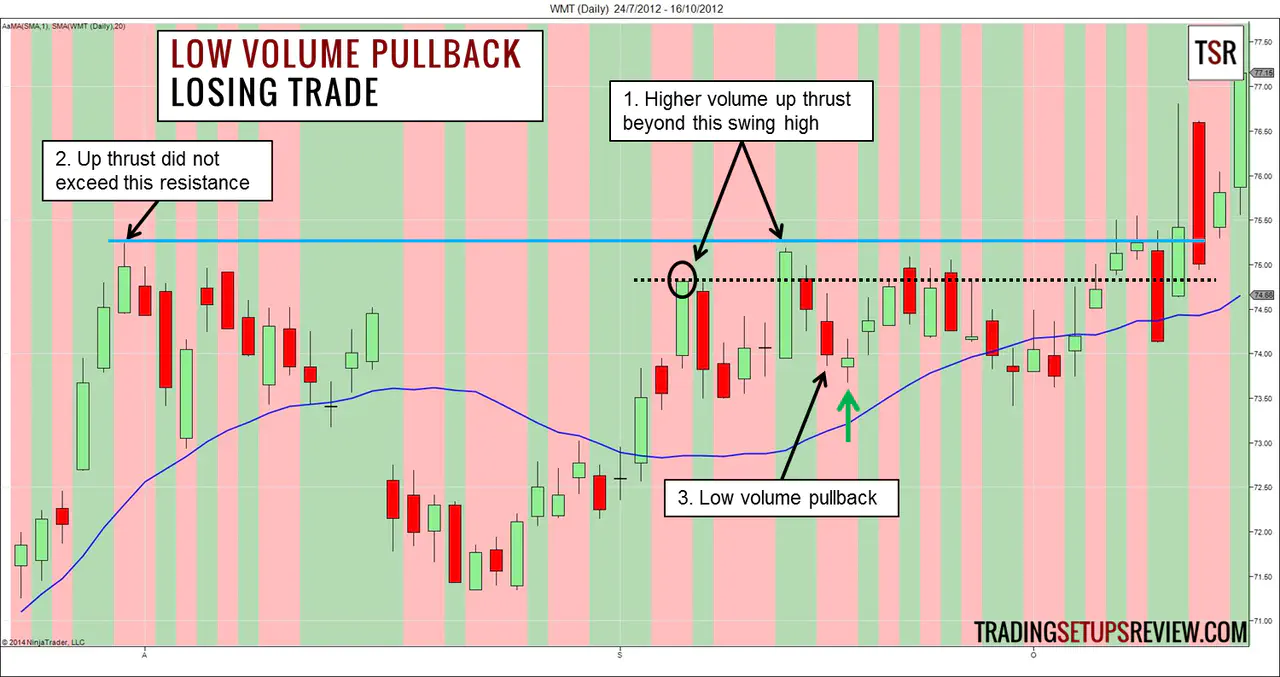

Forex trading mein "Low Volume Pullbacks" ek important concept hote hain. Yeh situation tab hoti hai jab price trend mein hote hue temporary reversal ya retracement show karta hai, lekin volume normal ya kam hota hai. Iska matlab hota hai ki retracement ya reversal mein market mein kam interest hai.

Low volume pullbacks ko samajhna trading ke liye crucial ho sakta hai kyun ki:

- Confirmation of Trend: Agar price trend mein hai aur ek pullback low volume ke saath hota hai, toh yeh confirm karta hai ki actual trend mein hai aur temporary move hai.

- Entry Points: Low volume pullbacks traders ko entry points provide karte hain existing trend mein. Yeh opportunity dete hain ki traders trend mein entry kar sake jab market temporarily reverse ho raha hota hai.

- Risk Management: Volume ki kammi ka pata lagakar, traders apna risk better manage kar sakte hain. Low volume pullbacks mein trading karte waqt stop-loss aur target levels ko adjust karna possible hota hai.

- Avoid False Signals: High volume fluctuations aksar false signals generate karte hain. Low volume pullbacks ko samajh kar traders false signals se bach sakte hain.

Overall, low volume pullbacks ko recognize karna, market ke actual movements ko samajhne mein madadgar hota hai. Yeh traders ko opportunities provide karte hain existing trend mein entry karne ke liye aur risk ko minimize karne ke liye.

- Volume Importance: Volume market ki strength ko represent karta hai. Agar price change low volume ke saath ho raha hai, toh yeh indicate karta hai ki market mein kam interest hai aur potential reversal ya consolidation ho sakta hai.

- Confirmation ke Liye: Volume indicators trend ko confirm karte hain. Agar price trend mein hai aur volume bhi high hai, toh yeh confirm karta hai ki trend strong hai.

- Volume Profile Analysis: Volume profile traders ko market ke specific levels aur price points ko samajhne mein madad karta hai. Yeh volume distribution ko visualize karta hai, jisse traders price levels ke importance ko identify kar sakte hain.

- Volume Oscillators: Volume oscillators jaise ki On-Balance Volume (OBV) ya Accumulation/Distribution Line (A/D Line) volume ke movements ko track karte hain aur price ke saath compare karte hain, jisse trends aur reversals ko anticipate kiya ja sakta hai.

- News aur Events ke Impact: Major news aur economic events market volume par significant impact daal sakte hain. Aise samay par volume analysis kiya ja sakta hai to gauge karna ki market sentiment kaisa hai.

- Divergences: Volume aur price ke divergences, jaise ki price high aur volume low ho, ya price low aur volume high ho, ko identify karke traders market ke possible reversals ya continuations anticipate kar sakte hain.

- Intraday Trading mein Use: Intraday traders often volume analysis ka use karte hain to identify entry aur exit points, especially jab market mein high volatility ho.

:max_bytes(150000):strip_icc()/dotdash_Final_LowVolume_Pullback_Definition_Jun_2020-01-e70fea9e10fb419e8cb21de8f9830fc0.jpg)

تبصرہ

Расширенный режим Обычный режим