takay unki trading mehnat ka behtar phal mile

:max_bytes(150000):strip_icc()/support-and-resistance-1-572b74e33df78c038efe0b14.jpg)

تبصرہ

Расширенный режим Обычный режим