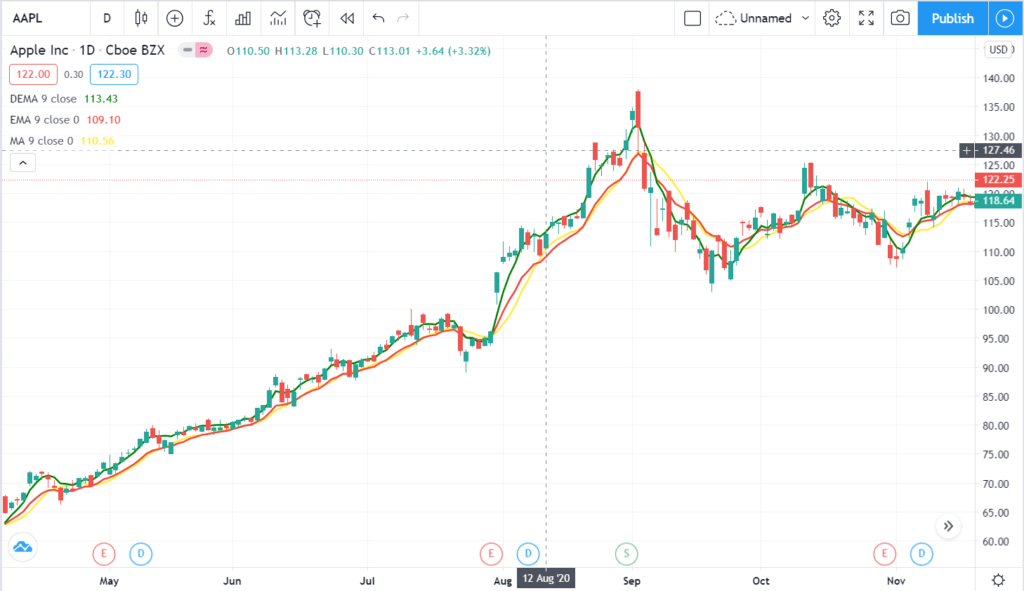

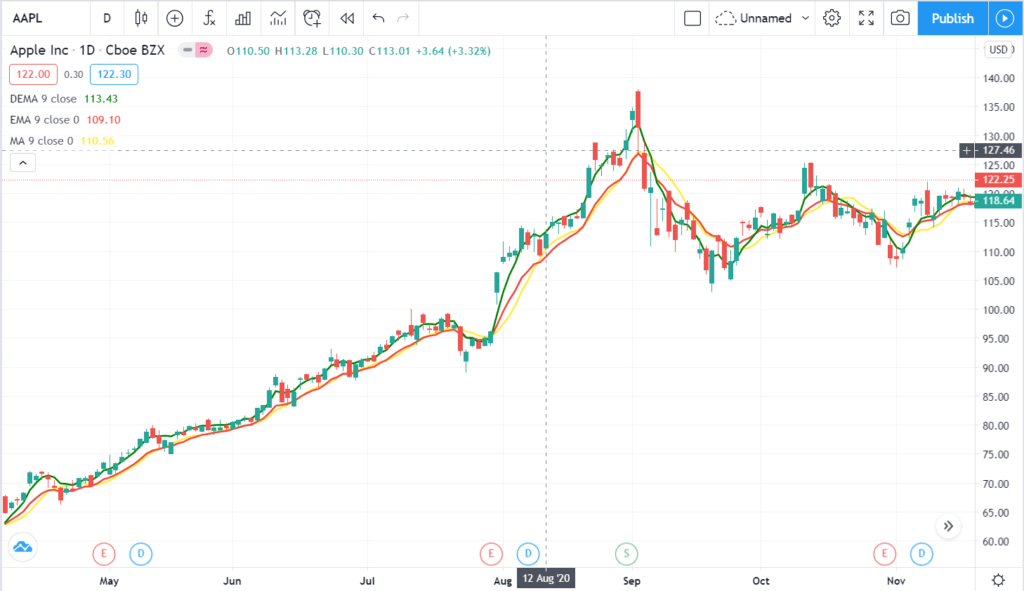

Forex trading technical analysis ne trends, patterns aur dakhli aur nikali jagahon ko pehchanne mein ahem kirdar ada karna shuru kiya hai. Tijarat karne walon mein se ek popular indicator hai moving average , jo keemati data ko smoothen karne mein madad karta hai aur trends ka saaf tasawur farahem karta hai. Lekin, aam moving averages hamesha asar andaz hone mein kamyabi nahi hasil kar sakti, khas kar jab market tezi se ya trend mein ho. Is maslay ka hal nikalne ke liye, traders aksar traditional moving averages ke liye ek mawafiq ya madakhilati tool ke tor par double exponential moving averages ka istemal karte hain.

