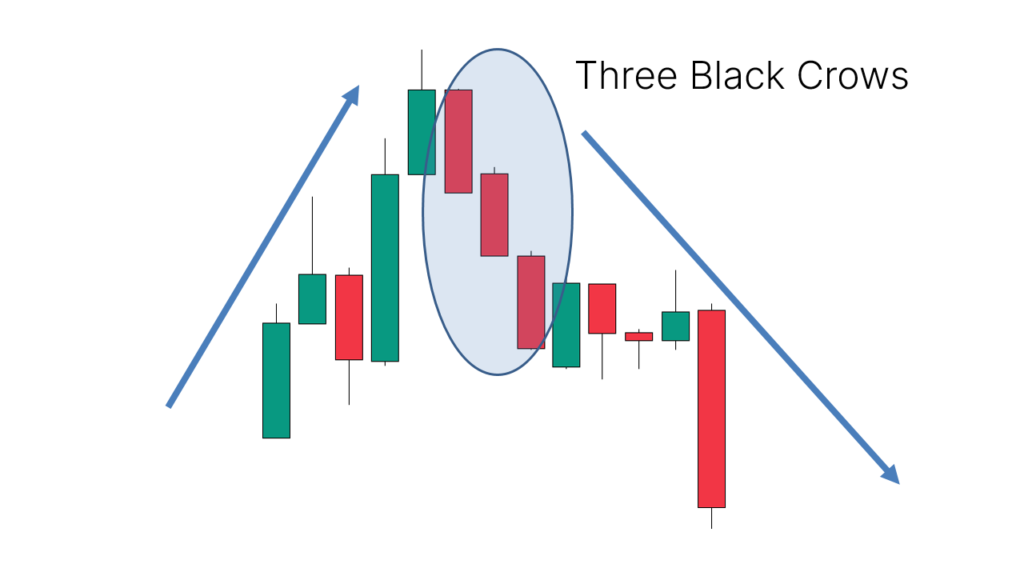

"Three Black Crows" candlestick pattern, forex trading mein ek bearish reversal pattern hai jo market trends ke context mein price movements ko indicate karta hai. Is pattern ka formation jab hota hai, toh yeh signal deta hai ke bullish trend ke baad bearish reversal hone ka potential hai.

Three Black Crows Pattern Kya Hota Hai?

Three Black Crows pattern ka formation jab market mein uptrend ke baad hota hai. Is pattern mein consecutive three bearish candles ka formation hota hai, jisme har ek candle close previous candle ke below hota hai. Yeh pattern ek strong bearish momentum ko represent karta hai.

Three Black Crows Pattern Ki Key Characteristics:

Consecutive Three Bearish Candles:

Three Black Crows pattern mein teen consecutive bearish candles hote hain, jinke closing prices ek dusre ke below hote hain.

Downward Movement:

Har ek candle ke open price previous candle ke close ke neeche hota hai, indicating a continuous downward movement.

Volume Increase:

Is pattern ke formation ke doran volume increase ho sakta hai, indicating ke market mein selling pressure badh rahi hai.

Three Black Crows Pattern Ka Interpretation:

Bearish Reversal Signal:

Three Black Crows pattern bearish reversal signal deta hai, indicating ke market sentiment mein bearish shift hone ka potential hai.

Market Psychology:

Pattern ka formation market psychology ko reflect karta hai, jisme buyers initially control mein the, lekin fir se sellers ka dominance aa gaya hai.

Three Black Crows Pattern Ka Trading Strategy:

Confirmation:

Traders Three Black Crows pattern ko confirm karne ke liye doosre technical indicators jaise ke support levels, resistance levels, ya doosre candlestick patterns ka istemal karte hain.

Entry Points:

Traders is pattern ke formation ke baad short positions le sakte hain, lekin confirmatory factors ke sath.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategically place karna important hai taki traders apne positions ko protect kar sakein.

Take-profit levels ko support levels, trendlines, ya pattern ke height ke basis par tay kiya ja sakta hai.

Three Black Crows Pattern Ka Dhyan Rakhein:

False Signals:

Kabhi-kabhi choppy markets mein ya low liquidity ke doran false signals bhi generate ho sakte hain, isliye confirmatory factors ka istemal zaroori hai.

Market Conditions:

Overall market conditions ko bhi dhyan mein rakhna important hai. Agar market choppy hai ya range-bound hai, toh pattern ka impact kam ho sakta hai.

Three Black Crows Pattern Kya Hota Hai?

Three Black Crows pattern ka formation jab market mein uptrend ke baad hota hai. Is pattern mein consecutive three bearish candles ka formation hota hai, jisme har ek candle close previous candle ke below hota hai. Yeh pattern ek strong bearish momentum ko represent karta hai.

Three Black Crows Pattern Ki Key Characteristics:

Consecutive Three Bearish Candles:

Three Black Crows pattern mein teen consecutive bearish candles hote hain, jinke closing prices ek dusre ke below hote hain.

Downward Movement:

Har ek candle ke open price previous candle ke close ke neeche hota hai, indicating a continuous downward movement.

Volume Increase:

Is pattern ke formation ke doran volume increase ho sakta hai, indicating ke market mein selling pressure badh rahi hai.

Three Black Crows Pattern Ka Interpretation:

Bearish Reversal Signal:

Three Black Crows pattern bearish reversal signal deta hai, indicating ke market sentiment mein bearish shift hone ka potential hai.

Market Psychology:

Pattern ka formation market psychology ko reflect karta hai, jisme buyers initially control mein the, lekin fir se sellers ka dominance aa gaya hai.

Three Black Crows Pattern Ka Trading Strategy:

Confirmation:

Traders Three Black Crows pattern ko confirm karne ke liye doosre technical indicators jaise ke support levels, resistance levels, ya doosre candlestick patterns ka istemal karte hain.

Entry Points:

Traders is pattern ke formation ke baad short positions le sakte hain, lekin confirmatory factors ke sath.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategically place karna important hai taki traders apne positions ko protect kar sakein.

Take-profit levels ko support levels, trendlines, ya pattern ke height ke basis par tay kiya ja sakta hai.

Three Black Crows Pattern Ka Dhyan Rakhein:

False Signals:

Kabhi-kabhi choppy markets mein ya low liquidity ke doran false signals bhi generate ho sakte hain, isliye confirmatory factors ka istemal zaroori hai.

Market Conditions:

Overall market conditions ko bhi dhyan mein rakhna important hai. Agar market choppy hai ya range-bound hai, toh pattern ka impact kam ho sakta hai.

:max_bytes(150000):strip_icc():format(webp)/The5MostPowerfulCandlestickPatterns3-f3b280e0165a4b2fa5e5d3b42b36e337.png)

تبصرہ

Расширенный режим Обычный режим