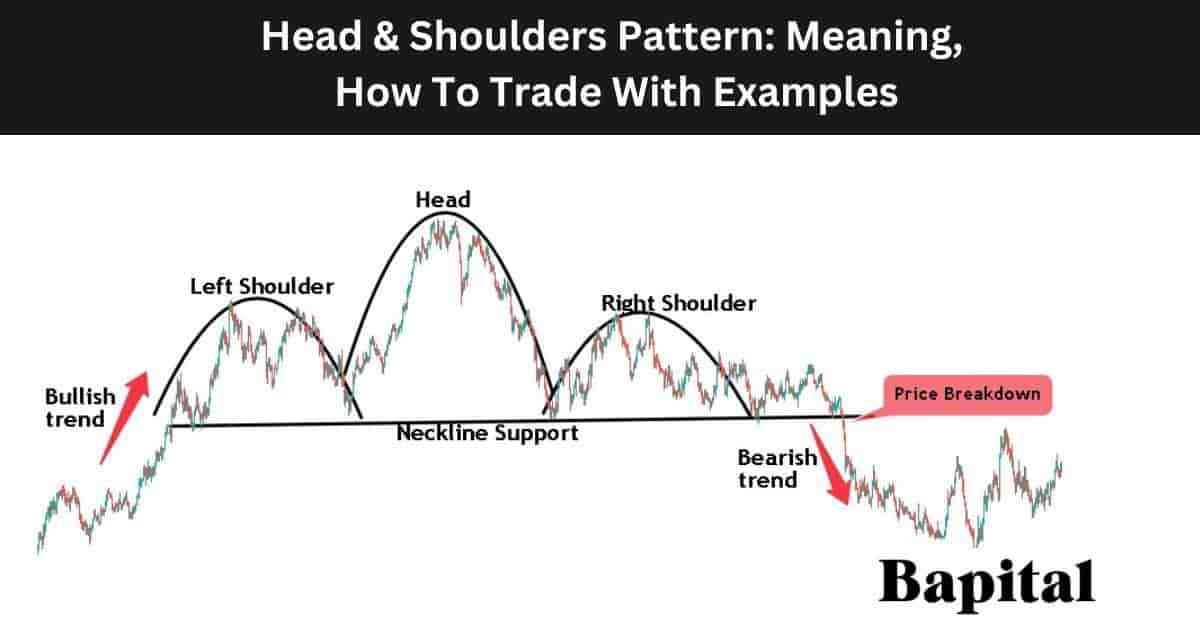

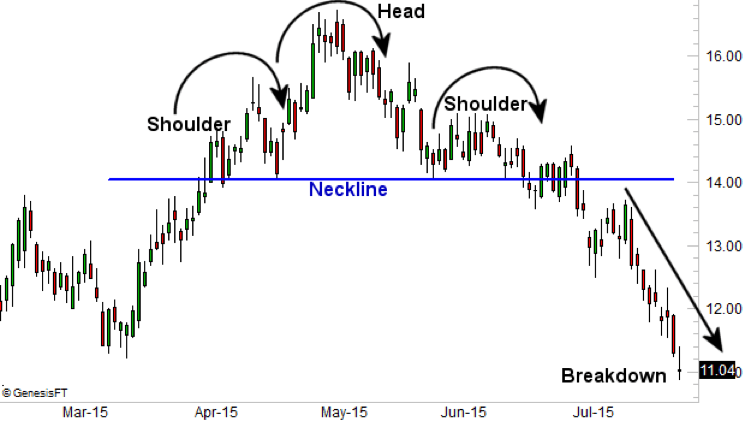

Head and Shoulders pattern ek price pattern hai jo chart analysis mein use hota hai. Is pattern mein typically teen peaks hote hain, jinhe "head" aur "shoulders" kaha jata hai.

Yeh pattern traders ko reversal indication provide karta hai. Jab price left shoulder ke peak se neeche jaata hai, fir se upar jaakar head banaata hai, aur phir right shoulder form karke neeche jaata hai, tab traders trend reversal ki possibility ko consider karte hain.

Head and Shoulders pattern ek bearish trend ke baad hota hai aur price ka trend reversal indicate karta hai. Is pattern ko validate karne ke liye traders typically neckline ke breach ko dekhte hain, jo left shoulder aur right shoulder ke lows ko connect karta hai. Agar price neckline ko breach karke neeche jaata hai, toh yeh bearish reversal signal hota hai.

https://www.google.com/imgres?imgurl...UQMygFegQIARBe

- Left Shoulder: Yeh pattern ka pehla peak hota hai, jo normal price action ke beech mein hota hai. Generally, yeh peak price ke upward movement se pehle hota hai.

- Head: Head shoulder pattern ka central peak hota hai aur typically left shoulder se higher hota hai. Is peak ke baad price usually downswing mein jaata hai.

- Right Shoulder: Head ke baad hone wala peak hota hai aur left shoulder ke similar hota hai. Yeh typically head ke right side par hota hai aur price ke reverses hone ka indication deta hai.Head and Shoulders pattern mein right shoulder left shoulder ke opposite hota hai. Yeh typically head ke baad hota hai aur left shoulder ke similar hota hai lekin left shoulder se kam height ka hota hai.

Right shoulder ka formation, jab price pehle head ke baad upar jaata hai aur phir dobara neeche aata hai, indicate karta hai. Is pattern mein right shoulder left shoulder ke symmetric hone ki tendency hoti hai, lekin left shoulder se kam upward movement ke saath.

Right shoulder banne ke baad, jab price downswing mein jaata hai aur neckline ko breach karta hai, yeh bearish reversal signal hota hai. Is situation mein traders trend reversal ki possibility consider karte hain aur selling positions open karte hain.

Yeh pattern traders ko reversal indication provide karta hai. Jab price left shoulder ke peak se neeche jaata hai, fir se upar jaakar head banaata hai, aur phir right shoulder form karke neeche jaata hai, tab traders trend reversal ki possibility ko consider karte hain.

Head and Shoulders pattern ek bearish trend ke baad hota hai aur price ka trend reversal indicate karta hai. Is pattern ko validate karne ke liye traders typically neckline ke breach ko dekhte hain, jo left shoulder aur right shoulder ke lows ko connect karta hai. Agar price neckline ko breach karke neeche jaata hai, toh yeh bearish reversal signal hota hai.

https://www.google.com/imgres?imgurl...UQMygFegQIARBe

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-02-694fa56fd5aa47d4877ff9a29d669563.jpg)

تبصرہ

Расширенный режим Обычный режим