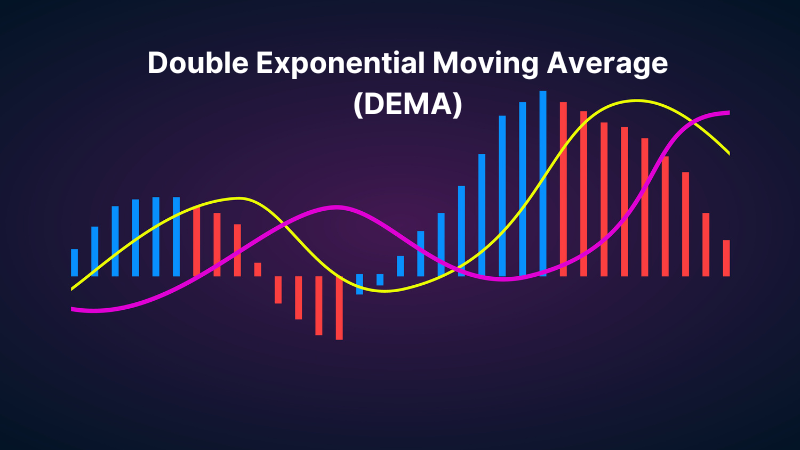

Double exponential moving averages trend following indicators ki ek qisam hain jo ek double smoothing process ka istemal karke calculate kiye jate hain. Is process mein keemat ko do exponential moving averages ka istemal karte hain, jin mein mukhtalif smoothing parameters hote hain, aur phir in dono ko ek dusre se minus karte hain. Iska natija ek nayi line hoti hai jo dono mool moving averages ke darmiyan farq ko afs reflect karti hai.

DEMA calculate karne ka pehla qadam hai keemat ko ek standard exponential moving average ke sath lagana hai jo keemat ko kam arsay ke liye, jese ke 12 periods ke liye, lagaya jata hai. Is EMA ko aam tor par fast exponential moving averages kaha jata hai. Dusra qadam hai keemat ko ek aur EMA ke sath lagana hai, lekin is bar lambay arsay ke liye, jese ke 26 periods ke liye. Is EMA ko slow EMA kaha jata hai.

DEMA calculate karne ka formula ye hota hai:

DEMA = FEMA - SLEMA

DEMA line khud bhi akele mein indicator ke tor par istemal ki ja sakti hai trends aur tijarat ke mauqaat ko pehchanne ke liye. Lekin, ise aksar doosre technical indicators ya strategies ke sath istemal kiya jata hai taake mazeed wazehgi aur signals ki tasdeeq ki ja sake.

DEMA ke aik ahem faida ye hai ke ise traditional moving averages ke muqable mein kam arsay ke price movements ko zyada durust taur par capture karne ki salahiyat hoti hai, khaas kar jab market tezi se ya trend mein hoti hai. Is liye ke DEMA apne calculations ke liye do mukhtalif arsay ka istemal karta hai, is se ye standard moving averages ke sath hone wale kuch shor aur distortions ko filter kar sakta hai. Do martaba price data ko smoothen karke, DEMA zyada refined aur responsive signal farahem kar sakta hai jo ke false positives ya whipsaws ke liye kam mawafiq hota hai.

DEMA ka doosra faida ye hai ke ye potential trend reversals ya price action aur indicator line ke darmiyan ikhtilafat ko pehchanne ki salahiyat rakhta hai. Jab DEMA price data ke ooper ya neeche se guzarta hai, to ye potential trend reversal ya continuation ko darust kar sakta hai, guzishta rukh ke mutabiq. Is ke alawa, jab DEMA price action se ikhtilaf karta hai, to ye mojooda trend mein momentum ke reversal ya exhaustion ko darust kar sakta hai. Ye signals khaas taur par traders ke liye useful hote hain jo chhotay arsay ke price movements par faida hasil karne ke liye entry ya exit points pe amal karna chahte hain.

Lekin ye yaad rakhna ahem hai ke DEMA, jese ke koi bhi technical indicator, doosre forms ke analysis aur risk management strategies ke sath istemal karna chahiye. Traders ko hamesha fundamental analysis, market ki khabrein aur waqeat, aur apne shakhsiy trading style aur pasandeedgiyon ko mad-e-nazar rakhte hue DEMA signals par faislay karne chahiye. Is ke alawa, traders ko ye bhi maloom hona chahiye ke kisi bhi technical indicator ke sath potential false signals ya whipsaws ke liye ihtiyaat baratna chahiye, khaas kar taiz ya ghair liquid markets mein.

DEMA ke forex trading mein implement ke liye traders is indicator ko apne overall trading approach mein shamil karne ke liye kuch strategies istemal kar sakte hain:

Double exponential moving averages trend following indicators ki ek qisam hain jo ek double smoothing process ka istemal karke calculate kiye jate hain. Is process mein keemat ko do exponential moving averages ka istemal karte hain, jin mein mukhtalif smoothing parameters hote hain, aur phir in dono ko ek dusre se minus karte hain. Iska natija ek nayi line hoti hai jo dono mool moving averages ke darmiyan farq ko afs reflect karti hai.

DEMA calculate karne ka pehla qadam hai keemat ko ek standard exponential moving average ke sath lagana hai jo keemat ko kam arsay ke liye, jese ke 12 periods ke liye, lagaya jata hai. Is EMA ko aam tor par fast exponential moving averages kaha jata hai. Dusra qadam hai keemat ko ek aur EMA ke sath lagana hai, lekin is bar lambay arsay ke liye, jese ke 26 periods ke liye. Is EMA ko slow EMA kaha jata hai.

DEMA calculate karne ka formula ye hota hai:

DEMA = FEMA - SLEMA

DEMA line khud bhi akele mein indicator ke tor par istemal ki ja sakti hai trends aur tijarat ke mauqaat ko pehchanne ke liye. Lekin, ise aksar doosre technical indicators ya strategies ke sath istemal kiya jata hai taake mazeed wazehgi aur signals ki tasdeeq ki ja sake.

DEMA ke aik ahem faida ye hai ke ise traditional moving averages ke muqable mein kam arsay ke price movements ko zyada durust taur par capture karne ki salahiyat hoti hai, khaas kar jab market tezi se ya trend mein hoti hai. Is liye ke DEMA apne calculations ke liye do mukhtalif arsay ka istemal karta hai, is se ye standard moving averages ke sath hone wale kuch shor aur distortions ko filter kar sakta hai. Do martaba price data ko smoothen karke, DEMA zyada refined aur responsive signal farahem kar sakta hai jo ke false positives ya whipsaws ke liye kam mawafiq hota hai.

DEMA ka doosra faida ye hai ke ye potential trend reversals ya price action aur indicator line ke darmiyan ikhtilafat ko pehchanne ki salahiyat rakhta hai. Jab DEMA price data ke ooper ya neeche se guzarta hai, to ye potential trend reversal ya continuation ko darust kar sakta hai, guzishta rukh ke mutabiq. Is ke alawa, jab DEMA price action se ikhtilaf karta hai, to ye mojooda trend mein momentum ke reversal ya exhaustion ko darust kar sakta hai. Ye signals khaas taur par traders ke liye useful hote hain jo chhotay arsay ke price movements par faida hasil karne ke liye entry ya exit points pe amal karna chahte hain.

Lekin ye yaad rakhna ahem hai ke DEMA, jese ke koi bhi technical indicator, doosre forms ke analysis aur risk management strategies ke sath istemal karna chahiye. Traders ko hamesha fundamental analysis, market ki khabrein aur waqeat, aur apne shakhsiy trading style aur pasandeedgiyon ko mad-e-nazar rakhte hue DEMA signals par faislay karne chahiye. Is ke alawa, traders ko ye bhi maloom hona chahiye ke kisi bhi technical indicator ke sath potential false signals ya whipsaws ke liye ihtiyaat baratna chahiye, khaas kar taiz ya ghair liquid markets mein.

DEMA ke forex trading mein implement ke liye traders is indicator ko apne overall trading approach mein shamil karne ke liye kuch strategies istemal kar sakte hain:

- Trend following: Traders DEMA ka istemal karke trends aur potential entry points ko pehchanne ke liye kar sakte hain, jab wo indicator line ke ooper ya neeche sambhalte hue moves dekhte hain. Phir wo trend ke rukh mein positions daal sakte hain aur risk ko manage karne ke liye stop-loss orders ka istemal kar sakte hain.

- Trend reversal: Traders DEMA ka istemal karke potential trend reversals ko pehchanne ke liye kar sakte hain, jab wo price action aur indicator line ke darmiyan crosses dekhte hain. Phir wo trend ke ulte rukh mein positions daal sakte hain aur risk ko manage karne ke liye stop-loss orders ka istemal kar sakte hain.

- Divergence: Traders DEMA ka istemal karke potential divergences ko pehchanne ke liye kar sakte hain, jab wo dekhte hain ke price action DEMA signals ke sath tasdeeq nahi karta. Phir wo in divergences ke basis par positions daal sakte hain aur risk ko manage karne ke liye stop-loss orders ka istemal kar sakte hain.

- Confirmation: Traders DEMA ko ek tasdeeqi tool ke tor par istemal kar sakte hain, jab wo DEMA signals aur doosre technical indicators ya fundamental analysis factors ke darmiyan mushahidat dekhte hain. Phir wo in tasdeeqat ke basis par positions daal sakte hain aur risk ko manage karne ke liye stop-loss orders ka istemal kar sakte hain.

تبصرہ

Расширенный режим Обычный режим