"Hanging Man" candlestick pattern, forex trading mein ek reversal pattern hai jo bearish trend ke indication ke liye istemal hota hai. Yeh pattern market mein price ke dynamics aur sentiment ko analyze karta hai, especially jab market mein bullish trend ke baad price ka reversal hone ka potential hota hai.

Hanging Man Candlestick Pattern Kya Hota Hai?

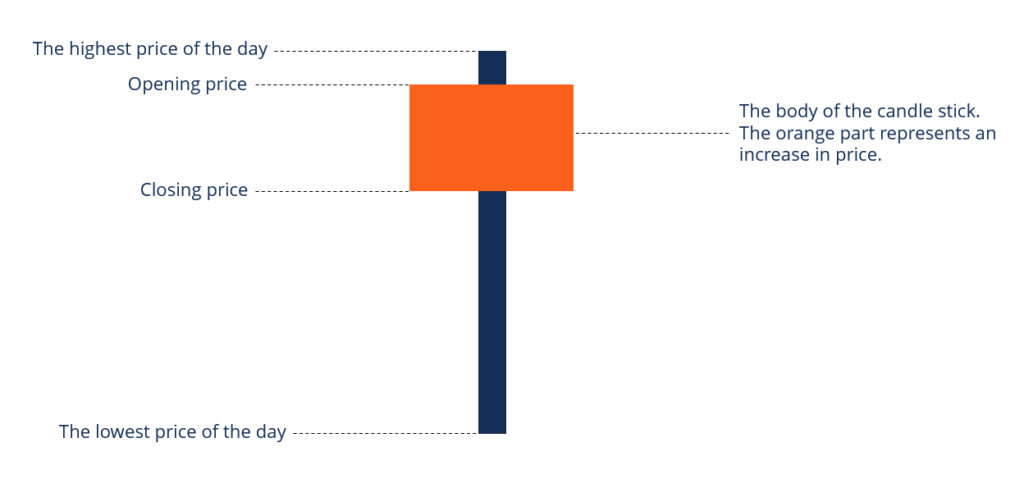

Hanging Man pattern ka formation ek single candle par based hota hai. Is candle mein price initially high open hoti hai, phir during the trading session price mein decline hoti hai, lekin by the end of the session, price wapas near the opening level ya slightly below close hoti hai. Is candlestick ko "Hanging Man" kehte hain kyun ki iska appearance ek small body ke sath ek long lower shadow ko resemble karta hai, jaise ki ek hanging man ke feet ki tarah. Hanging Man Pattern Ki Key Characteristics:

Small Body:

Hanging Man pattern ka main characteristic hota hai ke iski body choti hoti hai. Body ke size se indicate hota hai ke opening aur closing prices kafi close hote hain.

Long Lower Shadow:

Hanging Man candle ke neeche ek lambi shadow hoti hai, jo indicate karti hai ke price session ke low point tak gaya, lekin phir wapas upar aaya.

Hanging Man Pattern Ka Interpretation: Bearish Reversal Signal:

Hanging Man pattern bearish reversal signal deta hai, especially jab iska formation uptrend ke baad hota hai. Yeh pattern indicate karta hai ke buyers initially control mein the, lekin phir sellers ne comeback kiya hai.

Market Psychology:

Hanging Man candle market psychology ko reflect karta hai, jisme buyers ke initial strength ke baad sellers ka control badh gaya hai.

Hanging Man Pattern Ka Trading Strategy: Confirmation:

Traders Hanging Man pattern ko confirm karne ke liye doosre technical indicators jaise ke support levels, resistance levels, ya doosre candlestick patterns ka istemal karte hain. Entry Points: Hanging Man pattern ke baad traders short positions le sakte hain, lekin confirmatory factors ke sath.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategically place karna important hai taki traders apne positions ko protect kar sakein. Take-profit levels ko support levels, trendlines, ya pattern ke height ke basis par tay kiya ja sakta hai.

Hanging Man Pattern Ka Dhyan Rakhein: False Signals:

Kabhi-kabhi choppy markets mein ya low liquidity ke doran false signals bhi generate ho sakte hain, isliye confirmatory factors ka istemal zaroori hai.

Market Conditions:

Overall market conditions ko bhi dhyan mein rakhna important hai. Agar market choppy hai ya range-bound hai, toh pattern ka impact kam ho sakta hai.

Conclusion:

Hanging Man pattern, forex trading mein bearish reversal points ko identify karne mein madad karta hai. Iska sahi istemal karke, traders apne trading decisions ko refine kar sakte hain. Hamesha dhyan rahe ke ek single pattern par bharosa karke trading decisions lene se pehle, market context, confirmatory indicators, aur risk management ko bhi madde nazar rakha jaye.

Hanging Man Candlestick Pattern Kya Hota Hai?

Hanging Man pattern ka formation ek single candle par based hota hai. Is candle mein price initially high open hoti hai, phir during the trading session price mein decline hoti hai, lekin by the end of the session, price wapas near the opening level ya slightly below close hoti hai. Is candlestick ko "Hanging Man" kehte hain kyun ki iska appearance ek small body ke sath ek long lower shadow ko resemble karta hai, jaise ki ek hanging man ke feet ki tarah. Hanging Man Pattern Ki Key Characteristics:

Small Body:

Hanging Man pattern ka main characteristic hota hai ke iski body choti hoti hai. Body ke size se indicate hota hai ke opening aur closing prices kafi close hote hain.

Long Lower Shadow:

Hanging Man candle ke neeche ek lambi shadow hoti hai, jo indicate karti hai ke price session ke low point tak gaya, lekin phir wapas upar aaya.

Hanging Man Pattern Ka Interpretation: Bearish Reversal Signal:

Hanging Man pattern bearish reversal signal deta hai, especially jab iska formation uptrend ke baad hota hai. Yeh pattern indicate karta hai ke buyers initially control mein the, lekin phir sellers ne comeback kiya hai.

Market Psychology:

Hanging Man candle market psychology ko reflect karta hai, jisme buyers ke initial strength ke baad sellers ka control badh gaya hai.

Hanging Man Pattern Ka Trading Strategy: Confirmation:

Traders Hanging Man pattern ko confirm karne ke liye doosre technical indicators jaise ke support levels, resistance levels, ya doosre candlestick patterns ka istemal karte hain. Entry Points: Hanging Man pattern ke baad traders short positions le sakte hain, lekin confirmatory factors ke sath.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategically place karna important hai taki traders apne positions ko protect kar sakein. Take-profit levels ko support levels, trendlines, ya pattern ke height ke basis par tay kiya ja sakta hai.

Hanging Man Pattern Ka Dhyan Rakhein: False Signals:

Kabhi-kabhi choppy markets mein ya low liquidity ke doran false signals bhi generate ho sakte hain, isliye confirmatory factors ka istemal zaroori hai.

Market Conditions:

Overall market conditions ko bhi dhyan mein rakhna important hai. Agar market choppy hai ya range-bound hai, toh pattern ka impact kam ho sakta hai.

Conclusion:

Hanging Man pattern, forex trading mein bearish reversal points ko identify karne mein madad karta hai. Iska sahi istemal karke, traders apne trading decisions ko refine kar sakte hain. Hamesha dhyan rahe ke ek single pattern par bharosa karke trading decisions lene se pehle, market context, confirmatory indicators, aur risk management ko bhi madde nazar rakha jaye.

تبصرہ

Расширенный режим Обычный режим