Flag Pattern Kya Hota Hai?

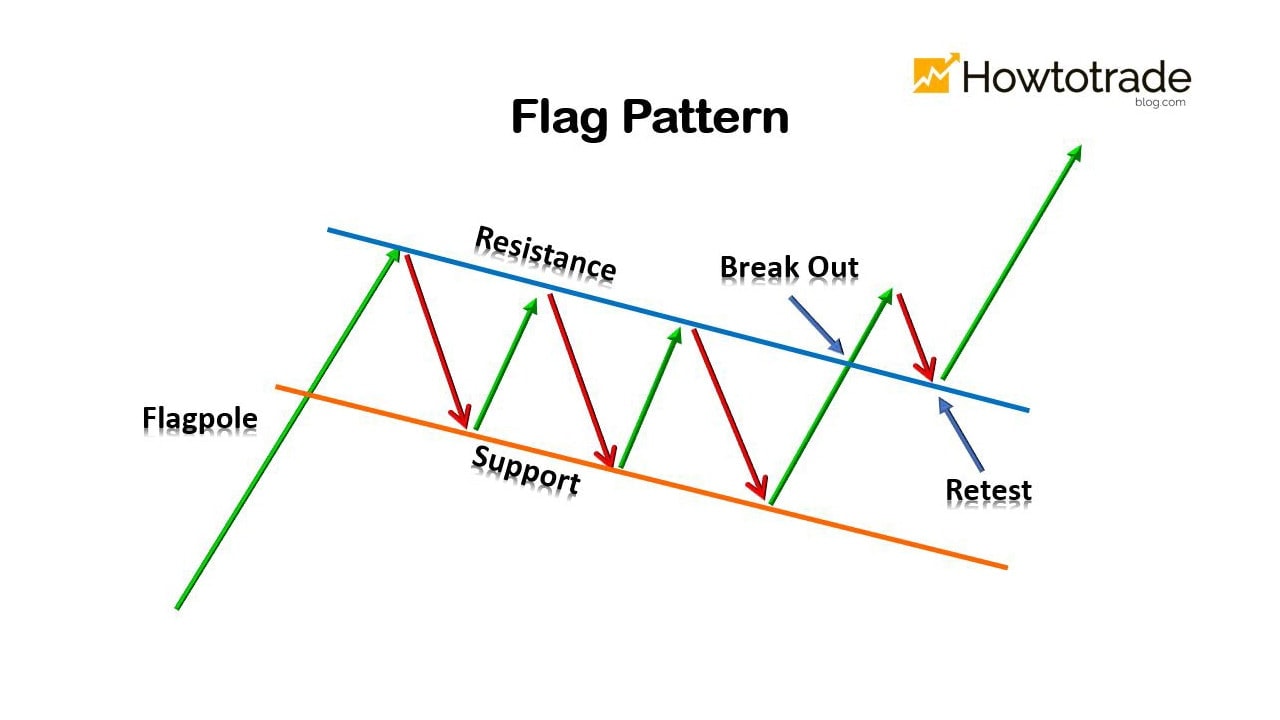

Flag pattern ek rectangle-shaped formation hoti hai, jise flag ke comparison mein liya jata hai. Is pattern mein ek strong trending move ke baad price mein short-term consolidation hoti hai aur phir ek rectangle ya parallelogram shape ka pattern banta hai.

Flag Pattern Ki Key Characteristics:

Strong Trending Move:

Flag pattern ka formation ek strong trending move ke baad hota hai, jo indicate karta hai ke market mein initially high momentum tha.

Consolidation:

Flag pattern mein price mein short-term consolidation hoti hai, jisme price range-bound hota hai.

Parallel Lines:

Pattern ke formation mein price ek rectangle ya parallelogram ke beech mein move karta hai, jisme parallel trendlines draw kiye ja sakte hain.

Flag Pattern Ka Formation:

Pole:

Flag pattern ka formation shuru hota hai ek vertical pole ke saath, jo strong trending move ko represent karta hai.

Consolidation:

Iske baad, price mein consolidation hoti hai aur rectangle ya parallelogram shape ka pattern ban jata hai.

Flag Pattern Ka Interpretation:

Continuation Signal:

Flag pattern continuation signal deta hai, indicating ke previous trend continue hone ka potential hai.

Market Psychology:

Flag pattern market psychology ko reflect karta hai, jisme initial trend ke participants consolidate karte hain, lekin phir se market mein interest bana rehta hai.

Flag Pattern Ka Trading Strategy:

Entry Points:

Traders flag pattern ke breakout ke baad entry points tay karte hain. Agar breakout upside direction mein hota hai, toh traders long positions le sakte hain, aur agar downside direction mein hota hai, toh short positions le sakte hain.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategically place karna important hai taki traders apne positions ko protect kar sakein.

Take-profit levels ko pattern ke height ya support/resistance levels ke basis par tay kiya ja sakta hai.

Flag Pattern Ka Dhyan Rakhein:

Volume Analysis:

Flag pattern ke breakout ke samay volume analysis important hai. Agar breakout volume ke saath hota hai, toh pattern ka reliability badh jata hai.

False Breakouts:

Kabhi-kabhi market choppy conditions mein false breakouts bhi ho sakte hain, isliye confirmatory factors ka istemal zaroori hai.

Flag pattern ek rectangle-shaped formation hoti hai, jise flag ke comparison mein liya jata hai. Is pattern mein ek strong trending move ke baad price mein short-term consolidation hoti hai aur phir ek rectangle ya parallelogram shape ka pattern banta hai.

Flag Pattern Ki Key Characteristics:

Strong Trending Move:

Flag pattern ka formation ek strong trending move ke baad hota hai, jo indicate karta hai ke market mein initially high momentum tha.

Consolidation:

Flag pattern mein price mein short-term consolidation hoti hai, jisme price range-bound hota hai.

Parallel Lines:

Pattern ke formation mein price ek rectangle ya parallelogram ke beech mein move karta hai, jisme parallel trendlines draw kiye ja sakte hain.

Flag Pattern Ka Formation:

Pole:

Flag pattern ka formation shuru hota hai ek vertical pole ke saath, jo strong trending move ko represent karta hai.

Consolidation:

Iske baad, price mein consolidation hoti hai aur rectangle ya parallelogram shape ka pattern ban jata hai.

Flag Pattern Ka Interpretation:

Continuation Signal:

Flag pattern continuation signal deta hai, indicating ke previous trend continue hone ka potential hai.

Market Psychology:

Flag pattern market psychology ko reflect karta hai, jisme initial trend ke participants consolidate karte hain, lekin phir se market mein interest bana rehta hai.

Flag Pattern Ka Trading Strategy:

Entry Points:

Traders flag pattern ke breakout ke baad entry points tay karte hain. Agar breakout upside direction mein hota hai, toh traders long positions le sakte hain, aur agar downside direction mein hota hai, toh short positions le sakte hain.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategically place karna important hai taki traders apne positions ko protect kar sakein.

Take-profit levels ko pattern ke height ya support/resistance levels ke basis par tay kiya ja sakta hai.

Flag Pattern Ka Dhyan Rakhein:

Volume Analysis:

Flag pattern ke breakout ke samay volume analysis important hai. Agar breakout volume ke saath hota hai, toh pattern ka reliability badh jata hai.

False Breakouts:

Kabhi-kabhi market choppy conditions mein false breakouts bhi ho sakte hain, isliye confirmatory factors ka istemal zaroori hai.

تبصرہ

Расширенный режим Обычный режим