Definition;

Risk management, Roman Urdu mein "Khatra Manzament" kehlata hai, ek tajaweezi aur tanazurati amal hai jo kisi tijarat ya karobar, ya kisi aur shobay mein, nuqsaan ka dar kam karne aur faiday ko barqarar rakhne ke liye istemal hota hai. Yeh ek maqsood-oriented process hai jo mukhtalif imkanaat aur mushkilat ko pehchanne, qadmon ko daalne aur unka tasawwur karta hai.

Explanation

Khatra manzament ka maqsad mukhtalif qisam ke khatrat ko pehchan kar unka asar kam karna hai, tijarat ya karobar ko nuqsaan se bachane ke liye. Isme tajaweezat aur intizamat shamil hote hain jinhe taqatwar aur mustehkam banane ke liye istemal kiya jata hai.

Yeh tijarat ya karobar ki zaruraton, maqsadon, aur muddaton ko samajhne par mabni hota hai, taaki aane wale khatrat ka sahi taur par inhesar kiya ja sake. Khatra manzament, achaar dalil aur shayariyon ka istemal karta hai taa ke nuqsaan se bachne ke liye behtar intizamat kiye ja sakein.

Significance

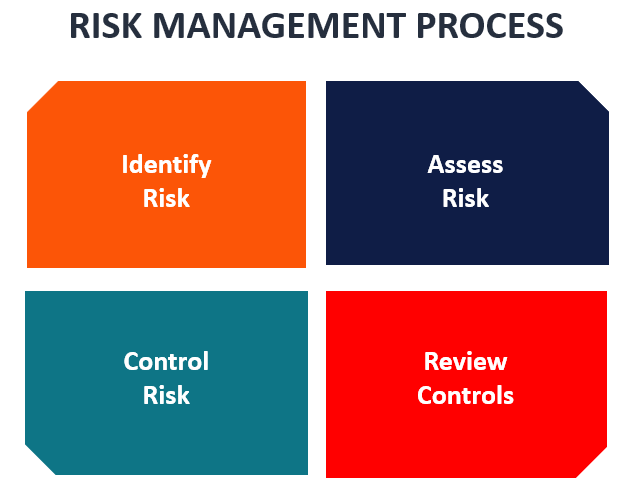

Isme do main hisse shamil hote hain: pehle, khatra ki tashkhees, jisme tajaweezat banai jati hain aur khatraat ko pehchanne ka maqamal jahan kiya jata hai. Dusra, khatra ka mawazna aur tasawwur, jisme tajaweezat aur intizamat ka faisla kiya jata hai.

Khatra manzament ek moaser tareeqa hai jo asal halat ko madde nazar rakhte hue apne maqasid ko paane mein madad karta hai. Yeh tijarat ya karobar mein hone wale tabdiliyon ka asar bhi shamil karta hai aur tajaweezat ko barqarar rakhne mein madad karta hai.

Yeh ek mustehkam aur ba aasani tareeqa hai jise tijarat aur karobar mein tajaweezat aur khatrat ka behtar inzar kiya ja sakta hai, aur nuqsaan se bachne mein madad karta hai.

Risk management, Roman Urdu mein "Khatra Manzament" kehlata hai, ek tajaweezi aur tanazurati amal hai jo kisi tijarat ya karobar, ya kisi aur shobay mein, nuqsaan ka dar kam karne aur faiday ko barqarar rakhne ke liye istemal hota hai. Yeh ek maqsood-oriented process hai jo mukhtalif imkanaat aur mushkilat ko pehchanne, qadmon ko daalne aur unka tasawwur karta hai.

Explanation

Khatra manzament ka maqsad mukhtalif qisam ke khatrat ko pehchan kar unka asar kam karna hai, tijarat ya karobar ko nuqsaan se bachane ke liye. Isme tajaweezat aur intizamat shamil hote hain jinhe taqatwar aur mustehkam banane ke liye istemal kiya jata hai.

Yeh tijarat ya karobar ki zaruraton, maqsadon, aur muddaton ko samajhne par mabni hota hai, taaki aane wale khatrat ka sahi taur par inhesar kiya ja sake. Khatra manzament, achaar dalil aur shayariyon ka istemal karta hai taa ke nuqsaan se bachne ke liye behtar intizamat kiye ja sakein.

Significance

Isme do main hisse shamil hote hain: pehle, khatra ki tashkhees, jisme tajaweezat banai jati hain aur khatraat ko pehchanne ka maqamal jahan kiya jata hai. Dusra, khatra ka mawazna aur tasawwur, jisme tajaweezat aur intizamat ka faisla kiya jata hai.

Khatra manzament ek moaser tareeqa hai jo asal halat ko madde nazar rakhte hue apne maqasid ko paane mein madad karta hai. Yeh tijarat ya karobar mein hone wale tabdiliyon ka asar bhi shamil karta hai aur tajaweezat ko barqarar rakhne mein madad karta hai.

Yeh ek mustehkam aur ba aasani tareeqa hai jise tijarat aur karobar mein tajaweezat aur khatrat ka behtar inzar kiya ja sakta hai, aur nuqsaan se bachne mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим