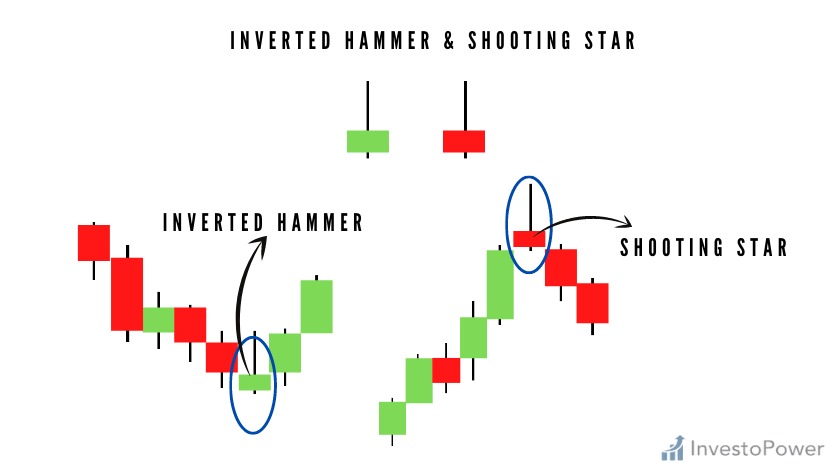

"Shooting Star" candlestick ek akele candlestick pattern hai jo ke Forex trading mein istemal hota hai aur ye price trend mein mukhalif palat (reversal) hone ki sambhavna ko darust kar sakta hai. Is pattern ki pehchan karne ke liye aapko ye cheezein dhyan mein rakhni chahiye:

Jab aap ek Shooting Star dekhte hain, especially kisi strong resistance level ke near, to ye indicate kar sakta hai ke market mein reversal hone ki possibility hai aur ab bearish trend shuru ho sakta hai. Yeh ek signal hai traders ke liye ke woh apni trading strategy ko adjust karein ya position close karein.

Lekin hamesha yaad rahe ke ek hi candlestick pattern par pura bharosa na karein aur dusre technical indicators aur market analysis ke saath combine karein trading decisions lene mein.

- Shape (Shakal): Shooting Star candlestick ka shape ek lambi upper wick aur choti lower body ke sath hota hai. Ye candle market mein upar ki taraf badha tha lekin phir price ne neeche aane ka koshish kiya aur candle ne neeche se close kiya.

- Color (Rang): Ideally, Shooting Star ki body red (bearish) hoti hai, lekin color itna important nahi hota. Woh key hai ke upper wick lambi ho aur lower body choti ho.

- Context (Hawala): Shooting Star hamesha ek trend ke baad aata hai, jo ke uptrend ho sakta hai. Iska matlab hai ke market mein tezi hai aur phir Shooting Star dikhai deta hai, indicating ke buyers thak gaye hain aur sellers control mein aa rahe hain.

Jab aap ek Shooting Star dekhte hain, especially kisi strong resistance level ke near, to ye indicate kar sakta hai ke market mein reversal hone ki possibility hai aur ab bearish trend shuru ho sakta hai. Yeh ek signal hai traders ke liye ke woh apni trading strategy ko adjust karein ya position close karein.

Lekin hamesha yaad rahe ke ek hi candlestick pattern par pura bharosa na karein aur dusre technical indicators aur market analysis ke saath combine karein trading decisions lene mein.

تبصرہ

Расширенный режим Обычный режим